Traders Launch is a game-changing platform that's revolutionizing the world of prop trading. With the ability to manage up to $200,000 and no time restrictions on payouts, this innovative service is turning heads in the trading community.

Traders Launch offers a unique evaluation method that rewards skill and consistency, allowing successful traders to keep 80% of their profits. What sets them apart? Their transparent rules, fair drawdown policies, and a scaling plan that grows with your success. Whether you're a seasoned pro or just starting out, Traders Launch provides the tools and opportunities you need to prove your strategy and receive funding.

The Traders Launch Difference

What sets Traders Launch apart from many other prop firms is its focus on long-term trader development. Rather than just providing capital, Traders Launch aims to nurture trading talent and help successful traders scale their strategies over time.

Some key advantages of trading with Traders Launch include:

| Feature | Details |

|---|---|

| Trading Instruments | Futures contracts (ES, NQ, GC, CL) |

| Profit Split | 80% for traders |

| Drawdown Rule | End of Day (EOD) Balance Based Drawdown |

| Withdrawal Restrictions | No time restrictions |

| Scaling Plan | 1 mini contract increase per 1% account growth, up to 15 contracts max |

| Evaluation Rules | Hit profit target, avoid EOD drawdown, 40% rule, 1% profit to move to live brokerage |

| Activation Fees | Zero |

| Payout Processing | Within 3 business days, usually same-day |

| Payout Methods | Bank wire or cryptocurrency |

| Trading Platforms | Interactive Brokers, NinjaTrader, T3 Global (for funded accounts) |

| Trading Hours | New York Session (9:30 am – 4 pm EST) |

| Minimum Trading Requirement | 1 trade per week (evaluation), 1 trade per month (funded) |

| Swing Trading | Not allowed during the evaluation |

| Account Sizes | $25,000 to $200,000 (based on provided examples) |

| CEO | Max Thomas and Connor Holly (Co-founders) |

| Contact Information | Available through the contact form on their website |

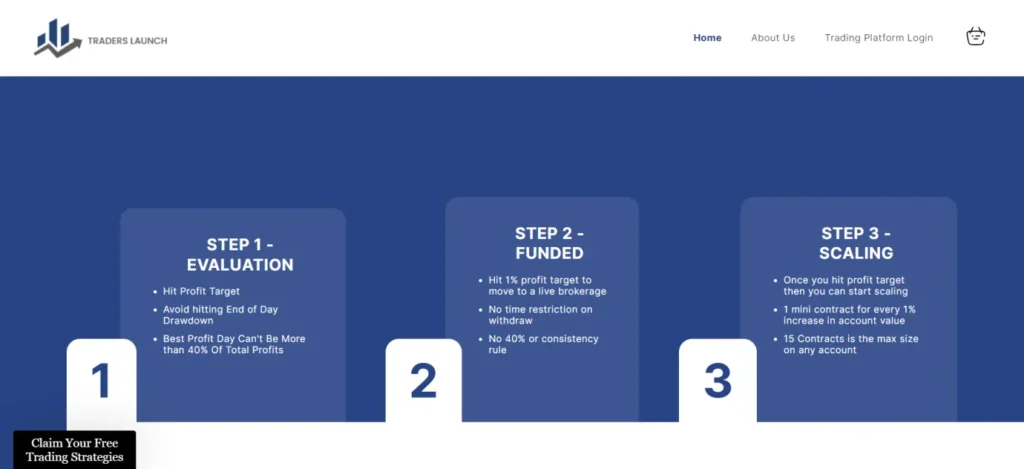

Traders Launch Evaluation Process

Traders Launch uses a one-step or two-step evaluation process, depending on the account type chosen. This allows traders to prove their skills in a simulated environment before managing real capital.

- One-Step Evaluation

The one-step evaluation is straightforward:

- Two-Step Evaluation

The two-step process adds an extra layer of verification:

Once a trader passes the evaluation, they move to a funded account where they can start trading live capital.

Account Types and Sizes

Traders Launch offers a range of account sizes to suit different trader needs and experience levels.

Here's a breakdown of their main account types:

| Account Size | Profit Target | EOD Drawdown Limit | Max Contract Size |

|---|---|---|---|

| $25,000 | $2,000 | $800 | 5 micros |

| $50,000 | $3,000 | $1,000 | 1 mini / 10 micros |

| $100,000 | $5,000 | $2,000 | 2 minis / 20 micros |

| $200,000 | $10,000 | $4,000 | 4 minis / 40 micros |

It's worth noting that these are just examples, and Traders Launch may offer additional account sizes or customized options for experienced traders.

Trading Instruments

Traders Launch focuses primarily on futures trading, offering a wide range of popular contracts.

Some of the main instruments available include:

This selection covers major stock indices, commodities, and currencies, giving traders ample opportunities to implement diverse strategies.

Platforms and Technology

Traders Launch utilizes a mix of proprietary and industry-standard platforms to provide a seamless trading experience. During the evaluation phase, traders use Traders Launch's proprietary web-based platform.

Once funded, traders are moved to live brokerage accounts with established providers like:

Interactive Brokers, NinjaTrader, and T3 Global.

This transition to professional-grade platforms ensures funded traders have access to the tools and execution capabilities needed for serious trading.

Profit Sharing and Payouts

Traders Launch offers an attractive profit-sharing model for funded traders. Here are the key points:

| S/N | Details |

|---|---|

| 1 | 80% profit split for traders |

| 2 | No time restrictions on withdrawals |

| 3 | Minimum payout of $100 |

| 4 | Payouts processed within 3 business days |

| 5 | Payment options include bank wire and cryptocurrency |

To be eligible for payouts, funded traders need to:

| S/N | Details |

|---|---|

| 1 | Grow their account by 1% (e.g., to $101,000 for a $100,000 account) |

| 2 | Maintain their account above this new baseline |

| 3 | Once these conditions are met, traders can withdraw profits above the baseline at any time. |

Scaling Plan

One of the most appealing aspects of Traders Launch is its scaling plan. As funded traders grow their accounts, they're given the opportunity to increase their position sizes.

Here's how it works:

- For every 1% account growth, traders can add 1 mini contract (or equivalent)

- Scaling continues up to a maximum of 15 contracts for any account size

This scaling plan allows successful traders to significantly increase their earning potential over time.

Help Guide

What is The Drawdown Rule?

Traders Launch uses an End of Day (EOD) Balance Based Drawdown that stops trailing at the initial account balance.

Is there a Time Limit on Withdrawals?

No, there are no time restrictions on withdrawals for funded accounts.

What are The Evaluation Rules?

Traders must hit the profit target, avoid hitting the EOD drawdown, ensure the best profit day isn't more than 40% of total profits, and achieve a 1% profit to move to a live brokerage.

Are there any Activation Fees?

No, Traders Launch charges zero activation fees. The only fee is the initial evaluation fee.

What are The Trading Hours?

Trading hours are locked to the New York Session, from 9:30 am to 4 pm EST.

Is there a Minimum Trading Requirement?

During evaluation, traders must place at least 1 trade per week. For funded accounts, it's at least 1 trade per month.

Can Traders Swing Trade During the Evaluation?

No, swing trading is not allowed during the evaluation stage.

Conclusion

Traders Launch offers a compelling opportunity for futures traders to prove their skills and gain access to significant funding. With its transparent evaluation process, trader-friendly rules, and generous profit-sharing model, the platform stands out in the proprietary trading firm landscape. The unique End of end-of-day drawdown system, absence of daily loss limits, and scaling plan provide traders with flexibility and growth potential. Moreover, the platform's commitment to transparency, minimal fees, and prompt payouts demonstrates its dedication to trader success.