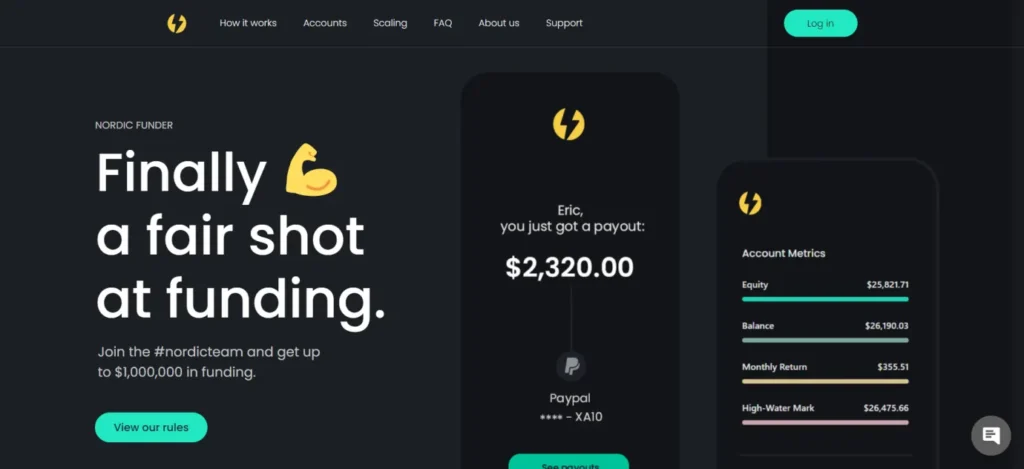

Nordic Funder offers a unique opportunity for traders to scale their skills and portfolios with our innovative funding solutions. Imagine starting with a $100,000 balance and having the chance to increase it by 10% to qualify for a funded account, all while adhering to fair and transparent rules. With a commitment to diverse and consistent trading strategies, Nordic Funder empowers traders to thrive in a supportive environment backed by the trusted Scandinavian Capital Markets.

What is a Nordic Funder?

| Detail | Information |

|---|---|

| Company Name | Nordic Funder |

| Legal Entity | Nordic Funder KB |

| Registration | Registered in Sweden (969783-7335) |

| Founded | November 2021 |

| CEO | David Nudleman |

| Headquarters | Stockholm, Sweden |

| Address | Vikingavägen 7, 195 51 MÄRSTA, Sweden |

| Contact Email | [email protected] |

| Contact Phone | +46 8 519 70 207 |

| Website | https://nordicfunder.com/ |

| https://twitter.com/nordicfunder | |

| https://www.instagram.com/nordicfunder/ | |

| Trading Platform | MetaTrader 4 (MT4) |

| Broker Partner | Scandinavian Capital Markets SCM AB |

| Account Sizes | $25,000 to $400,000 (scalable up to $1,000,000) |

| Profit Target | 10% |

| Maximum Drawdown | 10% |

| Daily Loss Limit | 5% |

| Profit Share Options | 50/50 (default), 70/30, 90/10 |

| Support Hours | 06:00 to 00:00 Central European Time |

Nordic Funder is an innovative proprietary trading firm based in Stockholm, Sweden that is revolutionizing the world of funded trading. Founded by an experienced team of finance and trading professionals, Funder offers retail traders the opportunity to receive funding and trade the firm's capital, keeping up to 90% of the profits they generate.

What sets Nordic Funder apart is its unique, customizable assessment process, one-step funding model, and trader-friendly rules that provide a clear path to success. Let's take a closer look at what makes Nordic Funder the leading funded trader program in Scandinavia.

Customizable Assessments

One of Nordic Funder's key differentiators is their test builder – the only one in the market that allows traders to customize their assessment and adjust parameters to fit their trading style. When building your assessment, you can choose from the following options:

| Parameter | Options |

|---|---|

| Account Size | $25k, $50k, $100k, $200k, $400k |

| Leverage | 1:10 (default), 1:20 (for an additional fee) |

| Profit Share | 50/50 (default), 70/30 (+20% fee), 90/10 (+40% fee) |

| Stop Loss | Required (default), Not required (for additional fee) |

This flexibility allows traders to craft an assessment that plays to their strengths and aligns with their strategy. Nordic Funder focuses on your ability to be profitable within reasonable risk parameters, not your capacity to pass an arbitrary, one-size-fits-all test.

