Funded Trading Plus has pledged to provide traders with the best experience possible. To achieve this, they’ve come up with the 5 Star Promise. The 5 Star Promise includes Competitive Program Pricing, Trusted Payout Assurance, Fair & Transparent Rules, Swift & Seamless User Journey, and Always Available 24/7 Support. In this article, we’ll talk about how this 5-Star Promise isn’t just a lip service.

Funded Trading Plus, a game-changer in the trading world. Imagine having access to substantial capital provided by a funding firm, allowing you to trade without risking your own money. This innovative approach not only offers the funds but also provides comprehensive support, including mentorship, trading education, and advanced tools. It's like having a safety net while you hone your trading skills and share in the profits.

What is Funded Trading Plus?

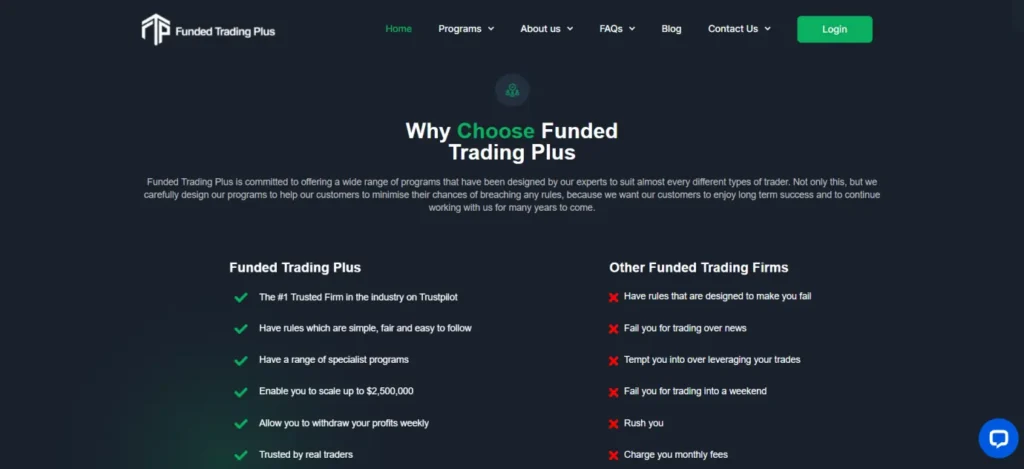

Funded Trading Plus is a proprietary trading firm based in London, UK that was founded in November 2021. The company is led by CEO Simon Massey and provides traders the opportunity to manage up to $200,000 in simulated capital, which can be scaled up to $2,500,000 based on performance.

With a focus on supporting trader growth and success through education, responsive customer service, and a user-friendly platform, Funded Trading Plus has quickly established itself as a leading player in the prop trading space.

| Key Feature | Details |

|---|---|

| CEO | Simon Massey |

| Platform | MT5, TradingView |

| Payout Split | Upto 90% |

| First Payout | 7 Days |

| Subsequent Payouts | Weekly |

| Daily Drawdown | 5% |

| Headquarters | United Kingdom |

| Expert Advisors | Allowed |

| Max Funding | $250,000 |

| Funding Programs | Experienced Trader Program, Advanced Trader Program, Premium Trader Program, Master Trader Program |

| Leverage | 30:1 |

| Weekend Holding | Allowed |

| Contact | support@fundedtradingplus.com |

| Trustpilot Rating | 4.8/5.0 |

How Does The Funded Trading Plus Evaluation Process Work?

Funded Trading Plus offers aspiring traders the opportunity to manage simulated capital and earn real profits through their evaluation programs. The evaluation process is designed to identify skilled traders who can trade profitably and consistently while adhering to the firm's risk management rules.

