With a 17-year experience in the brokerage sphere, IC Markets is a trustworthy and reliable FX broker, no matter the experience.

In this complete guide, we'll dive into the key aspects of IC Markets, including their platforms, account types, deposit and withdrawal options, and the various asset classes you can trade.

What is IC Markets all about?

IC Markets is a leading online trading platform that offers CFD and Forex trading services to retail and institutional clients worldwide.

Founded in 2007, IC Markets has grown to become one of the largest Forex CFD providers globally, known for its competitive pricing, fast execution speeds, and wide range of tradable instruments.

The broker allows all trading styles, including scalping, hedging, and the use of expert advisors (EAs), making it a popular choice among algorithmic traders.

| Key feature | Details |

|---|---|

| Regulations | FSA (Seychelles), ASIC (Australia), CySEC (Cyprus) |

| Supported Languages | English, Russian, Indonesian, Portuguese, Thai, Arabic, Italian, Spanish, Chinese, Vietnamese |

| Products | Currencies, Stocks, ETFs, Crypto, Bonds, Indices, Commodities, Futures |

| Min Deposit | $200 |

| Max Leverage | 1:500 (FSA), 1:30 (ASIC), 1:30 (CySEC ) |

| Trading Desk Type | ECN, No dealing desk |

| Trading Platforms | MT5, cTrader, MT4 |

| Deposit Options | Wire Transfer, Neteller, Skrill, Credit Card, PayPal, Visa, Mastercard, Union Pay, Bpay, Broker to Broker, Poli, Klarna, Local Deposit |

| Withdrawal Options | Wire Transfer, Neteller, Skrill, Credit Card, PayPal, Visa, Mastercard, Union Pay, Bpay, Broker to Broker, Poli, Klarna, Local Transfer |

| Demo Account | Yes |

| Foundation Year | 2007 |

| Headquarters Country | Australia |

Trading Platforms | Power and Flexibility at Your Fingertips

IC Markets understands that having a robust and user-friendly trading platform is crucial for a seamless trading experience.

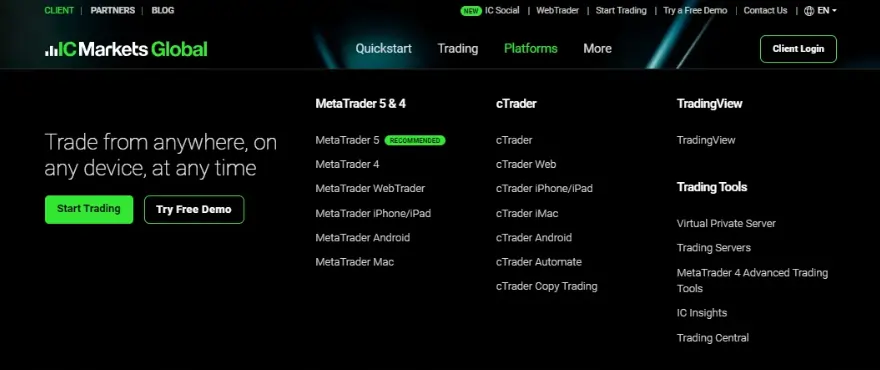

They offer three main platforms to suit different trading styles and preferences:

- MetaTrader 4 (MT4)

MT4 is the most popular trading platform in the world, known for its ease of use, advanced charting tools, and extensive customization options. IC Markets' MT4 platform comes with Raw Pricing, allowing you to trade with spreads as low as 0.0 pips. The platform also supports automated trading through Expert Advisors (EAs) and has a vast library of indicators and tools.

- MetaTrader 5 (MT5)

MT5 is the next-generation trading platform that builds upon the success of MT4. It offers additional features such as more timeframes, an expanded number of indicators, and the ability to trade multiple assets from a single account. IC Markets' MT5 platform also provides Raw Pricing and fast order execution, making it an excellent choice for serious traders.

