OctaFX is a well-established online forex and CFD broker that has been serving traders worldwide since 2011. In this article, we'll take a deep dive into what OctaFx has to offer, including its trading platforms, account types, asset classes, deposits and withdrawals, and more.

OctaFX is quickly becoming a favorite among traders worldwide. Whether you're a seasoned pro or just starting out, OctaFX has got you covered. From competitive spreads to multiple account types, this broker offers everything you need to succeed in the exciting world of forex trading.

What is OctaFX?

OctaFX, now known as Octa, is a popular online forex and CFD broker that has been operating since 2011. The broker has attracted over 42 million trading accounts across more than 180 countries, thanks to its commission-free access to financial markets, a wide range of trading services, and commitment to education and social responsibility.

In addition to its trading services, Octa is recognized for its educational resources, including webinars, articles, and analytical tools, as well as its involvement in humanitarian and charitable initiatives. The broker has received numerous awards over the years, such as ‘Most Reliable Broker Asia 2023‘ and ‘Best FX Broker India 2022‘, cementing its reputation as a trusted and reputable broker in the industry.

| Key feature | Details |

|---|---|

| Regulations | MISA (Comoros), CySEC (Cyprus), FSCA (South Africa) |

| Supported Languages | English, Urdu, Hindi, Indonesian, Portuguese, Thai, Spanish, Chinese, Vietnamese, Malaysian, German |

| Products | Currencies, Stocks, Crypto, Indices, Commodities |

| Min Deposit | $25 |

| Max Leverage | 1:1000 (MISA), 1:30 (CySEC ), 1:500 (FSCA) |

| Trading Desk Type | ECN, STP |

| Trading Platforms | MT5, MT4, Octatrader |

| Deposit Options | FasaPay, Cryptocurrencies, Wire Transfer, Skrill, Neteller, Credit Card, Ngan Luong, Visa |

| Withdrawal Options | Wire Transfer, Cryptocurrencies, Neteller, Skrill, Visa |

| Demo Account | Yes |

| Foundation Year | 2011 |

| Headquarters Country | Comoros |

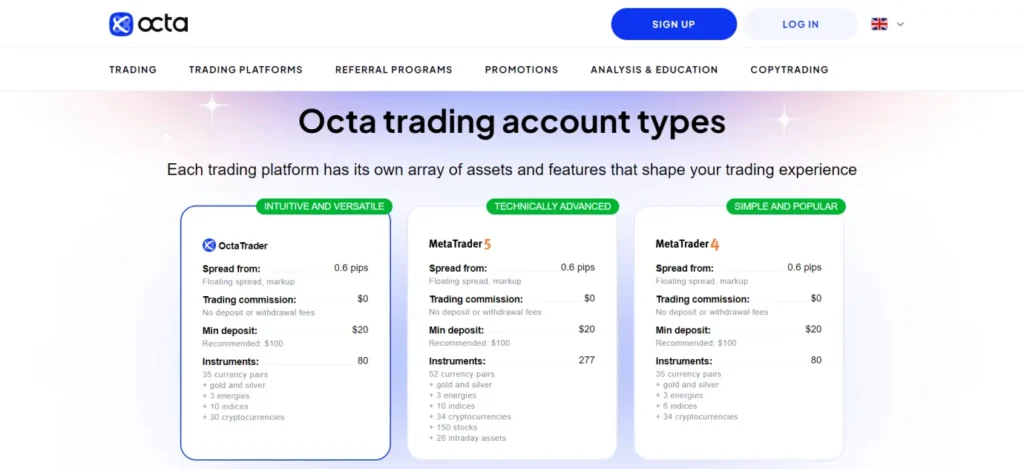

OctaFX Trading Account Types

OctaFX offers a variety of account types and trading platforms to cater to the needs of different types of traders. The broker provides access to the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its own proprietary web-based platform called OctaTrader.

- MT4 Platform

On the MT4 platform, OctaFX offers two main account types: the Micro account and the Pro account. The Micro account is suitable for beginners or those with limited trading capital, as it allows traders to start with a minimum deposit of just $100 and offers leverage up to 1:500. The Pro account, on the other hand, is designed for more experienced traders who require tighter spreads and higher trading volumes. It requires a minimum deposit of $500 and offers leverage up to 1:200.

- MT5 Platform

For traders who prefer the next-generation MT5 platform, Octa provides an account type with a minimum deposit of $100, leverage up to 1:500 (under MISA regulation) or 1:30 (under CySEC regulation), and raw spreads starting from 0.0 pips. The MT5 platform offers advanced features such as faster backtesting, multi-pair testing, and integration with centralized exchanges.

- OctaTrader

For traders seeking a simpler and more user-friendly trading experience, OctaFX provides its own web-based platform called OctaTrader. This platform is designed for beginners and offers intuitive management of profiles, accounts, and financial transactions. It also features extensive web trading functionality with different chart types, popular indicators, and analysis tools.

| Account/Platform | Minimum Deposit | Leverage | Minimum Trade Size | Spreads |

|---|---|---|---|---|

| MT4 Micro | $100 | Up to 1:500 | 0.01 lots | From 0.4 pips |

| MT4 Pro | $500 | Up to 1:200 | 0.1 lots | From 0.2 pips |

| MT5 | $100 | Up to 1:500 (MISA) or 1:30 (CySEC) | 0.01 lots | From 0.0 pips |

| OctaTrader | $25 | Up to 1:1000 (MISA), 1:30 (CySEC), 1:500 (FSCA) | 0.01 lots | From 0.6 pips |

MetaTrader 5 Vs. MetaTrader 4 vs. OctaFx Platforms

OctaFX offers traders a choice between three trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary OctaTrader platform. MT4 is the most widely used platform, known for its reliability, advanced charting capabilities, and extensive customization options. It offers a user-friendly interface and a built-in market for Expert Advisors and Custom Indicators. MT4 supports hedging, auto trading, and one-click trading, making it suitable for both beginners and experienced traders.