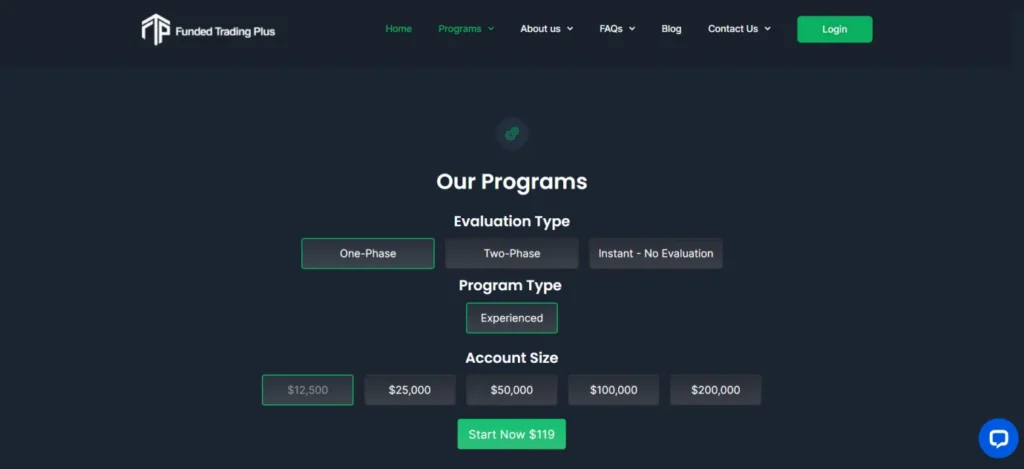

- Experienced Trader Program

The Experienced Trader Program is a one-step evaluation, meaning traders only need to complete a single phase to gain access to a funded account. The key objectives of this evaluation are to achieve a 10% profit target, Maintain a maximum daily loss limit of 4%, Adhere to a maximum trailing drawdown of 6%, No minimum trading day requirements, and Unlimited time to complete the evaluation.

Once a trader meets these objectives, they advance to the Funded Trading Plus Trader phase where they can start earning real profits from day one.

One Phase Evaluation (Experienced)

| Account Size | Pricing |

|---|---|

| $12,500 | $119 |

| $25,000 | $199 |

| $50,000 | $349 |

| $100,000 | $499 |

| $200,000 | $949 |

- Advanced Trader Program

The Advanced Trader Program is a two-step evaluation consisting of two phases:

- Phase 1: Traders must reach a 10% profit target.

- Phase 2: Traders must achieve a 5% profit target.

During both phases, the following rules apply: 5% maximum daily loss limit, 10% maximum trailing drawdown, No minimum trading days, and Unlimited time to complete each phase

After successfully completing both assessment phases, traders progress to the Funded Trading Plus account and can begin withdrawing real profits.

Two Phase Evaluation (Advanced)

| Account Size | Pricing |

|---|---|

| $25,000 | $199 |

| $50,000 | $349 |

| $100,000 | $499 |

| $200,000 | $949 |

- Premium Trader Program

Funded Trading Plus also offers a Premium Trader Program which is another two-step evaluation with slightly different objectives compared to the Advanced program.

Two Phase Evaluation (Premium)

| Account Size | Pricing |

|---|---|

| $25,000 | $247 |

| $50,000 | $397 |

| $100,000 | $547 |

| $200,000 | $1,097 |

- Master Trader Program

The Master Trader Program provides instant funding with no evaluation required. This is designed for highly experienced traders who want to bypass the assessment and start managing capital immediately. The program still has risk management rules in place: a 6% maximum daily loss limit and a Profit increase circuit breaker to prevent excessive risk. Master Traders can withdraw profits from day one and scale their accounts as they hit milestones.

Instant No Evaluation (Master)

| Account Size | Pricing |

|---|---|

| $5,000 | $225 |

| $12,500 | $450 |

| $25,000 | $1,125 |

| $50,000 | $2,250 |

| $100,000 | $4,500 |

Lightning-Fast Payouts and Profit Splits

Funded Trading Plus offers a fast and efficient payout system designed to give traders quick access to their profits. Withdrawals are available as soon as the closed account balance reaches $50 above the initial starting balance. The first payout can be requested 7 calendar days from the day the first trade is placed on the funded account. After that, payouts are available weekly, provided the account balance exceeds the starting balance.

