Hey traders!

Dreaming of that funded account but are stuck on the Apex Trader Funding vs Topstep decision for 2025?

We know the drill: challenging evaluations, confusing payout rules, and just figuring out which prop firm truly gets you.

This showdown breaks down what separates these two giants. Get ready to see which one could be your path to trading success and help you keep more of your profits!

Company Background | Apex Trader Funding vs Topstep

Understanding the history and mission of a prop firm can give you a good sense of its approach to traders. Here's how Apex Trader Funding and Topstep compare:

Apex Trader Funding

Founded around 2021 by traders, for traders, Apex Trader Funding has quickly made a name for itself in the proprietary trading world. Their core mission is to simplify the path to funding, focusing on fewer rules and helping traders achieve success.

Based in the US, Apex reports having funded over 100,000 traders across more than 150 countries and has paid out over $150 million since its inception. This rapid growth points to a significant community and a reputation built on making funding accessible and providing substantial payouts. They often highlight their “easiest to pass” evaluations and “highest paying” model, aiming for long-term relationships with their traders.

Topstep

Topstep has a longer history, established in 2012 by Michael Patak in Chicago. Their vision is to be a leading place for traders to develop their skills and reach financial independence in a secure setting.

Topstep's mission centers on empowering individuals worldwide to learn, profit, and achieve financial freedom through funded trading. They are known for their structured evaluation, the “Trader Combine,” which has been a core part of their offering for years.

Having funded thousands of traders in over 140 countries and paid out millions, Topstep emphasizes education, risk management, and a supportive community as key elements of their platform. Their longer presence in the market has helped build a recognized brand and a level of trust among traders.

Brokers | Apex Trader Funding vs Topstep

Your broker directly impacts trade execution speed and data accuracy.

Apex keeps its broker options streamlined, focusing on well-regarded names in the futures scene. Topstep offers a bit more variety, including some very established players.

Apex primarily connects you through Rithmic and Tradovate. Topstep traders can find themselves routed through Tradovate, and they also list connections with Dorman Trading, Cunningham Clearing (CQG), and NinjaTrader Brokerage.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Brokers | Rithmic, Tradovate | Tradovate, Dorman, CQG, NinjaTrader Brokerage, |

Trading Platforms | Apex Trader Funding vs Topstep

Your trading platform is your command center, so compatibility is key. Both Apex Trader Funding vs Topstep support a good range of popular third-party platforms, meaning you can likely stick with software you already know and trust.

Apex supports NinjaTrader, TradingView, Tradovate’s platform, Rithmic’s R Trader Pro, Quantower, Sierra Chart, MotiveWave, Bookmap, ATAS, Jigsaw Daytradr, VolFix, Finamark, EdgeProX, and WealthCharts.

Topstep also offers wide compatibility, including NinjaTrader, TradingView, Tradovate, Sierra Chart, Quantower, MotiveWave, Bookmap, ATAS, VolFix, R Trader Pro, and their proprietary platform, TopstepX. Additionally, they support T4, MultiCharts, Investor/RT, and Trade Navigator.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Trading Platforms | NinjaTrader, TradingView, Tradovate, R Trader Pro, Quantower, Sierra Chart, MotiveWave, Bookmap, ATAS, Jigsaw Daytradr, VolFix, Finamark, EdgeProX, WealthCharts | NinjaTrader, TradingView, Tradovate, Sierra Chart, Quantower, MotiveWave, Bookmap, ATAS, VolFix, R Trader Pro, TopstepX, T4, MultiCharts, Investor/RT, Trade Navigator |

Payment Methods (For Evaluation Fees) | Apex Trader Funding vs Topstep

When you're signing up for an evaluation, how you pay the fee matters for convenience. Both firms accept standard payment options.

Apex mainly accepts Credit/Debit Cards for evaluation fees. Some information suggests that Bank Transfers and Cryptocurrency might also be options for paying these initial fees.

Topstep accepts Credit/Debit Cards (Visa, Mastercard, American Express, Discover) and also offers PayPal as an option for paying evaluation fees.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Evaluation Payments | Credit/Debit Cards, Bank Transfers (possibly), Crypto (possibly) | Credit/Debit Cards, PayPal |

Payout Methods (Getting Your Profits) | Apex Trader Funding vs Topstep

This is what it's all about – getting paid!

Both firms offer several ways to receive your profits, catering to both domestic and international traders.

For payouts, Apex primarily uses Direct Deposit (ACH) for U.S. traders and international transfers via a service called Plane for non-U.S. traders. Bank Wire Transfers are also a standard option. Some sources also indicate that PayPal and Cryptocurrency payouts might be available through Apex.

