Traddoo has made a name for itself by offering a unique and completely funded trader program. This article delves into the TraddooTool, exploring its features, account types, platforms, and payout structures that make it an attractive option for aspiring and experienced traders alike.

Traddoo is more than just a tool; it's your trusted partner in the journey to financial success. With its user-friendly interface and cutting-edge technology, It ensures that you stay ahead of the curve. Whether you're a seasoned trader or just starting out, They offer the perfect blend of features to enhance your trading experience.

What is Traddoo?

| Details | Information | |

|---|---|---|

| Company Name | Traddoo LTD | |

| CEO | Dylan Worall | |

| Established | August 24, 2022 | |

| Headquarters | Malta | |

| Address | 30/1 Kenilworth Court, Sir Augustus Bartolo Street, Ta'Xbiex XBX1093, Malta | |

| Registration | Registered in the United States under company number C 104558 | |

| Parent Company | Traddoo Holdings Co. (Delaware corporation) | |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradeLocker | |

| Account Types | One-Phase Challenge, Two-Phase Challenge | |

| Maximum Account Size | $200,000 (with potential to scale up to $5 million) | |

| Profit Split | 80/20 (can increase to 90/10) | |

| Leverage | Up to 1:30 | |

| Instruments Offered | Forex, Cryptocurrencies, Stocks, Indices, Metals, CFDs | |

| Customer Support | 24/7 via Discord, dashboard, and email | |

| Unique Features | Daily payouts, no time limits on challenges, refundable fee policy | |

Traddoo is a proprietary trading firm that aims to empower skilled traders from around the globe. The company provides traders with the opportunity to manage substantial capital, up to $200,000, through its funded trader program. This approach allows traders to leverage their expertise without risking their own capital, creating a win-win situation for both the firm and the traders.

Key Features of TraddooTool

- Advanced Charting: The platform offers state-of-the-art charting capabilities, allowing traders to analyze market trends and patterns with precision.

- Real-Time Data: Traders have access to live market data, ensuring they can make informed decisions based on the most up-to-date information.

- Risk Management Tools: Tool incorporates robust risk management features, helping traders maintain discipline and protect their capital.

- Multiple Asset Classes: The platform supports trading across various financial instruments, including forex, stocks, commodities, and cryptocurrencies.

- Customizable Interface: Traders can personalize their workspace to suit their individual preferences and trading styles.

- Performance Analytics: Detailed performance metrics and reports enable traders to track their progress and identify areas for improvement.

Traddoo Account Types

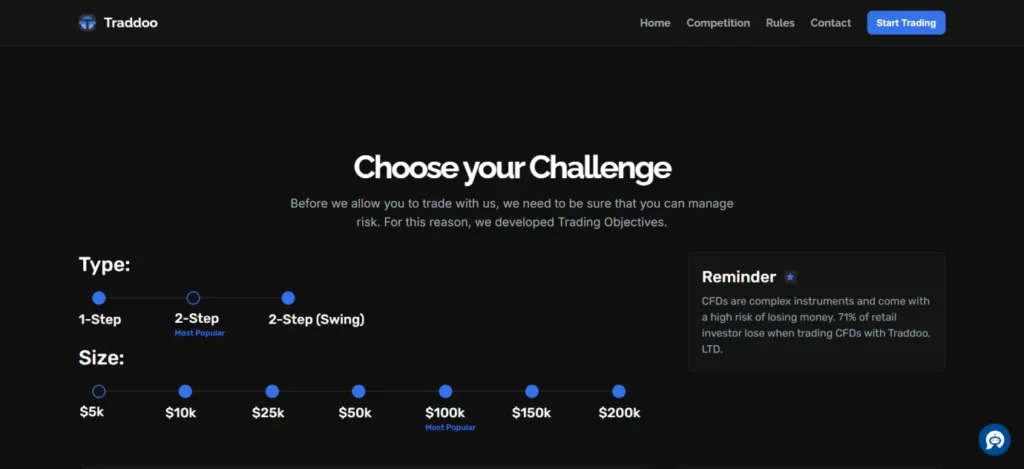

They offers traders a variety of account types to suit different trading styles and experience levels. The firm provides two main challenge structures: the One-Phase Challenge and the Two-Phase Challenge.

The One-Phase Challenge is designed for traders who prefer a straightforward path to funding, requiring them to achieve a 14% profit target with a 7% maximum drawdown.

The Two-Phase Challenge, on the other hand, offers a more structured approach with two distinct stages. In Phase 1, traders aim for a 10% profit target with a 10% maximum drawdown, while Phase 2 requires an 8% profit target with the same drawdown limit.

Both challenge types are available in various account sizes, ranging from $10,000 to $200,000, allowing traders to choose the level of capital that best matches their skills and risk tolerance.

The Funded Trader Program

Traddoo's funded trader program is designed to identify and support talented traders by providing them with significant capital to trade.

This program typically involves a multi-step process:

- Evaluation Phase: Traders start with a demo account and must demonstrate consistent profitability while adhering to risk management rules.

