Interactive Brokers, a powerhouse in the brokerage industry, was Founded in 1978. It has been revolutionizing the trading landscape for decades. With its roots firmly planted in technology and innovation, Interactive Brokers offers a comprehensive suite of tools and services that cater to both seasoned professionals and budding investors alike.

Whether you're trading stocks, options, futures, or even cryptocurrencies, IBKR provides access to over 150 global markets, ensuring you never miss an opportunity. Known for its competitive commission rates and advanced trading platforms, Interactive Brokers is not just a brokerage firm; it's a gateway to the world's financial markets.

Introduction to Interactive Brokers

Interactive Brokers (IBKR) is a leading online brokerage firm that provides sophisticated trading platforms and tools for traders and investors worldwide.

Founded in 1978 by Thomas Peterffy, IBKR has been at the forefront of using technology in financial markets. The company offers access to a wide range of markets, including stocks, options, futures, currencies, bonds, and funds across 150 global markets in 27 currencies.

With over $14 billion in equity capital, more than 2.75 million client accounts, and a presence in over 200 countries and territories, Interactive Brokers has established itself as a reliable and secure choice for investors.

| Key feature | Details |

|---|---|

| Regulations | CFTC (United States), IIROC (Canada), SEC US (United States) |

| Supported Languages | English, French, German, Italian, Spanish |

| Products | Currencies, Stocks, ETFs, Indices, Commodities |

| Min Deposit | $5 |

| Max Leverage | 1:78 (CFTC), 1:78 (IIROC), 1:78 (SEC US) |

| Trading Desk Type | DMA |

| Trading Platforms | Proprietary |

| Deposit Options | ACH, Wire Transfer |

| Withdrawal Options | ACH, Wire Transfer |

| Demo Account | Yes |

| Foundation Year | 1978 |

| Headquarters Country | United States |

What Platforms are offered by IB?

Interactive Brokers offers a suite of powerful trading platforms designed to cater to the needs of different types of traders, from casual investors to professional traders.

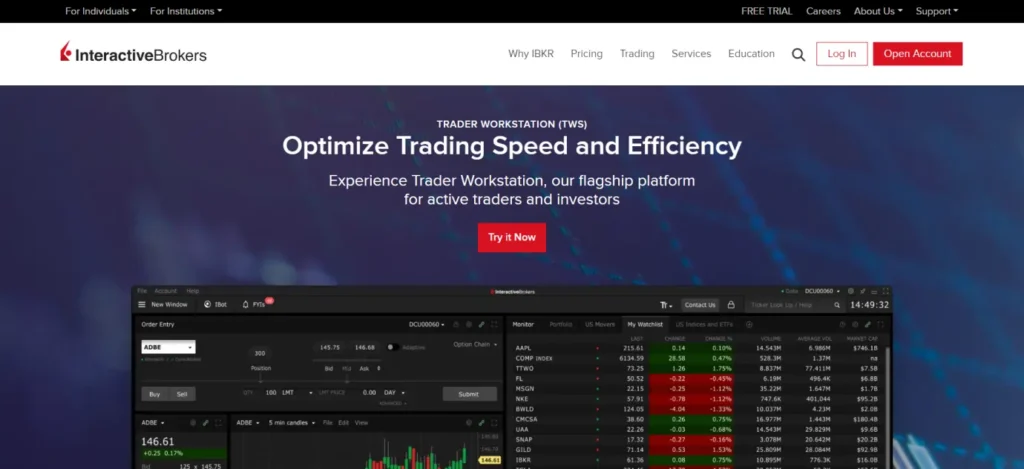

- Trader Workstation (TWS):

TWS is Interactive Brokers' flagship trading platform, designed for advanced traders who require a high level of customization and functionality. It offers a wide range of tools for trading stocks, options, futures, currencies, bonds, and funds across 150+ global markets. Key features include advanced charting, real-time monitoring, risk management tools, and algorithmic trading.

- IBKR Mobile:

IBKR Mobile is a mobile trading app available for iOS and Android devices. It allows traders to access their accounts, place trades, and monitor positions on the go. The app provides real-time streaming data, charts, and market scanners, as well as secure login and account management features.

- Client Portal:

Client Portal is a web-based platform that offers a streamlined interface for trading, account management, and research. It is ideal for casual traders who prefer a simpler and more user-friendly experience. Client Portal provides essential account information, portfolio performance tracking, and easy access to trading and account management tools.

- IBKR Desktop:

IBKR Desktop is a new trading platform that combines the most popular tools from TWS with a growing suite of original features suggested by Interactive Brokers' clients. It offers an intuitive interface for trading stocks, options, futures, and more across global markets.

