OANDA has been making waves in the online trading world for over 25 years, offering a comprehensive suite of tools and platforms for forex, CFD, and cryptocurrency traders. Founded by a computer scientist and an economist, this innovative company has grown into a globally recognized broker with a reputation for cutting-edge technology and reliable service.

Whether you're a seasoned pro or just dipping your toes into the trading waters, User-friendly interfaces and powerful analytics have got you covered. With multiple award-winning platforms, tight spreads, and a commitment to transparency, it's no wonder It has become a go-to choice for traders worldwide.

📊 What is OANDA all about?

OANDA is a globally recognized online trading platform and currency data provider with over 25 years of experience in the financial services industry. Founded in 1996, It offers multi-asset trading, including forex, indices, commodities, metals, and bonds, as well as accurate and reliable exchange rate data trusted by major corporations, tax authorities, and auditing firms worldwide.

With a presence in eight global financial centers, OANDA is headquartered in London, UK, and has offices in the United States, Canada, Singapore, Japan, and Australia. The company's CEO is Gavin Bambury, who brings more than 25 years of experience in the financial services industry to his role as Chief Executive Officer and Executive Director of the OANDA Board.

They provide innovative technology solutions for forex trading, currency information services, and historical currency data to a wide range of clients, from individual traders to large corporations and financial institutions. The company is committed to offering a fair, transparent, and flexible trading environment, along with comprehensive educational resources and reliable customer support. With its strong reputation for innovation and integrity, It continues to be a leader in the online trading and currency data services industry.

| Key feature | Details |

|---|---|

| Regulations | IFSC (Belize), MFSA (Malta), CFTC (United States), ASIC (Australia), IIROC (Canada), FCA (United Kingdom), JFSA (Japan), MAS (Singapore) |

| Supported Languages | English, Spanish, Chinese, German |

| Products | Currencies, Stocks, Crypto, Indices, Commodities |

| Min Deposit | $0 |

| Max Leverage | 1:200 (IFSC), 1:30 (MFSA), 1:50 (CFTC), 1:30 (ASIC), 1:45 (IIROC), 1:30 (FCA), 1:25 (JFSA), 1:20 (MAS) |

| Trading Desk Type | Market Maker |

| Trading Platforms | MT5, Oanda fxTrade, MT4 |

| Deposit Options | Wire Transfer, Neteller, Skrill, Debit Card, Credit Card |

| Withdrawal Options | Wire Transfer, Neteller, Skrill, Debit Card, Credit Card |

| Demo Account | Yes |

| Foundation Year | 1996 |

| Headquarters Country | United States |

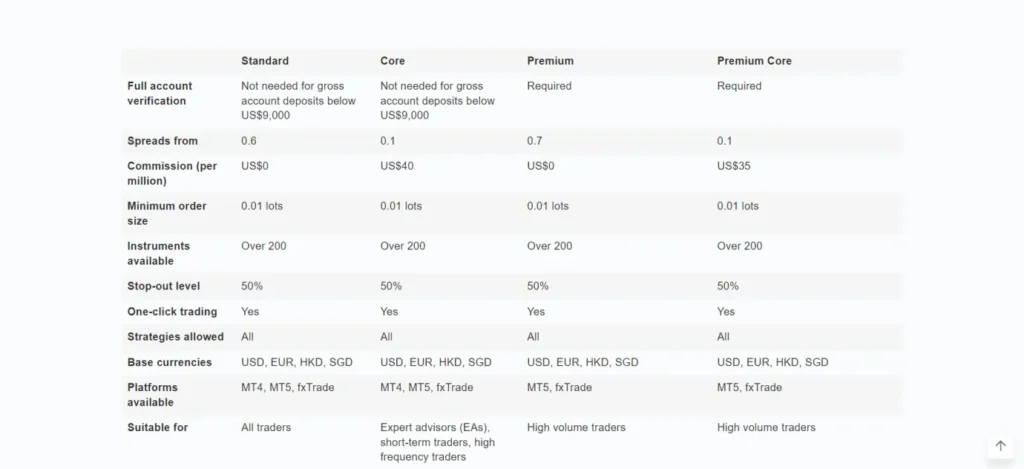

Account Types | Flexibility for Every Trader

It provides a variety of different accounts for its traders. All of them are summarized below:

- Standard:

OANDA's Standard account is suitable for most traders, offering competitive spreads starting from 0.6 pips with no commission fees.

- Standard Core:

The Standard Core account provides reduced spreads from 0.1 pips plus a commission of $3.50-$4.00 per side per 100k, making it ideal for short-term and high-frequency traders.

- Premium:

For high-volume traders, the Premium account offers spreads from 0.7 pips with no commission, but requires a minimum balance of $20,000 and monthly trading volume over $10 million. Additional benefits of the Premium account include a dedicated account manager, zero deposit fees, free withdrawals, and priority support.

