MiFunder, where trading innovation meets opportunity! Established in 2023 and operating under the name Lunnify (FTE) in the vibrant city of Dubai, MiFunder is redefining the landscape of proprietary trading. This firm stands out with its unique trading challenges, offering both single-step and multi-step evaluations on renowned platforms like MT4 and DxTrade. Traders can explore various financial instruments, including Forex, commodities, indices, and cryptocurrencies, all while enjoying competitive profit splits and zero commission during evaluations. Whether you're a seasoned trader or just starting, It provides the tools and flexibility to enhance your trading journey.

🔎 Starting with an Introduction to MiFunder

MiFunder, officially known as Lunnify (FTE), is a proprietary trading firm established in 2023 and based in Business Bay, Dubai, UAE. This innovative prop firm offers funded trading accounts to skilled traders, allowing them to demonstrate their abilities on simulated accounts using real market quotes from liquidity providers.

It provides a range of trading opportunities across various financial instruments, including Forex, commodities, indices, and cryptocurrencies. The firm is known for its competitive profit splits, zero commission rates during evaluations, and flexible trading conditions that cater to different trading strategies and experience levels.

One of MiFunder's unique features is its “Funded Phase Reset” option, which sets it apart from other prop firms. The company offers both 1-step and 2-step evaluation challenges, utilizing popular trading platforms such as MT4 and DxTrade.

| Detail | Information |

|---|---|

| Official Name | Lunnify (FTE) |

| Trading Name | MiFunder |

| Establishment Year | 2023 |

| Location | Business Bay, Dubai, UAE |

| Trading Platforms | MT4, DxTrade |

| Instruments | Forex, commodities, indices, cryptocurrencies |

| Account Sizes | $7k to $250k |

| Contact Email | help@mifunder.com |

| Website | https://mifunder.com |

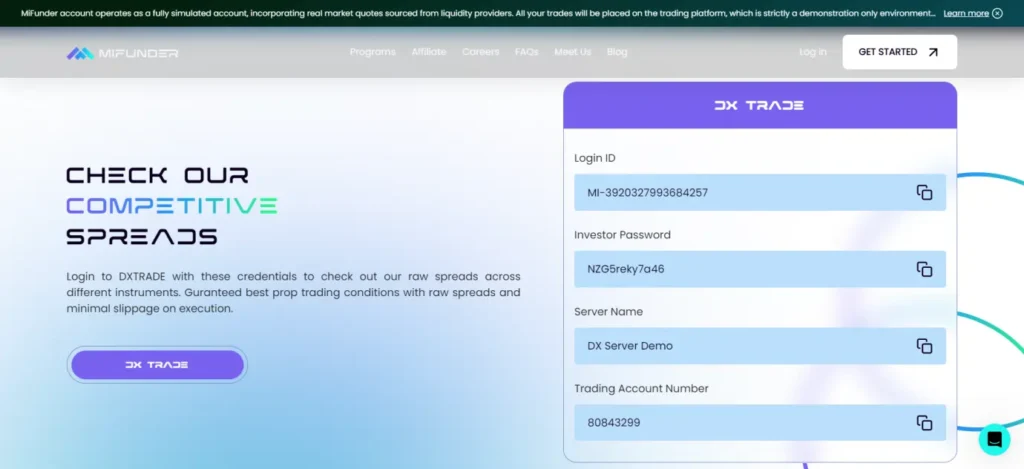

MiFunder Trading Platforms

It provides traders with access to two powerful trading platforms:

These platforms ensure that MiFunder's traders have the tools they need to execute their strategies effectively and efficiently.

Instruments Available

MiFunder offers a diverse range of tradable instruments, including:

This variety allows traders to diversify their portfolios and capitalize on various market conditions.