On the other hand, MT5 is a next-generation multi-asset trading platform designed to replace MT4. It offers faster backtesting, multi-pair testing, and integration with centralized exchanges. MT5 provides a wider range of tradable assets, including Forex, indices, stocks, and cryptocurrencies. The platform also supports stop-limit orders and features an economic calendar. MT5 uses the MQL5 programming language, which executes up to 20 times faster than MT4's MQL4. While MT5 combines the simple interface of MT4 with advanced features for technical and fundamental analysis, it may have a steeper learning curve for beginners.

For traders seeking a simpler and more user-friendly option, OctaFX provides its web-based OctaTrader platform. This platform is designed for beginners and offers intuitive management of profiles, accounts, and financial transactions. OctaTrader features extensive web trading functionality with different chart types, popular indicators, and analysis tools. However, it supports a more limited range of tradable instruments compared to MT4 and MT5.

Diverse Deposits and Withdrawals

OctaFX supports a variety of deposit and withdrawal methods to ensure convenience for its clients,

let’s take a look at them:

- Deposits

OctaFX offers several convenient methods to deposit funds into your trading account, including Bank Wire Transfer, Credit/Debit Cards (Visa, Mastercard), E-wallets (Skrill, Neteller, Perfect Money), and Cryptocurrencies (Bitcoin, Ethereum, Litecoin).

Deposits are typically processed instantly and OctaFx does not charge any internal fees for deposits. However, some third-party payment processors may charge their own fees.

To make a deposit:

- Withdrawals

OctaFx offers fast and fee-free withdrawals. The available withdrawal methods include Bank Wire Transfer, Credit/Debit Cards (Visa, Mastercard), E-wallets (Skrill, Neteller, Perfect Money), and Cryptocurrencies (Bitcoin, Ethereum, Litecoin).

To withdraw funds:

| Method | Deposit | Withdrawal | Fees | Processing Time |

|---|---|---|---|---|

| Bank Transfer | Yes | Yes | None from Octa Fx | Instant for deposits, 1-3 hours for withdrawals |

| Credit/Debit Card | Yes | Yes | None from Octa Fx | Instant for deposits, 1-3 hours for withdrawals |

| Skrill | Yes | Yes | None from Octa Fx | Instant for deposits, 1-3 hours for withdrawals |

| Neteller | Yes | Yes | None from Octa Fx | Instant for deposits, 1-3 hours for withdrawals |

| Bitcoin | Yes | Yes | None from Octa Fx | Instant for deposits, 1-3 hours for withdrawals |

Asset Classes

Octa offers a diverse range of asset classes for trading, although Octa currently does not offer trading in ETFs, futures, bonds, or options.

1. Forex (Currencies)

Octa has a strong focus on forex trading, offering over 35 currency pairs, including major, minor, and some exotic pairs. This makes it an attractive choice for forex traders.

2. Commodities

Traders can access various commodities through Octa, including energy products, precious metals, and others. This allows for diversification and trading based on commodity price movements.

3. Indices

Octa provides access to some of the world's major stock indices, enabling traders to speculate on the overall performance of a group of stocks.

4. Cryptocurrencies

Octa offers trading opportunities in popular cryptocurrencies such as Bitcoin, Litecoin, and Ethereum. However, it's important to note that cryptocurrency trading may not be available under all regulatory jurisdictions, such as CySEC.

5. Stocks CFDs

While Octa doesn't offer direct stock trading, it does provide access to stock CFDs, allowing traders to speculate on price movements of individual stocks without owning the underlying assets.

Common Queries

Does Octa charge any fees for Deposits or Withdrawals?

No, Octa does not charge any internal fees for deposits or withdrawals. However, some third-party payment processors may charge their own fees.

Is Octa a Regulated Broker?

Yes, Octa is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Mwali International Services Authority (MISA) in Comoros.

Does Octa offer any Bonuses or Promotions?

Octa offers a 50% deposit bonus to clients under its Saint Vincent and the Grenadines entity. It also runs occasional contests and promotions.

What Educational Resources Does Octa Provide?

Octa maintains a library of educational articles, video tutorials, webinars, and daily market analyses to help clients improve their trading knowledge.

How is Octa's Customer Support?

Octa offers 24/7 customer support via live chat, email, and phone. Support is available in multiple languages.

Is Octa a Trustworthy Broker?

While Octa is regulated in multiple jurisdictions, some like Comoros provide less robust oversight than major regulators like the FCA or ASIC.

Conclusion

Octa Fx is a reputable forex and CFD broker that offers a complete trading experience for both beginners and experienced traders. If you're looking for a reliable and feature-rich broker to start or continue your trading journey, Octa Fx is definitely worth considering.