Elite Trader Funding (ETF) has emerged as a prominent player in the world of prop trading firms, offering traders the opportunity to access substantial capital without risking their own money. ETF has quickly gained recognition for its innovative approach to funded trading. This article will delve into the various aspects of Elite Trader Funding, including its account types, platforms, payouts, and more.

Elite Trader Funding might just be the opportunity you've been waiting for. Founded in 2022, this Florida-based proprietary trading firm offers a unique platform where traders can showcase their skills in simulated environments and earn live funding to trade in real markets. With a variety of evaluation types tailored to different trading styles, Elite Trader Funding provides a flexible and transparent path to financial success. Plus, you can keep 100% of your first $12,500 in profits, making it an attractive option for both novice and experienced traders alike.

Starting Off with Elite Trader Funding Introduction

| Key Feature | Details |

|---|---|

| Platform | NinjaTrader, Tradovate, Rithmic, TradingView |

| Payout Split | 80/20 (100% of first $12,500) |

| Payouts | Weekly (processed on Wednesdays) |

| Maximum Drawdown | Varies by account type |

| Headquarters | Florida, USA |

| Max Funding | $300,000 |

| Funding Programs | One-Step, EOD Drawdown, Fast Track, Static, Diamond Hands Evaluations |

| Leverage | Not applicable (account balance is final buying power) |

| Weekend Holding | Allowed on Diamond Hands accounts |

| Contact | Through website |

| Trustpilot Rating | 4.0/5.0 |

Elite Trader Funding (ETF) is a proprietary trading firm founded in 2022 and based in Florida, USA. The company provides traders with the opportunity to earn live funding based on their performance in simulated accounts. ETF's mission is to empower retail traders by offering them access to substantial capital without risking their own money.

ETF was founded by three professionals with extensive experience in banking, the energy industry, and commodities trading. The founding team includes a CFA Charterholder, an individual with an MBA and BA in Economics, and collectively they bring over 40 years of trading experience to the table.

Elite Trader Funding is an attractive option for aspiring and experienced traders alike.

Account Types and Evaluation Process

ETF offers several account types, each designed to cater to different trading styles and experience levels. The evaluation process is crucial, as it determines whether a trader qualifies for a funded account. Let's explore the different account types and their respective evaluation processes:

| Account Type | Key Features | Minimum Trading Days | Drawdown Type | Time Limit |

|---|---|---|---|---|

| One-Step Evaluation | Standard offering | 5 | Intraday unrealized PNL trailing | No limit |

| EOD Drawdown Evaluation | End-of-day performance focus | 5 | End of the day PNL trailing | No limit |

| Fast Track Evaluation | Quick skill proof | 5 | Intraday unrealized PNL trailing | 14 days |

| Static Evaluation | Fixed drawdown limit | 5 | Static drawdown | No limit |

| Diamond Hands Evaluation | Allows overnight positions | 5 | End of the day PNL trailing | No limit |

1. One-Step Evaluation

The One-Step Evaluation is ETF's standard offering, featuring a straightforward process to qualify for funding:

| Account Size | Fee (every 30 days) |

|---|---|

| 50K | $165 |

| 100K | $205 |

| 150K | $295 |

| 250K | $515 |

| 300K | $655 |

2. EOD Drawdown Evaluation

The EOD (End of Day) Drawdown Evaluation offers an alternative approach, focusing on end-of-day performance rather than intraday fluctuations:

| Account Size | Fee (every 30 days) |

|---|---|

| 50K | $295 |

| 100K | $430 |

| 150K | $605 |

3. Fast Track Evaluation

The Fast Track Evaluation is designed for traders who want to prove their skills quickly:

| Account Size | Fee (14 days) |

|---|---|

| 100K | $75 |

| 250K | $175 |

4. Static Evaluation

The Static Evaluation offers a fixed drawdown limit, providing clarity on the maximum allowable loss:

| Account Size | Fee (every 30 days) |

|---|---|

| 50K | $165 |

| 100K | $205 |

| 150K | $295 |

5. Diamond Hands Evaluation

The Diamond Hands Evaluation is tailored for swing traders who prefer holding positions overnight:

