Lark Funding has carved out a niche for itself, offering a unique blend of flexibility, competitive terms, and trader-friendly features. Let's dive deep into what makes Lark Funding stand out in the crowded prop trading sphere.

Lark Funding is a proprietary trading firm that provides traders with the opportunity to manage virtual accounts and earn a share of the profits they generate. Founded in 2022 and based in Montreal, Canada, Lark Funding offers a structured evaluation process that allows traders to become funded traders by meeting specific performance targets. The firm is known for its flexible funding options, competitive profit-sharing model, and robust customer support.

What is Lark Funding?

| Feature | Details |

|---|---|

| CEO | Matt L |

| Contact Information | Email: support@larkfunding.com |

| Business Address | 3 Place Ville-Marie, Montréal, QC H3B 4W8, Canada |

| Upgraded Profit Split | Up to 90% trader, 10% Lark Funding |

| Payout Frequency | First payout after 30 days, subsequent payouts every 14 days |

| Weekly Payout Option | Available on 3-Stage Program (every 7 days) |

| Time Limits | No minimum or maximum trading days |

| Trading Platforms | MetaTrader 4 (MT4) and MetaTrader 5 (MT5) |

| Tradable Instruments | Forex, Commodities, Indices, Cryptocurrencies |

| Leverage | Varies by account type, upgradeable during checkout |

| Evaluation Phases | 1-Stage: 1 phase, 2-Stage: 2 phases, 3-Stage: 3 phases |

| Account Type | Simulated demo accounts |

| Unique Features | Lark Gain Protector, Touchless Passing, Lark Funded Reset |

Lark Funding is a proprietary trading firm that provides traders with the opportunity to trade with substantial simulated capital. Founded in June 2022, this Canada-based company has quickly gained traction in the prop trading community, thanks to its innovative approach and trader-centric policies.

The core idea behind Lark Funding is simple yet powerful: identify talented traders, provide them with simulated capital, and share the profits. It's a win-win situation where traders get to showcase their skills without risking their own capital, while Lark Funding benefits from the expertise of skilled traders.

Platforms and Trading Environment

Lark Funding partners with EightCap, an award-winning Forex broker, to provide traders with a robust and reliable trading environment. This partnership ensures fast execution and competitive spreads, which are crucial for successful trading.

Traders at Lark Funding have access to the most popular trading platforms in the forex world: MetaTrader 4 (MT4) MetaTrader 5 (MT5), and DXTrade.

While both platforms are available, it's worth noting that MT5 offers access to a broader range of markets and symbols compared to MT4. So, if you're looking to trade a diverse portfolio, MT5 might be the better choice.

Account Types and Evaluation Process

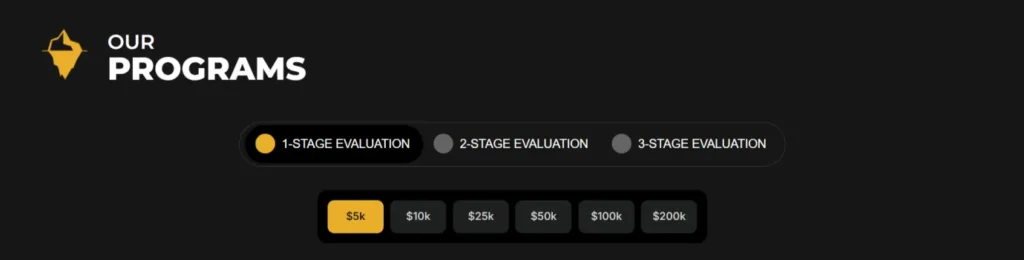

Lark Funding offers a tiered evaluation process, allowing traders to choose the path that best suits their trading style and experience level. Let's break down the three main types of evaluations:

1. 1-Stage Evaluation

This is the quickest route to becoming a funded trader at Lark Funding. Here's what you need to know:

- Profit Target: 10% account gain

- Maximum Drawdown: 6% (static, not trailing)

