If you've been dreaming of trading futures with substantial capital but don't have the funds to do so, Apex Trader Funding (ATF) might be the solution you've been looking for. Established in 2021, this Austin, Texas-based prop firm has quickly become a favorite among aspiring traders worldwide.

Apex Trader Funding (ATF) stands out as a beacon for traders looking to scale their strategies without risking their own capital. With a transparent and innovative approach, ATF provides not just funding, but also a robust educational system designed to enhance trading skills.

Whether you're an aggressive scalper or a conservative swing trader, ATF's tailored programs and cutting-edge platforms offer the perfect environment to thrive. Join the ranks of successful traders who have leveraged ATF's support to unlock their full potential and achieve substantial gains in the market.

What is Apex Trader Funding?

| Key Feature | Details |

|---|---|

| Founder | Darrell Martin |

| Platform | Rithmic, Tradovate, NinjaTrader |

| Payout Split | 100% of the first $25,000, 90% thereafter |

| First Payout | After a minimum of 10 trading days |

| Subsequent Payouts | Twice a month |

| Maximum Drawdown | Live trailing threshold |

| Headquarters | Austin, Texas |

| Max Funding | $300,000 |

| Funding Programs | Evaluation Accounts, Performance Accounts |

| Weekend Holding | Allowed (trading from 6 PM ET to 4:59 PM ET the next day) |

| Contact | support@apextraderfunding.com |

| Trustpilot Rating | 4.5/5.0 |

Apex Trader Funding is a proprietary trading firm that provides traders with the opportunity to trade futures markets using the company's capital. Their mission is to empower traders by offering a straightforward path to becoming funded traders without the need for significant personal capital.

Unlike traditional prop firms, Apex Trader Funding has revolutionized the trader payout model, focusing on a more customer-centric approach. This has led to their rapid growth, with a global community spanning over 150 countries and tens of thousands of members.

Apex Trader Funding Account Types and Evaluation Process

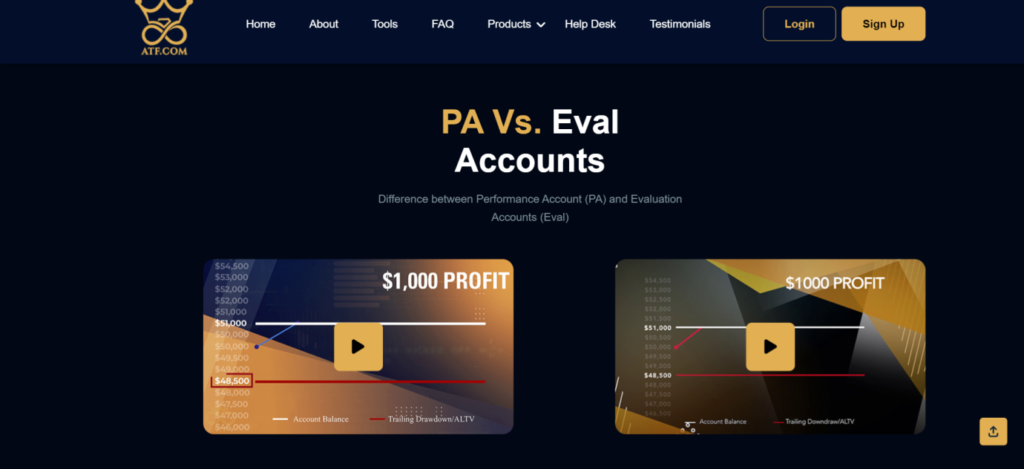

Apex Trader Funding offers two main types of accounts: Evaluation Accounts (Eval) and Performance Accounts (PA).

1. Evaluation Accounts

The evaluation process at Apex Trader Funding is designed to be trader-friendly and efficient. Here are some key features:

- Qualify in as little as 7 trading days

- Live trailing threshold eliminates daily drawdown concerns

- Trading is allowed on holidays and during news events (with some restrictions)

- No position size limitations (system caps prevent stop-outs)

- News trading is allowed (but specific strategies are prohibited)

2. Performance Accounts

Once you successfully complete the evaluation, you'll be upgraded to a Performance Account. This is where you'll trade with Apex Trader Funding's capital and earn real profits.

Account Sizes and Pricing

Apex Trader Funding offers a range of account sizes to suit different trader needs and experience levels. Here's a breakdown of their offerings:

| Account Size | Monthly Fee (Rithmic) | Monthly Fee (Tradovate) |

|---|---|---|

| $25,000 | $147 | $167 |

| $50,000 | $167 | $187 |

| $75,000 | $187 | $207 |

| $100,000 | $207 | $227 |

| $150,000 | $297 | $317 |

| $250,000 | $517 | $537 |

| $300,000 | $657 | $677 |

| $100,000 (Static) | $137 | $157 |

Note: Prices are subject to change, and Apex Trader Funding often runs promotions with significant discounts.

Trading Platforms

Apex Trader Funding provides access to multiple trading platforms, giving traders the flexibility to choose the one that best suits their needs. The main platforms offered are:

| Feature | rTrader | NinjaTrader | Tradovate |

|---|---|---|---|

| Web-based | Yes | No | Yes |

| Advanced charting | Moderate | Excellent | Good |

| Automation | Limited | Extensive | Moderate |

| Mobile app | Yes | Yes | Yes |

| Ease of use | High | Moderate | High |

- rTrader: A proprietary platform provided by Apex Trader Funding

- NinjaTrader: A popular third-party platform known for its advanced charting and automation capabilities

- Tradovate: A web-based platform that offers ease of use and accessibility from any device with an internet connection

Each platform has its strengths, and your choice may depend on factors like your trading style, technical requirements, and personal preferences.

