eToro, where trading meets social networking in an innovative blend that has captivated millions worldwide. Established in 2007, It has revolutionized the trading landscape by offering a platform that is not only user-friendly but also deeply engaging, thanks to its unique social trading features.

Imagine a place where you can connect with over 30 million investors, share insights, and even mimic the trades of successful traders through the pioneering CopyTrader feature. Whether you're a novice eager to learn or an experienced trader looking to diversify, eToro provides the tools and community support to enhance your trading journey.

📌 Starting with an Introduction to eToro

eToro is a leading social trading and multi-asset investment platform that has revolutionized the way people invest. Founded in 2007, eToro's mission is to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

One of eToro's key features is its social trading capabilities, which allow users to connect with other traders, share ideas, and even copy the trades of successful investors using the innovative CopyTrader™ tool. This unique approach to investing has attracted a global community of over 30 million users from more than 100 countries.

It is regulated by top-tier financial authorities, such as the FCA, ASIC, and CySEC, ensuring a secure and transparent trading environment.

| Key feature | Details |

|---|---|

| Foundation Year | 2007 |

| Headquarters Country | Cyprus |

| Regulations | CySEC (Cyprus), FCA (United Kingdom), FSA (Seychelles), ASIC (Australia) |

| Demo Account | Yes |

| Deposit Options | Sofort, Przelewy, Wire Transfer, Skrill, Neteller, iDeal, Klarna, Trustly, Rapid Transfer, Debit Card |

| Withdrawal Options | Wire Transfer, Neteller, Moneybookers, Webmoney, Skrill, PayPal, Debit Card, iDeal, Klarna, Sofort, Przelewy |

| Min Deposit | $50 |

| Max Leverage | 1:30 (CySEC ), 1:30 (FCA), 1:500 (FSA), 1:30 (ASIC) |

| Supported Languages | Turkish, English, Russian, French, Dutch, Portuguese, Thai, Taiwanese, Polish, Czech, Arabic, Italian, Spanish, Chinese, Finnish, Japanese, Swedish, Greek, Vietnamese, Malaysian, German, Multi-lingual, Romanian, Norwegian+9 |

| Products | Currencies, Stocks, ETFs, Crypto, Indices, Commodities |

| Trading Desk Type | Market Maker |

| Trading Platforms | eToro Platform |

Account Types for Every Investor

Offers several account types to cater to the diverse needs of its users:

| Account Type | Suitable For | Minimum Deposit | Key Features |

|---|---|---|---|

| Retail | Individual investors | $50 – $10,000 (varies by country) | Access to a wide range of assets, copy trading |

| Professional | Experienced traders | Varies | Higher leverage limits (only available in UK & Europe) |

| Corporate | Institutional investors | $10,000 | Designed for businesses to invest in multiple assets |

| Islamic | Muslim clients | Varies | Swap-free trading complies with Sharia law |

- Retail Account:

This is the standard account type suitable for most individual investors. It provides access to a wide range of assets, including stocks, ETFs, currencies, commodities, and cryptocurrencies. Retail accounts have low minimum deposit requirements, starting from just $50 in some countries. Users can engage in both manual trading and copy trading, where they can automatically mirror the trades of successful investors.

- Professional Account:

Designed for experienced traders who meet certain criteria, such as having a high trading volume or working in the financial sector. Professional accounts offer higher leverage limits compared to retail accounts. However, this account type is currently only available to users registered under eToro UK and eToro Europe.

- Corporate Account:

Tailored for institutional investors and businesses looking to invest through eToro. Corporate accounts allow companies to trade and invest in multiple asset classes. Setting up a corporate account requires submitting specific documentation and making a minimum first-time deposit of $10,000.

- Islamic Account:

Created to comply with Sharia law, the Islamic account enables Muslim clients to trade without incurring overnight fees or interest charges. This account type is designed to be swap-free, ensuring that users can invest in accordance with their religious beliefs.

eToro Trading Platforms

One of the key factors behind eToro's success is its commitment to providing a seamless and intuitive trading experience across multiple devices. Whether you prefer to trade on your desktop, laptop, or smartphone, It has you covered with its state-of-the-art platforms:

- Web Platform

eToro's web-based platform is accessible from any internet browser, offering a clean and user-friendly interface that makes navigating the markets a breeze. With real-time price updates, advanced charting tools, and one-click trading, you can easily stay on top of your investments and make informed decisions.

- Mobile App

For investors on the go, eToro's mobile app brings the power of the platform right to your fingertips. Available for both iOS and Android devices, the app allows you to monitor your portfolio, execute trades, and even engage with the community, all from the palm of your hand.