- IBot:

IBot is an AI-powered interface that allows traders to interact with their accounts using natural language commands. It can be accessed through TWS, IBKR Mobile, and Client Portal, enabling traders to retrieve information, place trades, and manage their accounts using plain English.

| Platform | Key Features | Best For |

|---|---|---|

| Trader Workstation (TWS) | Advanced charting, real-time monitoring, risk management, algorithmic trading | Professional traders who require advanced tools and customization |

| IBKR Mobile | Real-time data, charts, market scanners, secure login, account management | Traders who need to access their accounts and place trades on the go |

| Client Portal | Streamlined interface, essential account information, portfolio tracking, trading and account management tools | Casual traders who prefer a simpler and user-friendly platform |

| IBKR Desktop | Combines popular TWS tools with new features, intuitive interface for trading multiple asset classes | Traders looking for a balance between advanced features and ease of use |

| IBot | AI-powered natural language interface for retrieving information, placing trades, and managing accounts | Traders who want a convenient way to interact with their accounts using plain English |

A Range of Diverse Account Types

Interactive Brokers offers a variety of account types to cater to the diverse needs of traders and investors. The main account types include Individual, Joint, Trust, IRA, and UGMA/UTMA accounts.

- Individual accounts:

Individual accounts are designed for a single trader or investor, providing access to all trading functions and the ability to add additional users with Power of Attorney.

- Joint accounts:

Joint accounts are similar but owned by two account holders, with both having access to all functions. Trust accounts are controlled by a trustee, with the assets held for the benefit of another party.

- IRA:

IRA (Individual Retirement Accounts) are available to individual US tax residents, offering the same features as individual accounts.

- UGMA/UTMA:

UGMA/UTMA accounts are intended for a custodian managing assets for a minor US resident, with the custodian having access to all functions, but are limited to cash accounts only.

- IBKR Pro + Lite:

IBKR Pro serves active traders with access to lowest-cost commissions across 150+ markets, while IBKR Lite caters to occasional traders with commission-free US stock and ETF trading.

| Account Type | Best for | Key Features |

|---|---|---|

| Individual | For a single trader/investor | Access to all trading functions can add Power of Attorney to users |

| Joint | Owned by two account holders | Both holders have full access, to various joint ownership structures available |

| Trust | Assets held by trustee for beneficiary | The trustee has control, considered Professional for market data with multiple trustees |

| IRA | Individual Retirement Accounts | Available to US tax residents, the same features as Individual accounts |

| UGMA/UTMA | The custodian manages assets for minor | Custodian has full access, cash accounts only, for US residents |

| IBKR Pro | For active traders | Lowest commissions across 150+ global markets, full trading platform suite |

| IBKR Lite | For occasional traders | Commission-free US stock/ETF trading, simplified mobile and desktop platforms |

💰 Deposits and Withdrawals

Interactive Brokers supports various methods for funding your account and withdrawing funds:

Deposit Methods: Wire Transfer, ACH (Automated Clearing House), Online Bill Payment, Check, Stock Transfer, ACATS (Automated Customer Account Transfer Service).

Withdrawal Methods: Wire Transfer, ACH, Check, Transfer to a third-party recipient.

Withdrawal requests can be easily submitted through the Client Portal or TWS platforms. Most withdrawals are processed within 1-2 business days, subject to the availability of funds and any applicable holding periods.

Asset Classes

Interactive Brokers grants access to a broad range of asset classes and markets, enabling traders to diversify their portfolios:

Interactive Brokers offers competitive pricing across all asset classes, with low commissions, no hidden fees, and favorable interest rates on margin loans.

FAQs Related to Interactive Brokers

What are the minimum requirements to open an account?

To open an IBKR account, you need to fund it with a minimum of $100. There are no inactivity fees or minimum balance requirements after opening the account.

How do I fund my Interactive Brokers account?

You can fund your IBKR account through various methods, including wire transfer, ACH, online bill payment, check, stock transfer, and ACATS. The Client Portal provides instructions for each funding method.

What are the commissions and fees?

Interactive Brokers offers competitive commissions across all asset classes, with low fees, no hidden charges, and favorable margin rates.

How do I contact customer support?

IBKR provides several ways to get assistance, including the IBot AI assistant, phone support, secure message center, live chat, and email. The recommended method depends on your issue, with IBot and phone support being the quickest options. Support is available 24/6.

Is my account protected?

Yes, Interactive Brokers accounts have SIPC protection for up to $500,000, including $250,000 for cash claims. IBKR also provides excess SIPC insurance from Lloyd's of London for up to an additional $30 million per account, subject to an aggregate limit of $150 million.

Can I trade international markets?

Yes, IBKR provides access to exchanges and markets in over 30 countries for trading stocks, options, futures, currencies, bonds, and funds. This allows clients to easily diversify their portfolios globally.

What are the margin requirements?

Margin requirements vary depending on the product and market. IBKR provides a detailed margin requirements page explaining the rules for each asset class.

Conclusion

Interactive Brokers stands out as a top choice for sophisticated traders and investors seeking a powerful, low-cost platform with unparalleled global market access. With its advanced trading tools, extensive research offerings, and competitive pricing, IBKR caters to the needs of active traders and institutions alike.

While the learning curve may be steeper compared to more beginner-friendly brokers, the wealth of features and cost savings make it a compelling option for those willing to invest the time. As Interactive Brokers continues to innovate and enhance its platforms, such as the new IBKR GlobalTrader mobile app, it is poised to remain a leader in the online brokerage industry for years to come.