- Daily Drawdown: 5%

- Time Limit: No minimum or maximum

- Account Sizes: $5,000 to $200,000

| Account Size | Max Drawdown | Daily Drawdown | Min/Max Time | Account Gain Split | Leverage | Fee | Account Size |

|---|---|---|---|---|---|---|---|

| $5,000 | 6% | 5% | No Limit | 80% (up to 90%) | 1:10* | $75 | $5,000 |

| $10,000 | 6% | 5% | No Limit | 80% (up to 90%) | 1:10* | $105 | $10,000 |

| $25,000 | 6% | 5% | No Limit | 80% (up to 90%) | 1:10* | $225 | $25,000 |

| $50,000 | 6% | 5% | No Limit | 80% (up to 90%) | 1:10* | $325 | $50,000 |

| $100,000 | 6% | 5% | No Limit | 80% (up to 90%) | 1:10* | $525 | $100,000 |

| $200,000 | 6% | 5% | No Limit | 80% (up to 90%) | 1:10* | $1000 | $200,000 |

*Leverage upgrades are available upon checkout.

2. 2-Stage Evaluation

This evaluation process is split into two phases:

- Phase 1 Profit Target: 8% account gain

- Phase 2 Profit Target: 5% account gain

- Maximum Static Drawdown: 10%

- Daily Drawdown: 5%

- Time Limit: No minimum or maximum

- Account Sizes: $5,000 to $200,000

3. 3-Stage Evaluation

This is the most comprehensive evaluation process, consisting of three phases:

- Phase 1 Profit Target: 5% account gain

- Phase 2 Profit Target: 4% account gain

- Phase 3 Profit Target: 3% account gain

- Maximum Static Drawdown: 5%

- Daily Drawdown: No daily drawdown

- Time Limit: No minimum or maximum

- Account Sizes: $5,000 to $200,000

| Account Size | Max Static Drawdown | Daily Drawdown | Min/Max Time | Account Gain Split | Leverage | Starting At | Account Size |

|---|---|---|---|---|---|---|---|

| $5,000 | 5% | None | No Limit | 80% (up to 90%) | 15:1* | $60 | $5,000 |

| $10,000 | 5% | None | No Limit | 80% (up to 90%) | 15:1* | $105 | $10,000 |

| $25,000 | 5% | None | No Limit | 80% (up to 90%) | 15:1* | $175 | $25,000 |

| $50,000 | 5% | None | No Limit | 80% (up to 90%) | 15:1* | $240 | $50,000 |

| $100,000 | 5% | None | No Limit | 80% (up to 90%) | 15:1* | $370 | $100,000 |

| $200,000 | 5% | None | No Limit | 80% (up to 90%) | 15:1* | $700 | $200,000 |

*Leverage can be upgraded to 30:1 upon checkout.

Asset Classes and Tradable Instruments

Lark Funding offers a wide range of tradable instruments, catering to diverse trading strategies and preferences.

Here's what you can trade:

- Forex: Over 40 major and minor currency pairs

- Cryptocurrencies: Over 100 crypto derivatives

- Stocks: Major US, Australian, LSE, and XETRA stocks

- Indices: Various global indices

- Commodities: Including metals and energy products

The availability of these instruments may vary depending on the chosen platform (MT4 or MT5) and the specific evaluation program.