Topstep provides payouts via ACH (primarily for U.S. traders), Bank Wire Transfers (including International SWIFT), and Wise (which can handle fiat and crypto transfers). PayPal is also mentioned as a payout method by Topstep. Topstep notes that ACH payouts can take up to 10 business days, while International Wires might take 3-5 business days.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Profit Payouts | ACH (U.S.), Plane (International), Bank Wire, PayPal (possibly), Crypto (possibly) | ACH, Bank Wire/SWIFT, Wise (fiat/crypto), PayPal |

Trading Capacity Max Contracts at Apex Trader Funding vs Topstep

How many contracts you can trade often scales with the size of the account you're handling. This determines your potential position size and how you can approach different market conditions.

Apex Trader Funding | Contract Limits

Apex offers a pretty wide spread of account sizes, and their contract limits reflect this, especially in their standard one-step evaluation programs. They clearly define limits for both standard (mini) contracts and the equivalent in micro contracts.

For their 1-Step Evaluation accounts with a trailing drawdown:

Apex also has a 1-Step Evaluation with a static drawdown:

The $100,000 Static Drawdown account is more conservative, permitting up to 2 standard contracts (or 20 micro contracts). This lower limit aligns with the different risk structure of a static drawdown.

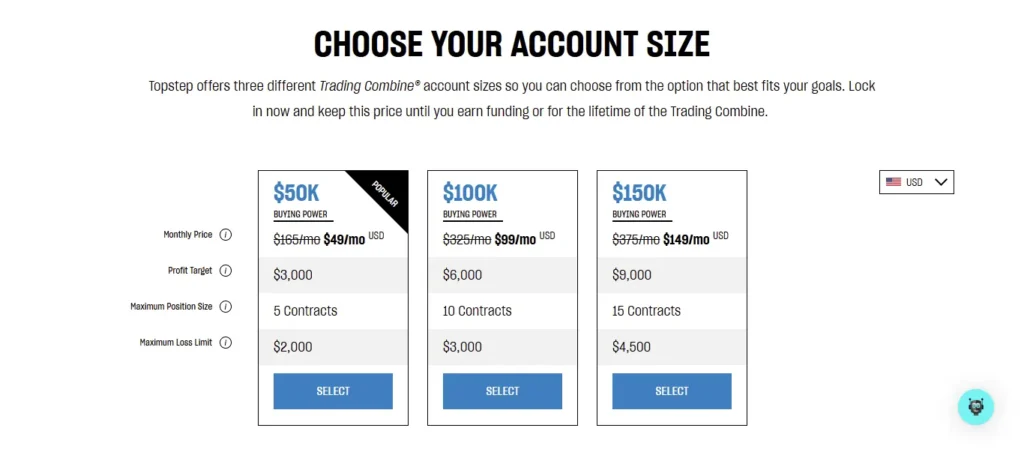

Topstep | Contract Limits

Topstep also ties its maximum allowed contracts directly to the account size, offering a clear path for traders.

Here's how their contract limits generally look:

So, you can see Apex generally offers more granular account sizes with varying contract limits, including very high limits on their largest accounts, while Topstep presents a more streamlined set of options with a straightforward increase in contract allowances.

Understanding the Rulebook | Consistency and Trading Guidelines at Apex Trader Funding vs Topstep

Prop trading firms establish specific rules to manage risk and encourage disciplined trading. Understanding these, particularly consistency rules, is vital for traders aiming to get funded and receive payouts. Both Apex Trader Funding vs Topstep have distinct approaches.

Consistency Expectations | Apex Trader Funding vs Topstep Evaluation Gate

The concept of “consistency” is handled differently by these two firms. Apex Trader Funding implements a 30% rule primarily in its funded Performance Accounts (PA).

This means that when you request a payout, no single trading day should contribute more than 30% of the total profit you've accumulated in that account (since your last payout or since the PA started). For example, if you've made $10,000, one day's profit shouldn't exceed $3,000. This rule is about sustainable profit generation in the funded stage.

Topstep, on the other hand, features a consistency target mainly during its Trading Combine (the evaluation phase). Here, your best trading day (the day with the most significant profit) must not be greater than 50% of your overall profit target for that Combine account.

If it is, you'll need to continue trading to reduce the best day's percentage relative to your total profits achieved to pass the evaluation.

Some discussions indicate Topstep has considered or implemented changes regarding consistency rules for funded accounts (XFA), possibly introducing a 50% rule there, but the primary emphasis in the provided materials is on the evaluation stage consistency.