- cTrader

cTrader is a powerful web-based platform that combines advanced trading tools with a user-friendly interface. It offers features like Level II Pricing, which displays the full depth of market liquidity, and one-click trading for fast order execution. IC Markets' cTrader platform is available as a web-based and mobile app, allowing you to trade on the go.

| Platform | Key Features | Pricing | Suitable For |

|---|---|---|---|

| MT4 | Ease of use, advanced charting, EAs | Raw Pricing spreads from 0.0 pips | Beginners and experienced traders |

| MT5 | Additional timeframes and indicators, multi-asset trading | Raw Pricing spreads from 0.0 pips | Serious traders |

| cTrader | Level II Pricing, one-click trading, web-based | Raw Pricing spreads from 0.0 pips | Traders who prefer a web-based platform |

Account Types | Tailored to Your Trading Style

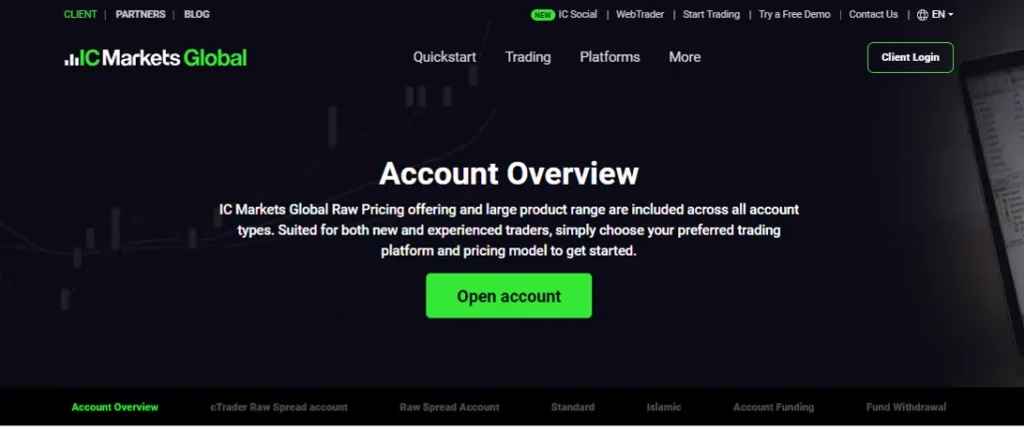

IC Markets offers three main account types to cater to different trading styles and preferences:

- Raw Spread Account

The Raw Spread account is designed for traders who prioritize low spreads and fast execution. It offers spreads starting from 0.0 pips and a small commission of $3.50 per lot per side. This account type is available on both MT4 and MT5 platforms and is suitable for scalpers, day traders, and those using EAs.

- Standard Account

The Standard account is a commission-free account with spreads starting from 0.8 pips. It is available on the MT4 and MT5 platforms and is ideal for traders who prefer a simple pricing structure without additional commissions.

- cTrader Raw Spread Account

The cTrader Raw Spread account combines the benefits of raw pricing with the advanced features of the cTrader platform. It offers spreads from 0.0 pips and a commission of $3.00 per side per 100k traded. This account type is suitable for traders who prefer the cTrader platform and seek competitive pricing.

| Account Type | Platforms | Spreads | Commission | Suitable For |

|---|---|---|---|---|

| Raw Spread | MT4, MT5 | From 0.0 pips | $3.50 per lot per side | Scalpers, day traders, EA users |

| Standard | MT4, MT5 | From 0.8 pips | None | Traders who prefer no commissions |

| cTrader Raw Spread | cTrader | From 0.0 pips | $3.00 per side per 100k | cTrader users seeking raw pricing |

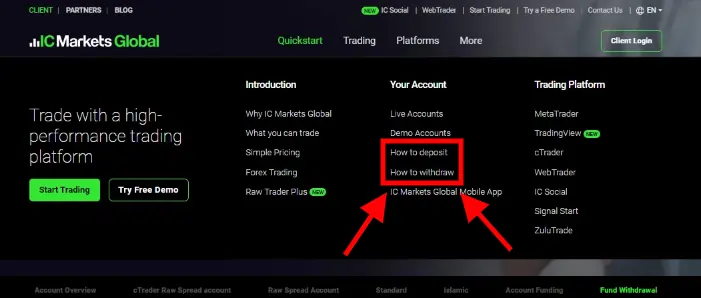

Deposits and Withdrawals | Convenient and Secure Funding Options

IC Markets offers a range of convenient and secure funding options for deposits and withdrawals. They do not charge any additional fees for these transactions, but you should be aware of potential fees charged by your bank or payment provider.