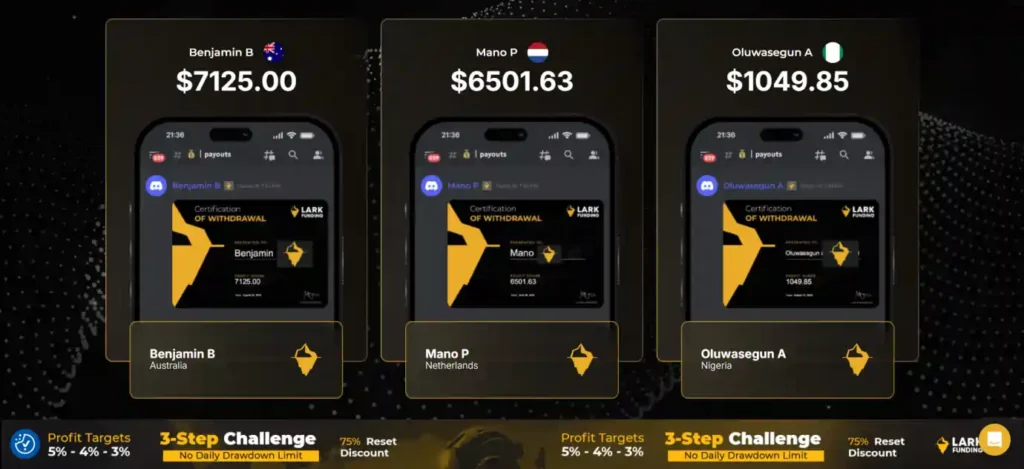

Payouts and Profit Sharing

Lark Funding offers an attractive payout and profit-sharing model that sets it apart in the prop trading industry. The standard profit split at Lark Funding is 80:20, meaning traders receive 80% of the gains they generate on their Simulated Funded Account, while Lark Funding retains 20%.

However, Lark Funding goes a step further by offering traders the option to increase their share to 90% during the checkout process, allowing for even greater earning potential.

The payout process at Lark Funding is designed to be both flexible and efficient. Payouts are processed via Wise or Riseworks, providing traders with a variety of payout methods to choose from.

One of Lark Funding's standout features is its rapid payout processing time, with an average of under 6 hours from request to completion. This quick turnaround time ensures that traders can access their earnings promptly.

For traders seeking more frequent access to their profits, Lark Funding offers weekly payouts on their 3-Stage Program. This option allows traders to receive their earnings on a more regular basis, providing greater financial flexibility. The first payout is typically processed after 30 days, with subsequent payouts occurring every 14 days.

| Feature | Details |

|---|---|

| Standard Profit Split | 80% trader, 20% Lark Funding |

| Upgraded Profit Split | Up to 90% trader, 10% Lark Funding |

| Payout Methods | Wise or Riseworks |

| Average Payout Processing Time | Under 6 hours |

| First Payout | After 30 days |

| Subsequent Payouts | Every 14 days |

| Weekly Payout Option | Available on 3-Stage Program |

The Most Trending Questions

What are The Maximum Drawdown Limits?

The maximum drawdown varies by program: 6% for 1-Stage, 10% for 2-Stage, and 5% for 3-Stage Evaluations.

Is there a Time Limit for completing The Evaluations?

No, Lark Funding does not impose minimum or maximum time limits on its challenges.

What Leverage is Offered?

The standard leverage is 1:15, with options to upgrade to higher leverage upon checkout.

How often are Payouts Processed?

Payouts are processed on average in under 6 hours, with the first payout after 30 days and subsequent payouts every 14 days.

What Financial Instruments Can Be Traded?

Traders can trade Forex, Commodities, Indices, and Cryptocurrencies.

Does Lark Funding allow News Trading and Expert Advisors (EAs)?

Yes, Lark Funding permits news trading and the use of Expert Advisors.

How does Lark Funding handle breaching Daily Drawdown Limits?

Lark Funding offers a unique feature called the Lark Gain Protector, which allows traders to request a withdrawal from their Simulated Funded Account even if they've exceeded the daily drawdown limit, subject to certain conditions.

Conclusion

Lark Funding has established itself as a leading prop firm in the industry, offering traders a range of innovative programs and features. With their competitive pricing, flexible trading conditions, and commitment to customer service, Lark Funding provides an attractive opportunity for traders looking to showcase their skills and potentially earn significant payouts.

The company's unique offerings, such as the Gain Protector and custom challenge options, set them apart from competitors. As evidenced by the testimonials from satisfied traders, Lark Funding has built a strong reputation for supporting and empowering its community.