Oanda stands out as a pioneering force, offering traders a robust platform to navigate the complexities of the financial markets. Founded in 1996 by Dr. Michael Stumm and Dr. Richard Olsen, it was among the first to harness the Internet for currency data and trading, setting a new standard in the industry.

Suppose you're a seasoned trader or just starting. In that case, it's a comprehensive suite of tools—ranging from real-time market data to advanced technical analysis resources—that empowers you to make informed decisions. With a global presence and a commitment to innovation, they remain a trusted partner for traders worldwide.

What is OANDA Prop Trader?

OANDA Prop Trader is a program that enables traders to become signal providers for OANDA's proprietary trading models. Successful traders who pass a two-phase Challenge gain access to an OANDA Prop Trader account with virtual capital. Although the trades are virtual, traders can earn a real share of the profits generated in their accounts.

The program is designed to benefit both OANDA and the traders. It gets access to potentially profitable trading signals, while traders get to leverage OANDA's technology, market relationships, and capital without risking their own money.

| Detail | Information |

|---|---|

| CEO | Gavin Bambury (as of August 26, 2019) |

| support-proptrader@oanda.com | |

| Virtual Funds | Up to $500,000 |

| Contact Numbers | Varies by region |

| Website | https://proptrader.oanda.com/en/ |

| Profit Share | Up to 90% |

| Trading Platform | MetaTrader 5 (MT5) |

| Available Assets | Forex, indices, commodities, precious metals |

OANDA Prop Trader Challenge

To become an OANDA Prop Trader, you must first pass a two-phase Challenge. This Challenge is designed to assess your trading skills, risk management abilities, and consistency.

Here's how it works:

Let's break down each of these steps

OANDA Challenge Tiers

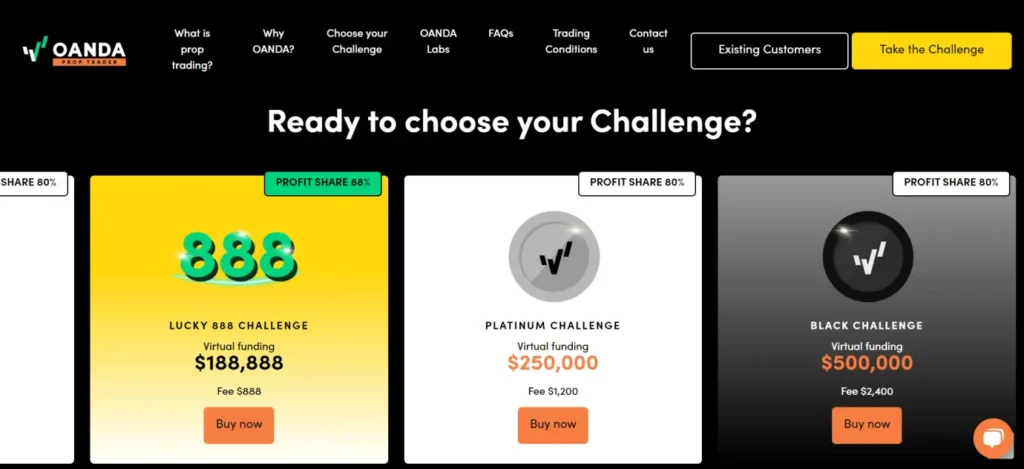

It offers several Challenge tiers, each with different virtual capital amounts and fees:

| Tier | Fee | Virtual Capital | Profit Share |

|---|---|---|---|

| 10k | $169 | $10,000 | 80% |

| Titanium | $249 | $25,000 | 80% |

| Silver | $399 | $50,000 | 80% |

| Gold | $699 | $100,000 | 80% |

| Platinum | $1,200 | $250,000 | 80% |

| Black | $2,400 | $500,000 | 80% |

| Titanium X | $299 | $25,000 | 90% |

| Lucky 888 | $888 | $188,888 | 88% |

As you can see, the virtual capital ranges from $10,000 to $500,000, with fees starting at $169 and going up to $2,400. The profit share is generally 80%, with the Titanium X and Lucky 888 tiers offering slightly higher percentages.

Challenge Phases

The Challenge consists of two phases, each with specific objectives and rules. While OANDA doesn't publicly disclose all the details of these phases, they likely involve profit targets, maximum drawdown limits, and trading duration requirements, similar to other prop firm challenges in the industry.

Verification Process

After completing both phases of the Challenge, traders must go through a verification process. This involves providing identification and completing a liveness check. Traders must also have an active OANDA Global Markets account, which is where the profit share will be paid.

Trading as an OANDA Prop Trader

Once you've passed the Challenge and verification process, you'll gain access to an OANDA Prop Trader account.

Here's what you need to know about trading with this account:

Trading Platforms

OANDA Prop Trader exclusively uses MetaTrader 5 (MT5) for its prop trading program. MT5 is available as a WebTrader, desktop application, and mobile app, offering flexibility in how and where you trade.

While MT5 is a powerful and feature-rich platform, it's worth noting that OANDA's platform selection is more limited compared to some other prop firms. They don't offer popular alternatives like TradingView, cTrader, or even MetaTrader 4, which might be a drawback for some traders.

Available Assets

As an OANDA Prop Trader, you'll have access to a wide range of assets, including:

In total, they offer over 70 tradable instruments. However, it's worth noting that cryptocurrencies are not available for prop trading.

Forex pairs, Indices, Commodities, and Precious metals.

Leverage and Margin

OANDA Prop Trader offers competitive leverage:

The specific margin requirements vary by instrument, so checking the details for each asset you plan to trade is important.

Payouts and Profit Sharing

One of the most attractive aspects of prop trading is the potential for significant payouts.

Trading as an OANDA Prop Trader

- Profit Share

The profit share ranges from 80% to 90%, depending on the Challenge tier you choose. This is quite competitive compared to many other prop firms in the market.

- Payout Frequency

It processes payouts every 14 days, which is more frequent than some prop firms that only offer monthly payouts.

- Payout Methods

Profits can be withdrawn through various methods, including:

| S/N | Payout Method |

|---|---|

| 1 | Bank transfers |

| 2 | Skrill |

| 3 | Neteller |

The availability of these methods may vary depending on your location.

- Fee Refund

OANDA offers an interesting perk: if you make a profit, they'll refund your Challenge fee along with your first payout. This effectively reduces the initial cost of joining the program if you're successful

Answering Commonly Asked Queries regarding OANDA Prop Trader

What is the OANDA Prop Trader Program?

Is the OANDA Prop Trader Program available globally?

What verification is needed to become an OANDA Prop Trader?

How do I open an OANDA Global Markets Account?

How can I access my profit share as an OANDA Prop Trader?

What are the risks of trading with OANDA?

Does OANDA Offer Cryptocurrency Trading?

📈 Conclusion | Is OANDA Prop Trader Right for You?

OANDA stands out as a compelling choice for beginners venturing into forex trading. Its user-friendly platform, extensive educational resources, and robust customer support create an environment conducive to learning and growth. The availability of a demo account allows novices to practice without financial risk, while the absence of a minimum deposit requirement makes it accessible to a wide range of users.

OANDA's regulatory compliance offers additional security, ensuring that beginners can trade with confidence. By emphasizing education and risk management, It equips new traders with the tools necessary for informed decision-making and successful trading experiences.