The profit split varies depending on the specific program. For the Experienced Trader, Advanced Trader, and Premium Trader programs, the split starts at 80% for the trader and 20% for Funded Trading Plus. This can increase to a 90% split for the trader after achieving 20% profit, and even reach 100% after hitting 30% profit. The Master Trader program has a slightly different structure, starting at a 70% split for the trader which can scale up to 100% after reaching 40% profit.

When requesting a payout, the account must be flat with no open trades. Many payouts are processed the same day, and in general, all payouts are handled within 2 business days unless there is unusually high demand. The payout button in the dashboard will be greyed out if the trader is not eligible for a payout at that time.

FT+’s Commitment to Education & Support

Funded Trading Plus is committed to supporting its traders' growth and development, both during the evaluation process and beyond. They offer a range of educational resources and support services to help traders succeed.

For those just starting out, FT+ provides a comprehensive trading course that covers the fundamentals of trading, risk management, psychology, and more. This course is designed to give new traders the foundation they need to approach the markets with confidence.

In addition to educational content, Funded Trading Plus offers dedicated support for their funded traders. They have a team of knowledgeable support staff available 24/7 to assist with any questions or issues that may arise.

The sense of camaraderie and shared purpose is one of the things that makes the FT+ experience so special.

Funded Trading Plus Platforms & Technology

To provide traders with the best possible experience, Funded Trading Plus has partnered with some of the leading trading platforms and technology providers in the industry.

Their primary platform is MetaTrader 5 (MT5), a powerful and versatile trading software used by millions of traders worldwide. MT5 offers advanced charting capabilities, a wide range of indicators and analysis tools, and the ability to trade multiple assets including forex, stocks, commodities, and more. FT+ provides MT5 as a web-based platform that can be accessed from any device with an internet connection.

In addition to MT5, FT+ also supports trading through TradingView, a popular charting and analysis platform. This allows traders to use the tools and interfaces they are already comfortable with while still accessing FT+ funding and infrastructure on the backend.

FAQs Related to Funded Trading Plus

Does Funded Trading Plus allow EAs (Expert Advisors)?

Yes, Funded Trading Plus allows the use of EAs, although some abusive strategies like arbitrage or grid trading are prohibited.

Is there a free trial or free repeat offered?

Funded Trading Plus does not offer a free trial or free repeat, but does provide a discounted reset fee if a trader fails a challenge.

What Trading platforms are supported?

Funded Trading Plus supports popular platforms including cTrader, TradingView, MatchTrader, and DXtrade.

Can traders hold positions over the weekend?

Traders can hold positions over the weekend in most programs, but not in the Master Trader instant funding program.

How does the drawdown work in a Funded Trading Plus account?

The relative drawdown limit is typically 6-10% depending on the program. If a trader reaches 6% profit, the drawdown limit locks at the initial account balance. Withdrawals impact the remaining drawdown allowance.

What happens if a trader violates the Trading rules?

If a trader violates the trading rules or exceeds the drawdown limits, their account may be closed. Trades are reviewed by the risk team before issuing funded accounts to ensure proper risk management.

How long does a trader have to complete the Evaluation programs?

There are no time limits to complete the evaluation phases in any of the programs. Traders can proceed at their own pace as long as they place at least one trade every 30 days to keep the account active.

The Bottom Line

Funded Trading Plus stands out as a premier platform for traders seeking to hone their skills in a risk-free, simulated-live environment. With a commitment to transparency, competitive pricing, and unparalleled support, the company ensures that every trader's journey is both rewarding and educational.

The 5 Star Promise, backed by glowing customer reviews, underscores their dedication to excellence. By maintaining substantial capital reserves and offering flexible trading strategies, Funded Trading Plus not only supports traders' growth but also fosters a thriving trading community. Partner with Funded Trading Plus and embark on a trading journey where success and learning go hand in hand.