Deposit Options include Credit and Debit Cards, PayPal, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLI, Thai Internet Banking, Rapidpay, Klarna, and Vietnamese Internet Banking.

IC Markets processes withdrawal requests promptly, with most methods taking 1-5 business days. The available withdrawal options include Credit and Debit Cards, PayPal, Neteller, Skrill, Wire Transfer, Bpay, and Broker to Broker.

It's important to note that IC Markets does not accept third-party payments, so all deposits must come from a bank account or credit card in your name.

Asset Classes | A World of Trading Opportunities

IC Markets offers a wide range of asset classes for you to trade, including:

- Forex

Trade over 60 currency pairs with tight spreads from 0.0 pips and leverage up to 1:500. IC Markets provides deep liquidity and fast execution, making it an excellent choice for forex traders.

- Indices

Gain exposure to global equity markets with 25 index CFDs, including major indices like the S&P 500, NASDAQ, and FTSE 100. Trade indices with no commissions and leverage up to 1:200.

- Commodities

Trade a variety of commodities, including energy, agriculture, and metals, with flexible lot sizes and competitive pricing. IC Markets offers both spot and futures CFDs on commodities.

- Stocks

Access over 2,100 large-cap stocks from the ASX, NYSE, and NASDAQ exchanges. Trade stocks with leverage up to 1:20 and benefit from potential dividend payments.

- Bonds

Speculate on interest rates and global risk sentiment with a range of government-issued bonds, including US Treasuries, European bonds, and Japanese government bonds. Trade bonds with no commissions and leverage up to 1:200.

- Cryptocurrencies

Trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin with leverage up to 1:200 on MT4/MT5 and 1:5 on cTrader and TradingView. IC Markets offers long and short trading on cryptocurrencies 7 days a week.

| Asset Class | Number of Instruments | Key Features |

|---|---|---|

| Forex | 60+ currency pairs | Tight spreads from 0.0 pips, leverage up to 1:500 |

| Indices | 25 global indices | No commissions, leverage up to 1:200 |

| Commodities | 20+ commodities | Spot and futures CFDs, flexible lot sizes |

| Stocks | 2,100+ stocks | ASX, NYSE, NASDAQ, leverage up to 1:20 |

| Bonds | 9+ government bonds | No commissions, leverage up to 1:200 |

| Cryptocurrencies | 21 popular cryptocurrencies | 7-day trading, leverage up to 1:200 (MT4/MT5) or 1:5 (cTrader) |

Common Queries

How long do Deposits and Withdrawals take to process?

Online deposit methods like cards, PayPal, Neteller, and Skrill are processed instantly. Domestic wire transfers and Bpay take 1-2 business days. International wire transfers can take 2-5 business days.

Does IC Markets allow Scalping, Hedging, and EAs?

Yes, IC Markets allows all trading styles including scalping, hedging, and the use of expert advisors (EAs). There are no restrictions on trading styles.

Where are IC Markets' servers located for each platform?

MetaTrader 4/5: Equinix NY4 data center in New York, cTrader: London. The NY4 location provides a low latency of under 1 ms to major VPS providers for fast execution.

What is The Stop-out level at IC Markets?

The stop-out level, where open positions start to be closed automatically, is 50% for IC Markets accounts.

Does IC Markets offer Swap-Free Islamic accounts?

Yes, IC Markets offers swap-free Islamic accounts that are compliant with Sharia law and have no rollover interest on overnight positions.

What is The Maximum leverage offered by IC Markets?

IC Markets offers leverage up to 1:500 for forex trading on MT4/MT5. For the cTrader platform, the maximum leverage is 1:30.

The Bottom Line

IC Markets stands out as a leading online trading platform, offering a robust and reliable environment for both novice and experienced traders.

With its competitive spreads, advanced trading tools, and a commitment to transparency, IC Markets has established itself as a preferred choice for many in the financial trading community. The platform's use of cutting-edge technology ensures fast and efficient trade execution, while its comprehensive educational resources empower traders to make informed decisions.