- Verification Phase: Successful traders move to a live account with a smaller balance to prove their strategies work in real market conditions.

- Funded Account: Traders who pass both phases receive a fully funded account with substantial capital to trade.

Benefits of the Funded Trader Program

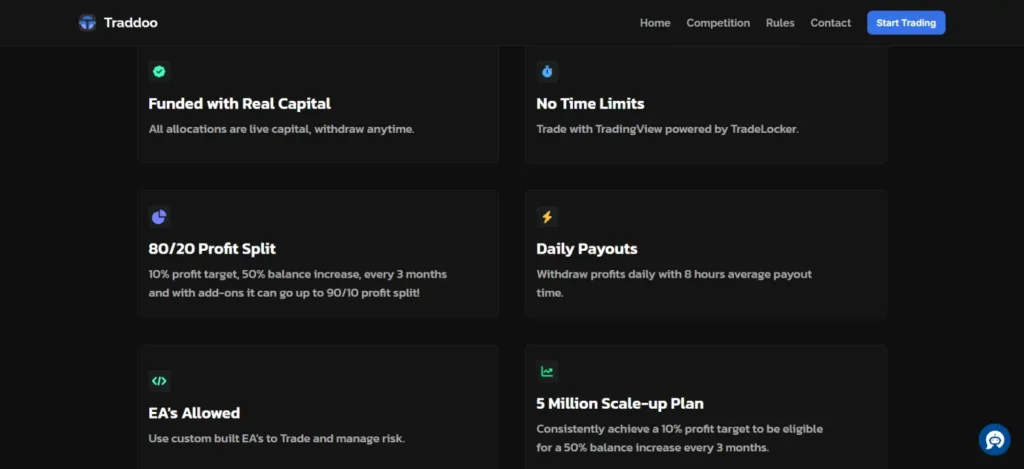

- Access to Capital: Traders can manage up to $200,000 without risking their own funds.

- Profit Sharing: Generous profit-sharing arrangements allow traders to keep a significant portion of their earnings.

- Scaling Opportunities: Successful traders can increase their account size over time.

- Professional Development: It may offer educational resources and mentorship to help traders improve their skills.

Traddoo Platforms

| Platform | Type | Key Features |

|---|---|---|

| MetaTrader 4 | Industry-standard | Advanced charting, Expert Advisors, MQL4 language |

| MetaTrader 5 | Industry-standard | Enhanced timeframes, Economic calendar, MQL5 language |

| TradeLocker | Proprietary | Custom tools, Potentially tailored for Traddoo traders |

Traddoo offers traders access to industry-standard trading platforms to execute their strategies effectively. The firm supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely recognized and popular among traders worldwide.

These platforms provide a robust set of tools for technical analysis, automated trading, and real-time market data.

Additionally, Traddoo partners with TradeLocker, offering their proprietary platform as an alternative option for traders. This diverse platform selection ensures that traders can choose the environment that best suits their trading style and preferences.

Each platform comes with its own set of features, including advanced charting capabilities, customizable interfaces, and support for various order types.

Payouts and Profit Sharing

One of the most attractive aspects of prop trading firms like Traddoo is the potential for significant payouts. While the exact profit-sharing structure is not specified in the search results, prop firms typically offer competitive arrangements.

Here's an example of how a profit-sharing structure might look:

| Performance Level | Trader's Share | Firm's Share |

|---|---|---|

| Standard | 70% | 30% |

| High Performer | 80% | 20% |

| Elite Trader | 90% | 10% |

Again, these figures are illustrative, and Traddoo's actual profit-sharing structure may differ. Traders should refer to the official Traddoo website for the most accurate information on payouts and profit-sharing arrangements.

Commonly Asked Questions

Is there a time limit for completing The Trading Challenge?

No, Traddoo does not impose any time limits on their trading challenges.

What Financial Instruments Can Be Traded?

Traders can access over 100 assets across six distinct groups, including forex, cryptocurrencies, stocks, indices, metals, and CFDs.

What is The Maximum Leverage offered?

Traddoo offers leverage of up to 1:30 on various instruments.

Is there a Refundable Fee option?

Yes, Traddoo offers a refundable fee option for traders who successfully pass the evaluation.

Does Traddoo offer a Free Trial?

Yes, Traddoo provides free trial accounts ranging from $5,000 to $200,000 for traders to test their services.

Is there a Scaling Plan available?

Yes, Traddoo offers a scaling plan that allows traders to potentially manage up to $1,000,000 in funds.

What kind of Customer Support does Traddoo provide?

Traddoo offers 24/7 dedicated support to assist traders with any inquiries or issues.

To Conclude

TraddooTool and the associated funded trader program offered by Traddoo present a compelling opportunity for skilled traders to leverage their expertise and potentially earn significant profits without risking personal capital. With the ability to manage up to $200,000 in funds, traders can access opportunities that might otherwise be out of reach.