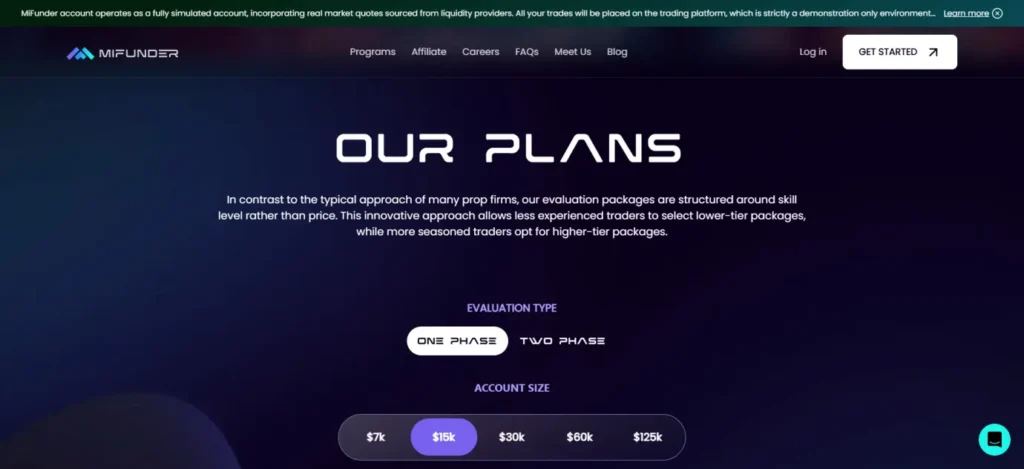

Account Types and Sizes

MiFunder offers a range of account sizes and plans to cater to traders with varying experience levels and financial capacities. The firm provides both one-step and two-step evaluation challenges, allowing traders to choose the path that best suits their skills and preferences. Account sizes start from a modest $7,000 and go up to an impressive $250,000, giving ample room for growth and scalability.

Each account size comes with its own set of profit targets and risk management rules, designed to test and develop traders' abilities. The one-step challenge is more direct and intense, while the two-step challenge offers a more gradual approach to proving trading proficiency.

| Account Size | One-Step Challenge Price | Two-Step Challenge Price |

|---|---|---|

| $7,000 | $59 | $49 |

| $15,000 | $109 | $99 |

| $30,000 | $189 | $179 |

| $60,000 | $339 | $319 |

| $125,000 | $489 | $479 |

| $250,000 | $989 | $889 |

Profit Splits and Payouts

It offers generous profit splits to reward successful traders:

Payouts are structured as follows:

This payout schedule allows traders to plan and manage their financial goals effectively.

Commissions and Fees

MiFunder promotes a competitive fee structure to support traders during their evaluation journey:

This fee policy encourages traders to maximize their performance without worrying about high costs eating into their profits.

Frequently Asked Queries

How can I get started with MiFunder?

To get started, you likely need to create an account on their website and purchase an evaluation account to begin the qualification process.

What markets can I trade with MiFunder?

The website doesn't specify exact markets, but as a prop firm, MiFunder likely offers trading in forex, commodities, indices, and possibly cryptocurrencies.

Does MiFunder offer an affiliate program?

Yes, MiFunder has an affiliate partner program where partners can earn commissions for referring new traders.

What are the commission rates for affiliates?

Affiliate commissions start at 15% and can go up to 25%, which MiFunder claims is among the highest in the industry.

How often are affiliate payouts made?

Affiliates start with bi-weekly payouts and can progress to weekly and even daily payouts as they reach higher tiers.

Is MiFunder available globally?

The affiliate program mentions opportunities to attend conferences and workshops in different parts of the world, suggesting a global presence.

How does MiFunder ensure fair trading conditions?

MiFunder uses simulated accounts with real market quotes from liquidity providers, which suggests they aim to provide realistic trading conditions.

🔎 To Conclude

MiFunder has emerged as a trailblazer in the prop trading industry, offering innovative features like the Funded Phase Reset and Evaluation Phase Reset that provide traders with unparalleled flexibility and support. With a diverse range of trading instruments, competitive profit splits, and commission-free evaluation phases, It has positioned itself as an attractive choice for traders seeking to maximize their potential. As the firm continues to evolve and adapt to the ever-changing landscape of forex trading, it remains committed to empowering traders with the tools, resources, and opportunities they need to succeed in this dynamic and challenging market.