| Account Size | Fee (every 30 days) |

|---|---|

| 50K | $295 |

| 100K | $430 |

| 150K | $605 |

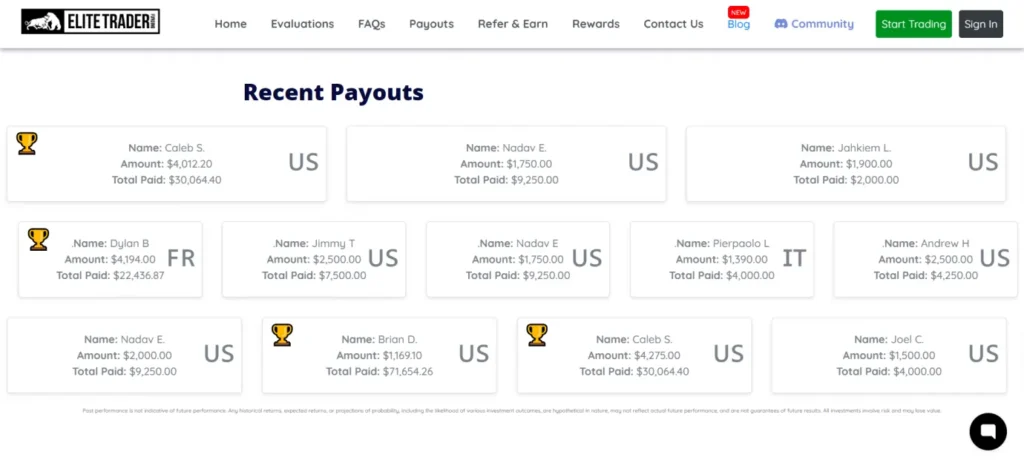

Elite Trader Funding Payout Process

Payouts for Elite Sim Funded Traders are approved daily beginning at 3 pm EST and processed on Wednesdays. Live Elite payouts are processed daily.

To be eligible for a payout, traders must meet certain criteria:

- Demonstrate consistent trading activity

- Maintain a reasonable distribution of profits

- Avoid manipulative trading behavior

- Execute at least one trade per calendar week

- Meet the required number of Active Trading days per payout cycle

Trading Platforms and Instruments

Elite Trader Funding offers traders access to several popular trading platforms, providing flexibility and choice for their funded trading experience.

The company supports four main platforms: NinjaTrader, Tradovate, Rithmic, and TradingView.

Each platform comes with its own unique features and benefits, catering to different trading styles and preferences.

To enhance the trading experience, Elite Trader Funding provides free real-time data and a complimentary NinjaTrader license key with all accounts. This allows traders to access advanced charting, market analysis tools, and execution capabilities without additional costs.

| Platform | Key Features |

|---|---|

| NinjaTrader | Advanced charting, custom indicators, free license |

| Tradovate | Cloud-based, mobile-friendly, commission-free trading |

| Rithmic | Low-latency execution, advanced risk management |

| TradingView | Social trading, extensive indicator library |

Asset Classes

Elite Trader Funding primarily focuses on futures trading, offering a wide range of instruments across various asset classes. Based on the information available on their website,

here's an overview of the asset classes provided by Elite Trader Funding:

- Equity Futures: These include popular indices like the S&P 500, NASDAQ, and Dow Jones.

- Interest Rate Futures: Various treasury bonds and notes across different durations.

- Currency Futures: Major forex pairs and currency-based futures contracts.

- Commodity Futures: Including metals, energy, and agricultural products.

- Cryptocurrency Futures: Limited offerings in major cryptocurrencies.

| Asset Class | Examples of Instruments |

|---|---|

| Equity Futures | MES (Micro E-mini S&P 500), MNQ (Micro E-mini NASDAQ 100), MYM (Micro Mini-DOW) |

| Interest Rate Futures | ZB (U.S. 30-Year Treasury Bond), ZN (10-Year T-Note), ZF (5-Year T-Note) |

| Currency Futures | 6A (Australian Dollar), 6B (British Pound), 6E (Euro) |

| Commodity Futures | GC (Gold), CL (Crude Oil), ZC (Corn), ZS (Soybean) |

| Cryptocurrency Futures | MBT (Micro Bitcoin), MET (Micro Ethereum) |

Answering your Questions

What are The Minimum Trading Days required?

All evaluations require a minimum of 5 trading days.

Does ETF allow Overnight Trading?

Most account types do not allow overnight trading, except for the Diamond Hands Evaluation which allows holding positions overnight and on weekends.

Is there a Daily Drawdown Limit?

The drawdown rules vary by account type. Some have intraday trailing drawdowns, while others have end-of-day drawdowns.

What are The Maximum Position sizes allowed?

Maximum position sizes vary by account size. For example, a 50K account allows up to 8 minis or 80 micros.

Can Traders reset failed Accounts?

Resets are allowed for most account types, except for Fast Track evaluations. The reset fee is typically $75.

Is there a Monthly Fee for Funded Accounts?

Yes, there is an $80 monthly fee for funded accounts, regardless of account size or type.

Does ETF offer any Educational Resources?

While ETF's primary focus is funding, they do offer some educational resources through their help center and blog posts.

To Conclude

Elite Trader Funding offers a compelling opportunity for traders to access significant capital without risking their own funds. With its variety of account types, support for popular platforms, and generous profit-sharing structure, ETF has positioned itself as a noteworthy player in the prop firm landscape.

Elite Trader Funding stands out as a flexible and appealing choice for traders aiming to achieve financial independence. As the firm continues to grow, it remains a promising partner for aspiring elite traders.