Apex Trader Funding | Other Key Trading Rules

Beyond the payout-related consistency, Apex has several other guidelines for its traders:

Topstep | Other Key Trading Rules

Topstep has its own set of operational rules for traders:

Cashing Out | Apex's Payout System

Apex Trader Funding allows traders to keep 100% of the first $25,000 withdrawn per funded Performance Account (PA). After this $25,000 threshold for a specific account, the profit share becomes 90% for the trader and 10% for Apex on subsequent payouts from that same account.

However, a significant milestone exists: after a trader completes five approved payouts, they become eligible to withdraw 100% of all their profits starting from the sixth payout onwards, with no cap, provided the minimum balance is maintained.

To request a payout, traders must have traded for at least eight separate trading days since their last payout request, and at least five of these days must show a profit of $50 or more. There's no longer a specific payout window; requests can be made anytime these conditions are met.

For the first three payouts, a “Safety Net” rule applies: the account balance must be equal to the account's drawdown amount plus $100 (e.g., $52,600 for a $50k account).

The minimum payout amount is $500. For the first five payouts, there are maximum withdrawal limits based on account size (e.g., $2,000 for a $50k account). These caps are removed from the sixth payout onwards.

Remember, Apex also applies a consistency rule at payout: no single trading day should account for more than 30% of the profit being withdrawn.

Cashing Out | Topstep's Payout System

Topstep offers traders 100% of their profits for the first $10,000 in payouts. This $10,000 is cumulative per trader, across all their funded accounts. After a trader has received $10,000 in total, the profit split changes to 90% for the trader and 10% for Topstep for subsequent withdrawals.

Additionally, traders can become eligible to withdraw 100% of their profits in a Live Funded Account after they have accumulated a total of 30 “winning trading days” (days with a Net PNL of $200 or more) across both their Express Funded Account and Live Funded Account.

In an Express Funded Account, traders can request a payout of up to $5,000 or 50% of their account balance, whichever is lower, after accumulating five winning trading days. A winning trading day is defined as a day where the Net PNL is $200 or more. These five winning days do not need to be consecutive, and this requirement resets after each payout.

In a Live Funded Account, traders can also request a payout of up to 50% of their account balance after accumulating five winning trading days (Net PNL ≥ $200) since the last payout. If a trader is “called up” to a Live Funded Account from an Express account, they may be eligible for a payout even if they haven't yet completed five winning days since their last payout in the Express account.

The minimum payout request at Topstep is $125. A critical rule for Topstep is that once a payout request is processed, the Maximum Loss Limit for that funded account is automatically set to $0, meaning the account balance cannot drop to or below zero after a withdrawal.

Top 6 FAQs | Apex Trader Funding vs Topstep in 2025

Which Firm Offers better Profit Splits?

Apex lets traders keep 100% of the first $25,000 per account, while Topstep offers 100% only on the first $10,000 total across all accounts.

Who allows Larger Contract Sizes?

Apex permits up to 35 contracts on $300k accounts, while Topstep caps at 15 contracts for $150k accounts.

Which Evaluation is Faster to pass?

Apex requires 7 trading days minimum, while Topstep enforces a 50% daily profit limit during evaluations.

Can I trade News Events?

Apex allows news trading but bans holding both long/short positions. Topstep permits new strategies without restrictions.

How often can I Withdraw Profits?

Apex allows payouts every 8 trading days (5 profitable days). Topstep requires 5 days with $200+ profits per payout.

Which Firm supports Scaling Better?

Apex offers 7 account sizes with uncapped payouts after 5 withdrawals. Topstep limits scaling to 3 account tiers.

Final Thoughts | Apex Trader Funding vs Topstep in 2025

Deciding between Apex Trader Funding vs Topstep boils down to your trading priorities. Apex shines with flexible rules, higher contract limits, and uncapped payouts after five withdrawals—ideal for aggressive futures traders aiming to scale quickly. Topstep’s structured evaluations and emphasis on risk discipline cater to those valuing gradual growth and educational support.

Consider Apex if you prefer fewer restrictions on news trading or want to maximize profit potential with larger accounts. Opt for Topstep if you prioritize a proven track record, community resources, and a clear path to consistent payouts. Both firms offer unique advantages, so review their funding models, profit splits, and trading rules against your strategy.

Ready to take the next step? Assess your risk tolerance, preferred markets, and long-term goals to determine which prop firm aligns with your vision for 2025.

Stay informed, trade smart, and let your strategy guide your choice in the Apex Trader Funding vs Topstep debate.