Alpha Capital Group is a proprietary trading firm established in November 2021, based in London, UK. The firm offers a challenge-based funding model that allows skilled traders to access trading accounts with capital up to $200,000. Alpha Capital Group emphasizes risk management and transaction consistency, providing an 80% profit split to traders.

The firm supports trading in various instruments, including forex pairs, metals, indices, and stocks, with leverage up to 1:100. It also offers advanced trading platforms like MT4 and MT5, and a proprietary platform called TradeLocker. Alpha Capital Group is known for its supportive customer service, educational resources, and biweekly payouts, aiming to enhance the trading experience and success of its participants.

🔱 What is Alpha Capital Group?

Alpha Capital Group (ACG) is a London-based proprietary trading firm established in November 2021 by Andrew Blaylock and George Kohler. The firm offers a unique challenge-based model to assess traders' strategies and risk management skills through a two-phase evaluation process.

ACG provides its traders with a custom-built trading dashboard that offers advanced analytics, a trading journal, and market data. The firm also offers personalized 1-on-1 risk reviews with accredited market experts to support traders in their journey to success.

With its commitment to empowering traders through innovative tools and resources, Alpha Capital Group has quickly gained a reputation as a leading prop trading firm.

| Key Feature | Details |

|---|---|

| CEO | Andrew Baylock |

| Platform | MT5 and cTrader |

| Payout Split | Upto 80% |

| Subsequent Payouts | 2 Weeks |

| Max Drawdown | 10% |

| Headquarters | London |

| Expert Advisors | Allowed |

| Max Funding | $200,000 |

| Funding Programs | Alpha Pro Challenge |

| Leverage | Upto 1:100 |

| Weekend Holding | Allowed |

| Contact | support@alphacapitalgroup.com |

| Trustpilot Rating | 4.0/5.0 |

Alpha Capital Group Evaluation Process| A Two-Phase Journey

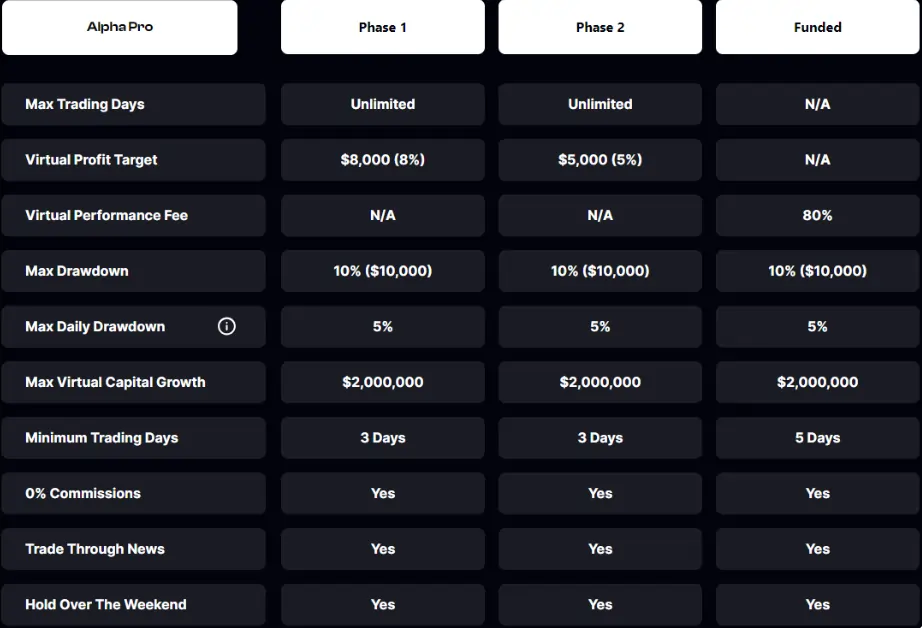

Alpha Capital Group's approach lies in its two-phase evaluation process, designed to assess traders' strategies and risk management skills in a simulated institutional trading environment. The challenges, ranging from $5K to $200K, cater to traders at various skill levels and capital requirements.

Phase 1 focuses on assessing the trader's ability to navigate the markets while adhering to strict risk parameters. With no time constraints, traders can adapt their virtual strategies to optimize performance. Upon successful completion of Phase 1, traders progress to Phase 2, where they further demonstrate their consistency and proficiency.

Throughout the evaluation process, traders benefit from a host of features, including:

- Real-time pricing feeds, allowing for millisecond-level precision in strategy assessment

- Zero commission accounts, ensuring a level playing field for all participants

- Access to a wide range of tradable assets, including forex, commodities, gold, and indices

| Account Size | Price |

|---|---|

| $5,000 | $50 |

| $10,000 | $97 |

| $25,000 | $197 |

| $50,000 | $297 |

| $100,000 | $497 |

| $200,000 | $997 |

Payouts| Rewarding Excellence

One of the most attractive aspects of Alpha Capital Group's model is its generous profit-sharing structure. Qualified traders, known as Alpha Prop virtual traders, can earn up to 80% of the profits generated on their accounts. This industry-leading split serves as a testament to the firm's commitment to rewarding excellence and supporting the growth of its traders.

