Lux Trading Firm is one of the supreme prop firms that has gone one step further by offering account sizes up to $1,000,000. While they offer substantial funding, the traders looking to earn huge capital should also be prepared to go through a rigorous evaluation process. However, with the true Trader-centric spirit you can easily achieve it. In this article, we’ll go through the ins and outs of this prop firm.

What is a Lux Trading Firm?

Lux Trading Firm is a proprietary trading firm based in London, UK that provides traders with the opportunity to trade the financial markets using the firm's capital. Founded in 2020, Lux has quickly gained traction in the prop trading space.

The firm operates on an evaluation model, where traders must first prove their skills by passing a multi-stage evaluation process. If successful, traders receive a funded account ranging from $50,000 to $1,000,000 and keep a percentage of the profits they generate, typically 75%.

One of Lux's unique selling points is its Career Plan, which allows traders to start with as little as $5,000 and scale up to $2,500,000+ by hitting profit targets at each account level. The firm also assigns a dedicated risk manager to each funded trader for personalized support.

With a focus on transparency, education, and community, Lux Trading Firm aims to empower traders to reach their full potential while managing risk responsibly. The firm has earned positive reviews for its professional support, fast payouts, and overall trader-centric approach.

| Key Feature | Details |

|---|---|

| Headquarters | London |

| Platform | MT5, TradingView |

| Payout Split | Upto 75% |

| Payouts | 30 Days |

| Daily Drawdown | 6% |

| Expert Advisors | Allowed |

| Max Funding | $,1000,000 |

| Funding Programs | 1-Step Evaluation and 2-Step Evaluation |

| Leverage | Upto 1:30 |

| Weekend Holding | Allowed |

| Contact | support@luxtradingfirm.com |

| Trustpilot Rating | 4.3/5.0 |

Evaluation Process and the Unreal Account Sizes

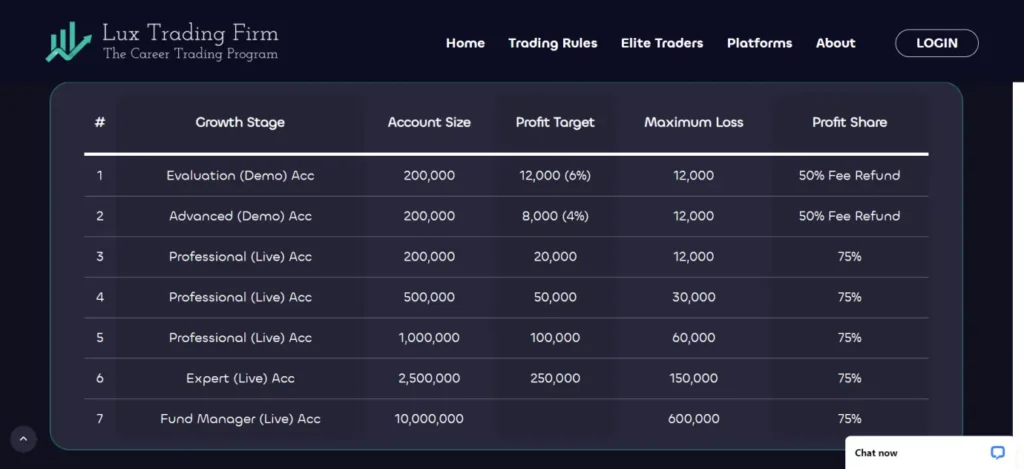

Lux Trading Firm offers a multi-stage evaluation process for traders to prove their skills and earn a funded trading account. The evaluation varies depending on the account size:

For the Standard $50K and $200K accounts, there are two phases:

Phase 1: requires a 6% profit target and has a 6% maximum drawdown. Traders must be active for at least 29 days, with no maximum time limit.

Phase 2: requires a 4% profit target with the same 6% drawdown limit. There is no minimum trading day requirement.

For the Special $1M account, there is a single evaluation phase requiring a 15% profit target, 6% max drawdown, and a minimum of 29 trading days.

Lux Trading Firm uses a combination of automated systems and manual reviews to assess a trader's performance and compliance with trading rules. Traders have access to a personal dashboard to monitor their progress.

Violating any trading rules, such as copying trades or allowing drawdown to exceed limits, can result in immediate account termination. Traders who fail the evaluation can retry by paying a reset fee, although Lux reserves the right to refuse resets at their discretion.