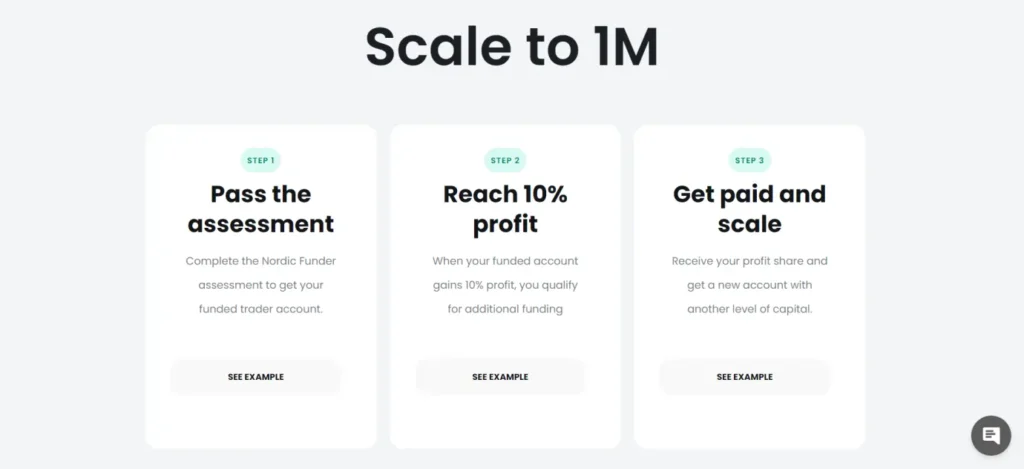

One-Step Funding Model

Another aspect that makes Nordic Funder unique is its one-step funding model. While many prop firms put traders through multiple hoops with staged evaluations, Nordic Funder believes in a “prove it once” approach.

Here's how it works:

- Build your assessment and pay the one-time fee

- Trade the assessment account, aiming for a 10% profit

- Upon reaching the profit target, receive your funded account

That's it – no additional steps, no recurring fees, no hidden rules. Once you pass the assessment, you go straight to a live funded account and can begin trading Nordic Funder's capital and withdrawing your profit share.

Nordic Funder Scaling Plan

Every time you reach 10% profit in your funded account, you are eligible to scale to a larger account size. The scaling plan looks like this:

| Level | Account Size |

|---|---|

| 1 | $25,000 |

| 2 | $50,000 |

| 3 | $75,000 |

| 4 | $100,000 |

| 5 | $200,000 |

| 6 | $300,000 |

| 7 | $400,000 |

| 8 | $500,000 |

| 9 | $1,000,000 |

When you scale, all positions are closed, your profit share is paid out, and you receive a new funded account with the next account size increment. The maximum funding level is $1,000,000.

Nordic Funder Payouts

The funder pays funded traders a performance fee, or profit share, on the gains they generate in their funded account. The default split is 50/50, but traders can opt for 70/30 or 90/10 when building their assessment for an additional fee.

You can request a payout at any time after your funded account has been active for 24 hours. The minimum withdrawal is 2% of your starting balance. So for a $100k account, the minimum withdrawal would be $2,000.

Here's an example payout scenario:

- Funded account starting balance: $100,000

- Profit share: 70/30

- Profits generated: $8,000

- Trader payout: $5,600 (70% of $8,000)

- Nordic Funder keeps: $2,400 (30% of $8,000)

After your first payout request, you can request subsequent withdrawals every 14 days or more. Nordic Funder uses a streamlined payment system to efficiently compensate traders.

Trading Platforms

Currently, Nordic Funder only supports the MetaTrader 4 (MT4) platform. MT4 is an industry-standard, especially in the forex market, known for its user-friendly interface, advanced charting capabilities, and algorithmic trading features.

Nordic Funder's MT4 accounts are hosted by their brokerage partner Scandinavian Capital Markets, a well-established Swedish STP broker. This exclusive relationship gives Nordic Funder more capacity than many of its competitors.

Traders can download MT4 directly from the Nordic Funder user portal after registering and purchasing an assessment. The platform is also available on the official MetaTrader website.

Common Questions

When can Traders Request Payouts?

The first payout can be requested 24 hours after receiving a funded account. Subsequent payouts can be requested every 14 days.

What Trading Platform is used?

Nordic Funder uses MetaTrader 4 (MT4) hosted by Scandinavian Capital Markets.

What Assets Can Be Traded?

Traders can trade forex, crypto, metals, oil, indices and more.

Are there any Recurring Fees?

No, there are no recurring fees after paying the initial assessment fee.

How does Scaling Work?

Traders can scale to larger account sizes by reaching 10% profit targets.

Is The Assessment Fee Refundable?

Yes, the assessment fee is refunded when a trader reaches 10% profit in their funded account.

What are The Key Rules?

Key rules include a 10% maximum drawdown, a 5% daily loss limit, and a requirement to trade diverse assets.

Why Choose Nordic Funder

Nordic Funder has positioned itself as a trader-friendly prop firm that values transparency, simplicity, and fairness. With its one-stage assessment, customizable accounts, generous scaling system, and competitive profit-sharing structure, it offers an attractive proposition for both novice and experienced traders.

To learn more and start your funded trading journey, visit https://nordicfunder.com/.