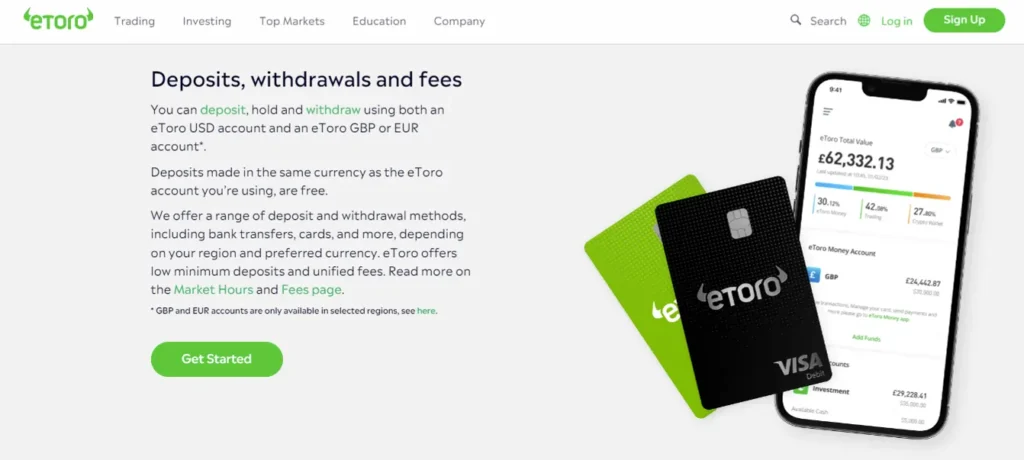

Deposits and Withdrawals Made Simple

Funding your eToro account and withdrawing your profits is a straightforward process, with a variety of payment methods available to suit your preferences. With low minimum deposits starting at just $50 and fast processing times, you can start investing with eToro in no time. Plus, with the added security of segregated client funds and industry-leading encryption, you can rest assured that your money is always safe and secure.

| Payment Method | Deposit | Withdrawal | Processing Time |

|---|---|---|---|

| Credit/Debit Card | ✓ | ✓ | Instant |

| Bank Transfer | ✓ | ✓ | 3-7 business days |

| PayPal | ✓ | ✓ | Instant |

| Skrill | ✓ | ✓ | Instant |

A World of Asset Classes at Your Fingertips

One of the biggest advantages of trading with eToro is the sheer diversity of asset classes available. Whether you're interested in traditional investments like stocks and bonds or looking to explore emerging markets like cryptocurrencies, eToro has something for everyone:

- Stocks

With over 2,000 stocks from major exchanges around the world, eToro allows you to invest in some of the biggest and most influential companies on the planet. From tech giants like Apple and Amazon to blue-chip stalwarts like Coca-Cola and Johnson & Johnson, you can build a diversified stock portfolio with just a few clicks.

- Indices

For investors looking to gain broad exposure to entire markets, It offers a range of popular stock indices, such as the S&P 500, NASDAQ 100, and FTSE 100. By investing in an index, you can effectively spread your risk across multiple companies and sectors, reducing the impact of individual stock fluctuations on your overall portfolio.

- Commodities

Commodities like gold, silver, and oil have long been considered a hedge against inflation and market volatility. With eToro, you can easily add these valuable assets to your portfolio, either as a long-term investment or a short-term trading opportunity.

- Currencies

The foreign exchange (forex) market is the largest and most liquid financial market in the world, with trillions of dollars changing hands every day. It allows you to trade a wide range of currency pairs, from major pairs like EUR/USD and GBP/USD to exotic pairs like USD/ZAR and USD/MXN.

- Cryptocurrencies

As one of the first platforms to offer cryptocurrency trading, eToro has established itself as a leader in this exciting and rapidly evolving space. With support for popular coins like Bitcoin, Ethereum, and Litecoin, as well as newer altcoins like Cardano and Polkadot, It makes it easy to diversify your portfolio with digital assets.

Common Queries Regarding eToro

How do I deposit funds into my eToro account?

You can deposit funds via bank transfer, credit/debit card, PayPal, Skrill, Neteller, and other methods. The minimum deposit varies by country but starts from $50 for some regions.

Are there fees for withdrawals?

Yes, eToro charges a withdrawal fee. The exact amount depends on your account currency and withdrawal method.

What assets can I trade on eToro?

They offer trading in stocks, cryptocurrencies, ETFs, indices, commodities, currencies, and more.

Does eToro offer leverage?

Yes, eToro offers leveraged trading on certain assets, with leverage ratios varying based on the asset type and your account classification.

Is copy trading available on eToro?

Yes, eToro's CopyTrader feature allows you to automatically copy the trades of other investors on the platform.

Is eToro regulated?

Yes, It is regulated by various financial authorities in different jurisdictions where it operates.

Does eToro offer a demo account?

Yes, It provides a virtual portfolio (demo account) with $100,000 in virtual funds for practice.

📌 The Bottom Line

eToro has fundamentally transformed online trading, integrating social networking features with an accessible platform. With a vibrant community of over 30 million users worldwide, It encourages collaboration and allows traders at any level to share insights and strategies. Its diverse range of financial instruments, including stocks, cryptos, and ETFs, combined with unique tools like copy trading, empowers users to make informed investment decisions. By prioritizing user experience and financial education, eToro stands out as a revolutionary platform, promoting transparency and community engagement in the trading world.