Alpicap is a Swiss-based proprietary trading firm that's shaking up the industry. Founded in 2022, this newcomer is already making waves with its innovative approach to trader support. Offers a two-step evaluation challenge across a wide range of financial instruments, from forex to cryptocurrencies. With account sizes ranging from $15,000 to $200,000 and an attractive 80% profit split, they're serious about empowering traders to reach their full potential. Whether you're a seasoned pro or just starting out, Alpicap's blend of cutting-edge platforms like MT4 and DxTrade, coupled with their commitment to transparency and support, might just be the boost your trading career needs.

⨹ The Alpicap Overview

Alpicap is a Swiss-based proprietary trading firm that provides traders with the opportunity to access significant capital and trade in various financial markets. Founded in 2022 and headquartered in Geneva, Switzerland, It has quickly gained recognition for its trader-friendly approach and innovative offerings.

The company stands out for its industry-leading 12% drawdown allowance, which gives traders more flexibility to navigate market volatility. Offers a two-phase challenge program for traders to prove their skills and gain access to funded accounts ranging from $15,000 to $200,000.

It supports popular trading platforms like MetaTrader 4 and DxTrade, allowing traders to access a wide range of instruments including forex, commodities, indices, metals, and cryptocurrencies.

| Detail | Information |

|---|---|

| Company Name | Alpicap |

| Founded | 2022 |

| Headquarters | Geneva, Switzerland |

| Website | https://alpicap.com |

| Trading Platforms | MetaTrader 4, DxTrade |

| Account Sizes | $15,000 to $200,000 |

| Drawdown Limit | 12% |

| Profit Split | 80% for traders |

| Contact | support@alpicap.com |

⨹ Alpicap Trading Platforms

Understand that the right tools can make all the difference in a trader's success.

To cater to diverse trading styles and preferences, the firm offers two powerful platforms:

Both platforms are designed to provide traders with a seamless and efficient trading experience across various markets and instruments.

Account Types and Funding Options

| Account Size | Minimum Trading Days | Maximum Trading Days (Phase 1) | Maximum Trading Days (Phase 2) | Price |

|---|---|---|---|---|

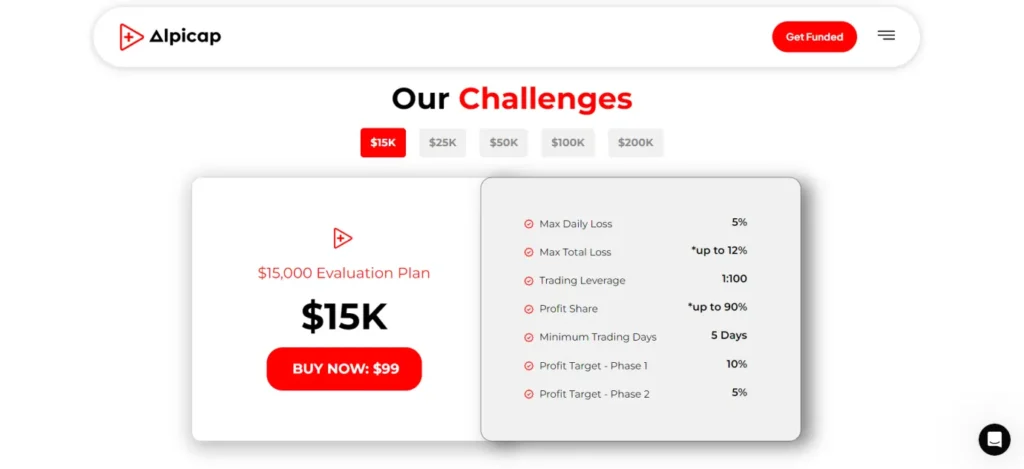

| $15,000 | 5 | 30 | 60 | $99 |

| $25,000 | 5 | 30 | 60 | $149 |

| $50,000 | 5 | 30 | 60 | $299 |

| $100,000 | 5 | 30 | 60 | $499 |

| $200,000 | 5 | 30 | 60 | $977 |

Offers a range of account sizes to suit different trader needs and experience levels. Funding options start from $15,000 and go up to an impressive $200,000. This variety allows both novice traders and seasoned professionals to find an account size that matches their skills and risk tolerance.

⨹ The Alpicap Challenge

Path to funded trading is structured as a two-phase challenge, designed to identify and nurture skilled traders:

Phase 1

Phase 2

Traders who successfully complete both phases are offered a funded account, where they can trade Alpicap's capital and earn a substantial share of the profits.

Profit Split and Payout Structure

It offers an attractive profit-sharing structure that rewards successful traders generously. The firm provides an industry-leading 80% profit split, allowing traders to keep a substantial portion of their earnings. This high percentage demonstrates Alpicap's commitment to aligning its interests with those of its traders.

For payouts, It has established a clear and trader-friendly process. The initial payout is available 30 days after a trader achieves funded status and meets the profit targets. Following this initial payout, traders can enjoy bi-weekly withdrawals, providing a steady income stream for consistent performers.

This payout schedule strikes a balance between allowing traders to access their earnings regularly while also ensuring a stable trading environment. The combination of the high-profit split and frequent payout opportunities makes Alpicap an appealing choice for traders looking to maximize their potential returns in the prop trading space.

Answering Popular Alpicap Questions

What is Alpicap?

What trading platforms does Alpicap use?

What financial instruments can be traded with Alpicap?

Traders can access forex pairs, commodities, indices, metals, and cryptocurrencies through it.

How does Alpicap's profit-sharing work?

Are there any trading day requirements at Alpicap?

What is the maximum account size offered by Alpicap?

Is news trading permitted at Alpicap?

Yes, traders are allowed to engage in news trading while using proper

⨹ The Bottom Line

Alpicap emerges as a dynamic prop trading firm that caters to the diverse needs of traders through its flexible funding options, advanced trading platforms, and comprehensive instrument offerings. With its commitment to providing exceptional support, reliable payouts, and a rewarding profit-sharing model, It has garnered positive feedback from the trading community. As a relatively young firm based in the financial hub of Switzerland, It is well-positioned to empower traders seeking professional growth and financial success. For those ready to elevate their trading careers, Alpicap presents a compelling opportunity to leverage cutting-edge technology and capitalize on the firm's trader-centric approach.