Performance fees are paid out bi-weekly, with requests processed within 2 business days via bank wire transfer or Rise, a cryptocurrency-based withdrawal option. Alpha Capital Group has partnered with a deliverable FX institution to ensure competitive exchange rates for traders receiving payouts in their domestic currencies.

One of the most attractive aspects of ACG is its generous profit-sharing structure, with qualified traders earning up to 80% of the profits generated on their accounts.

Platforms| Empowering Traders with the Finest Technology

To provide its traders with an unparalleled trading experience, Alpha Capital Group has developed its own proprietary platform, ACG Markets. This state-of-the-art platform replicates institutional trading conditions, offering: Prime of prime liquidity, Ultra-low latency, sub-30ms targeted execution time, and Raw spreads from 0.1 pips

In addition to ACG Markets, the firm supports popular third-party platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to traders' preferences and ensuring a seamless transition from the evaluation phase to live trading.

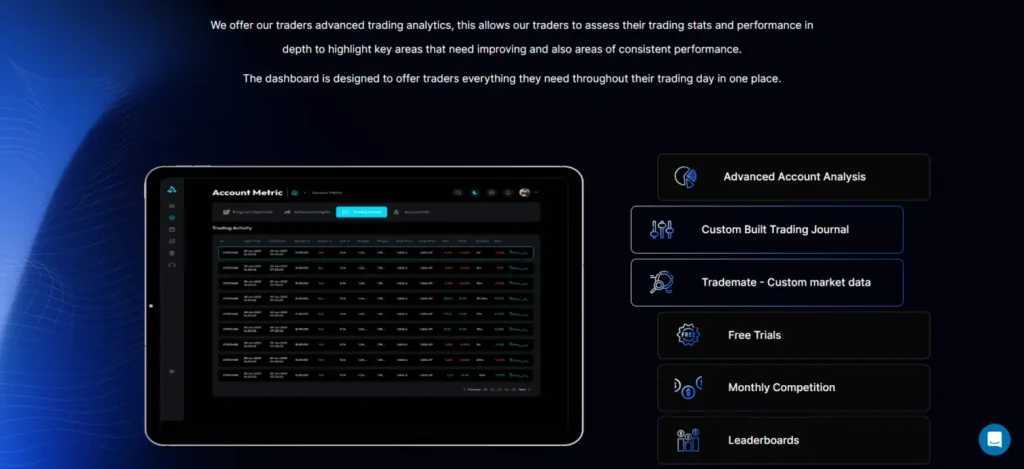

Trading Dashboard| Insights at Your Fingertips

Alpha Capital Group's innovative trading dashboard is a game-changer for traders seeking to elevate their performance. This custom-built tool provides advanced trading analytics, allowing traders to assess their stats and identify areas for improvement. Key features include Advanced account analysis, Custom-built trading journal, Trademate – custom market data, and Free trials, and monthly competition leaderboards.

With the trading dashboard, Alpha Prop virtual traders have everything they need to make informed decisions and achieve unparalleled success in the forex markets.

FAQs related to Alpha Capital Group

What are the profit targets and risk management rules?

Profit targets are set at 8% for the first phase and 5% for the second phase. A max daily loss of 5% and a total loss limit of 10% are in place to encourage responsible trading.

Are there any commission fees at ACG?

For the Standard Assessment, there are no commission fees applicable to trades across all asset classes. For the RAW Assessment, a charge of $2.5 per lot is incurred for each transaction in both directions. Indices are commission-free across both account types.

What happens if a trader violates a rule?

Depending on the rule violated it can result in a soft breach, a hard breach leading to account failure, or a complete ban from the platform and funding.

Does ACG offer a free trial?

Yes, ACG offers a free trial, allowing traders to test the execution environment, dashboard, and trading analytics. They also offer free monthly trading competitions.

What broker does ACG use?

ACG exclusively uses ACG Markets, a 3rd party FSA Regulated Brokerage, which provides a simulated institutional environment for assessments.

Is there a legal agreement with ACG?

Yes, once an analyst has passed the assessments, a general service agreement between Alpha Capital Group Limited and the analyst will be signed prior to receiving their account credentials.

The Bottom Line

As the trading sphere continues to evolve, one thing remains certain: Alpha Capital Group will be at the forefront, pioneering new solutions and empowering traders to achieve their full potential. With its visionary leadership, robust technology, and unwavering commitment to its clients, this prop firm is poised to redefine the future of proprietary trading, one successful trader at a time.

Alpha Capital Group stands out as a premier proprietary trading firm, dedicated to empowering traders with cutting-edge tools and comprehensive support. With a focus on providing advanced trading analytics, personalized risk reviews, and a zero-commission trading environment, Alpha Capital Group ensures that traders have everything they need to succeed. The firm's commitment to fostering talent through its structured evaluation programs and free trial accounts makes it an ideal choice for aspiring traders.