| Account Sizes | Pricing |

|---|---|

| $50,000 | £299 |

| $200,000 | £599 |

| Account Sizes | Pricing |

|---|---|

| $1,000,000 | £1,499 |

Profit Payouts and Scaling

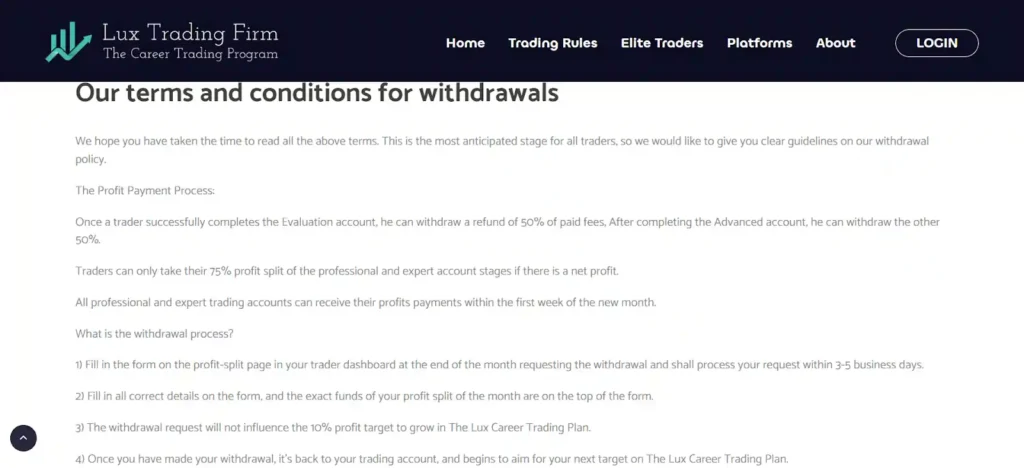

One of the most appealing aspects of Lux Trading Firm is its payout structure. Traders keep a substantial 75% of profits generated on the Standard and Career Plan Accounts. The profit split drops to 50% for the highest Professional and Expert Account levels.

Lux Trading Firm also offers lucrative scaling opportunities. On the Career Plan, accounts automatically scale to the next level, up to $2.5M, each time the trader achieves a 10% profit target. There are no time limits to reach the profit targets.

Payouts are processed monthly and Lux aims to complete withdrawals within 3-5 business days. Traders can request one withdrawal per month.

Lux Trading Firm Trading Platforms

Lux Trading Firm provides access to some of the most popular and powerful trading platforms:

- MetaTrader 5 (MT5): The widely used multi-asset platform known for its advanced charting, fast execution, and algorithmic trading features. MT5 is available for Windows, Mac, web, iOS and Android.

- TradingView: A premium web-based charting platform with an extensive library of indicators, drawing tools, and real-time data. TradingView is integrated with Lux's proprietary trading infrastructure.

- Lux Trader Platform: Lux's custom-built platform combines TradingView charts with its own trading engine and risk management tools. However, it is currently in beta.

Lux Trading Firm also provides a personalized trader dashboard for monitoring equity, drawdown, trading stats, journals, and more. The dashboard is accessible from any device.

Customer Support and Community

Lux Trading Firm prides itself on providing prompt, professional customer support. Their support team is reachable via email and live chat 24/5.

Each funded trader is also assigned a dedicated risk manager who provides personalized support, and trade analysis, and can help with account queries. This high-touch support is a standout feature.

Lux has also cultivated a tight-knit community of traders who share ideas and analysis in Lux's Discord server and Facebook group. The community hosts regular webinars and Q&A sessions with Lux's risk managers and other industry experts.

FAQs related to Lux Trading Firm

What instruments can you trade with Lux Trading Firm?

Over 50 forex pairs, indices, commodities, metals, cryptocurrencies, and single stocks.

Are EAs (Expert Advisors) allowed?

Yes, EAs are allowed but they must be built by the trader, not a third party. Copy trading and mirror trading are not permitted.

What is the Maximum Leverage offered?

Up to 1:30 on forex, indices, commodities, and metals. Up to 1:5 on stocks and crypto.

How are Withdrawals Processed?

Payouts are processed monthly and Lux aims to complete withdrawals within 3-5 business days. Traders can request one withdrawal per month.

What Trading rules and restrictions are there?

Some key rules include no trading the news, no copy trading, mandatory stop losses, and accounts that breach drawdown limits are automatically closed. A minimum of 5 trading days per month is required.

Does Lux Trading Firm offer a free trial?

Yes, Lux offers a 7-day free trial of their platforms and dashboard for traders to test out before signing up.

What is the Lux Elite Traders Club?

An alternative funding program that provides more flexible rules, optional resets, a personal mentor, customizable risk desk, and aims to increase success rates from 1% to over 20%.

Is Lux Trading Firm well-reviewed by users?

On TrustPilot, Lux Trading Firm has a 4.3/5 rating from over 600 reviews, with 79% being 5-star reviews.

In a nutshell

Lux Trading Firm has quickly established itself as a leading prop trading firm by offering attractive profit splits, high funding levels, powerful trading tech, and a supportive community. While their evaluation process is challenging, it's achievable for skilled traders with proven strategies.

If you're considering applying to Lux Trading Firm, be sure to carefully review their rules, build a track record on a demo account, and ask questions to their support team. With hard work and discipline, Lux Trading Firm could be the partner to help you take your trading career to the next level.