Tradable Instruments

Apex Trader Funding offers a wide range of futures contracts across various asset classes. Here's a sample of the available instruments:

| Name | Symbol | Exchange | Tick Size | Point Value |

|---|---|---|---|---|

| Gold | GC | COMEX | 0.1 | $100 |

| Silver | SI | COMEX | 0.005 | $5,000 |

| Copper | HG | COMEX | 0.0005 | $25,000 |

| E-mini S&P 500 | ES | CME | 0.25 | $50 |

| E-mini Nasdaq 100 | NQ | CME | 0.25 | $20 |

| Crude Oil | CL | NYMEX | 0.01 | $1,000 |

| Natural Gas | NG | NYMEX | 0.001 | $10,000 |

| Euro FX | 6E | CME | 0.00005 | $125,000 |

This diverse selection allows traders to focus on their preferred markets or diversify their trading across different asset classes.

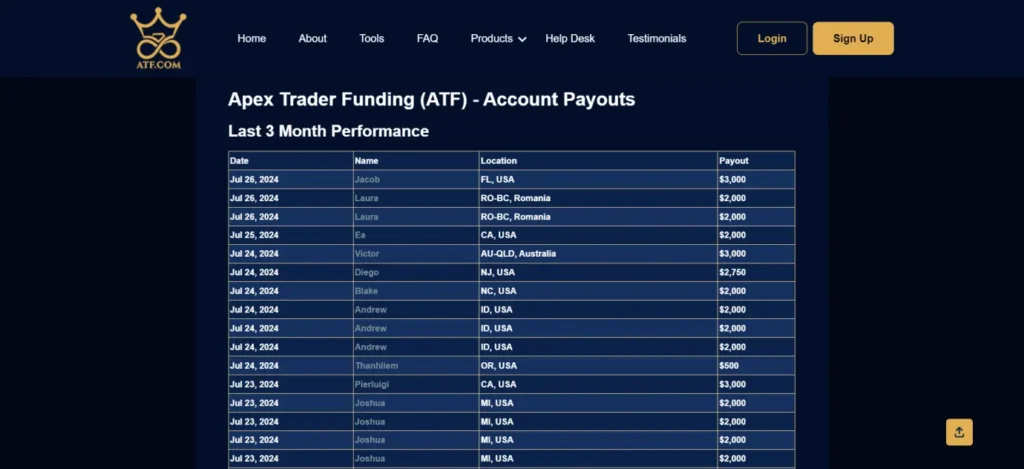

ATF Payout Structure and Profit Sharing

Apex Trader Funding offers a generous and competitive payout structure that sets it apart in the prop trading industry.

Traders who successfully complete the evaluation process and move to a funded Performance Account (PA) can enjoy a lucrative profit-sharing model. The company provides 100% of the first $25,000 in profits per account to the trader, which is an exceptional offer compared to many other prop firms.

After reaching this initial threshold, traders continue to earn an impressive 90% of all subsequent profits. This high-profit split allows successful traders to maximize their earnings potential. Payouts are available twice a month, providing regular income opportunities for consistent performers.

To ensure a balance between trader earnings and risk management, Apex Trader Funding implements a minimum payout amount of $500 for the first three payout months. However, from the fourth month onwards, there is no maximum payout limit, allowing top-performing traders to fully capitalize on their success.

This payout structure demonstrates Apex Trader Funding's commitment to rewarding skilled traders and aligning the company's interests with those of its funded traders.

Recurrent Questions regarding ATF

What are The Monthly Fees?

Monthly fees vary depending on the account size and platform chosen. For Rithmic, fees range from $137 to $657 per month. For Tradovate, fees range from $157 to $677 per month.

What Trading Platforms Does Apex Trader Funding Support?

Apex Trader Funding supports both Rithmic and Tradovate trading platforms.

What are The Trading Hours?

Trading is allowed from 6 PM ET to 4:59 PM ET the next day, including holidays and during news events.

Are There Position Limits?

Traders can trade up to the maximum position size. The system caps positions to prevent stop-outs in both evaluation and funded accounts.

Is News Trading Allowed?

General news trading is allowed, but specific strategies like directional pre-news entries are prohibited.

Is There a Referral Program?

Yes, Apex Trader Funding offers a 15% Lifetime Referral Commission program. Referrers earn a 15% commission every month for the entire lifetime of customers they refer, applicable to both evaluation plans and resets.

Final Say

Apex Trader Funding offers a unique opportunity for traders to access substantial capital and keep a high percentage of the profits. By passing their evaluation process, which involves trading a funded account according to specific rules and criteria, traders can demonstrate their skills and discipline.

While the evaluation process may be challenging, it serves as a proving ground for traders to showcase their abilities. Apex Trader Funding's model provides a viable path for talented traders to potentially achieve financial success without risking their own capital. As with any trading endeavor, thorough research, practice, and risk management are essential. For those who are dedicated and well-prepared, Apex Trader Funding can be a valuable stepping stone in their trading career.