- Premium Core:

The Premium Core account combines tight spreads from 0.1 pips with a discounted commission of $35 per million traded, along with premium features like free VPS, API support, and discounted third-party platform access. To qualify for a Premium or Premium Core account, traders must maintain the minimum balance and trading volume requirements.

| Account Type | Minimum Deposit | Spreads | Commissions | Platforms |

|---|---|---|---|---|

| Standard | $0 | From 0.6 pips | None | OANDA Trade, MT4, TradingView |

| Standard Core | $0 | From 0.1 pips | $3.50-$4.00 per side per 100k | Trade, MT4, TradingView |

| Premium | $20,000 | From 0.7 pips | None | Trade, MT5 |

| Premium Core | $20,000 | From 0.1 pips | $35 per million traded | Trade, MT5 |

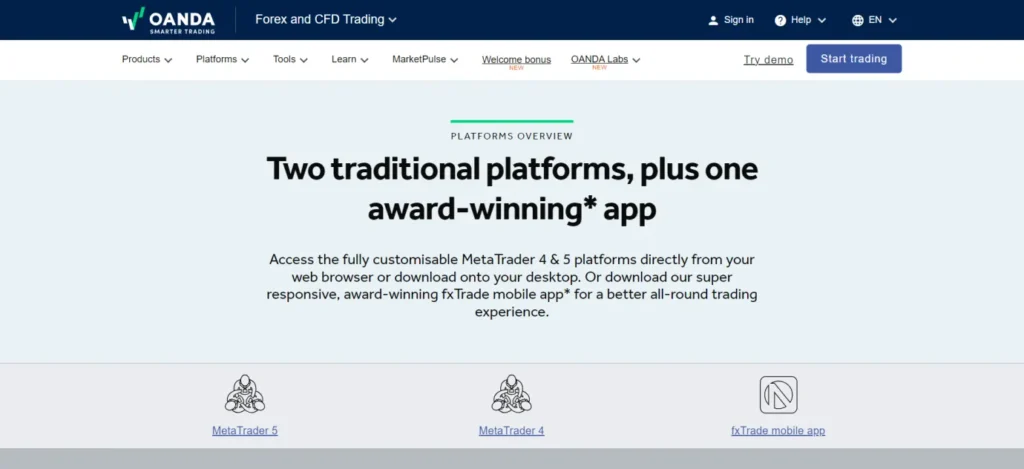

OANDA Platforms | Versatility at Your Fingertips

OANDA offers a suite of powerful trading platforms designed to cater to the diverse needs of its clients. Whether you prefer web-based trading, desktop applications, or mobile apps, It has you covered.

1. OANDA Trade Web

The OANDA Trade web platform is a user-friendly, browser-based trading interface that offers a seamless trading experience. Key features include:

2. OANDA Trade Mobile and Tablet Apps

For traders on the go, provides native mobile apps for Android and iOS devices. These apps offer the same functionality as the web platform, allowing you to:

3. MetaTrader 4 (MT4)

It also supports the popular MetaTrader 4 platform, which offers advanced features such as:

4. TradingView Integration

Through a partnership with TradingView, OANDA clients can access:

| Platform | Instruments | Mobile Trading | Price Alerts | Advanced Order Types | Cost | Platform |

|---|---|---|---|---|---|---|

| OANDA Trade Web | All instruments | ✕ | ✕ | ✕ | Free | OANDA Trade Web |

| OANDA Trade Mobile | All instruments | ✔ | ✔ | ✕ | Free | OANDA Trade Mobile |

| MetaTrader 4 | All instruments | ✔ | ✔ | MT4 Premium Tool Pack | Free | MetaTrader 4 |

| TradingView | All instruments | ✔ | ✔ | ✕ | Free (standard account), paid plans available | TradingView |

Deposits and Withdrawals | Secure and Convenient

OANDA supports a variety of payment methods for deposits and withdrawals, ensuring a smooth and secure funding process. Deposits are typically processed instantly, while withdrawals may take 1-5 business days depending on the method used. It does not charge any fees for deposits or withdrawals, but third-party fees may apply. These include:

Asset Classes | A Variety of Opportunities

It offers a diverse range of tradable instruments across multiple asset classes, allowing traders to diversify their portfolios and capitalize on various market opportunities. These include:

Regulation and Security | Your Funds in Safe Hands

OANDA is a regulated broker, holding licenses from top-tier financial authorities around the world, including:

Common Queries

Is OANDA regulated?

Yes, OANDA is a regulated broker, holding licenses from top-tier financial authorities around the world.

What are OANDA's hours of operation?

Its hours of operation coincide with the global financial markets. For example:

In the US, trading is available from approximately 5 p.m. Sunday to 5 p.m. Friday (New York time), In Asia, trading is available from 6 am Monday to 6 am Saturday (Singapore time).

What is the average response time for trade inquiries at OANDA?

Trade inquiries vary in complexity, so the response time also varies, but you should typically receive a response within two to five business days.

What is margin trading?

Margin trading allows you to leverage the funds in your account to generate larger profits by depositing just a fraction of the total value of your trade.

Can I withdraw the capital I trade with from my OANDA Prop Trader account?

No. The capital that you trade with is a virtual allocation of OANDA's capital and remains under OANDA's ownership.

How can I contact OANDA for support?

It provides several ways to contact their support team:

Existing customers can email cxsupport@oanda.com or call the support numbers listed on their website. Prospective customers can email info.eu@oanda.com or call the sales numbers provided.

Conclusion

OANDA has established itself as a leading online forex broker, offering a comprehensive trading platform, competitive spreads, and a commitment to transparency and security. With its user-friendly interface, advanced charting tools, and educational resources, OANDA caters to both novice and experienced traders alike. The company's dedication to innovation and customer satisfaction has earned it a strong reputation in the forex trading community.

As It continues to expand its services and adapt to the ever-changing financial landscape, it remains well-positioned to provide traders with the tools and support they need to navigate the dynamic world of forex trading successfully.