Saxo Bank has been a pioneering force in online trading since 1992. Based in Denmark, Saxo Bank has grown into a global powerhouse, serving over a million clients with more than €100 billion in managed assets.

Whether you're a seasoned trader or just starting, Saxo offers a comprehensive platform with access to over 71,000 financial instruments across 50 exchanges. With a commitment to transparency and innovation, Saxo Bank empowers you to explore, invest, and grow your wealth with confidence.

💁♂️ Introduction to Saxo Bank

Saxo Bank is a leading Danish investment bank specializing in online trading and investment services. Founded in 1992 by Kim Fournais, Lars Seier Christensen, and Marc Hauschildt, Saxo Bank has grown to become a global financial institution serving clients in over 180 countries.

Headquartered in Copenhagen, Denmark, Saxo Bank also has offices in major financial hubs such as London, Singapore, Dubai, and Tokyo. The company is privately held, with CEO and co-founder Kim Fournais owning a significant stake alongside Chinese automotive company Geely and Finnish financial services group Sampo.

The company's focus on providing accessible, transparent, and efficient trading solutions has earned it a reputation as a trusted partner for investors and financial institutions worldwide.

| Key Feature | Details |

|---|---|

| Foundation Year | 1992 |

| Headquarters Country | Denmark (Copenhagen) |

| Regulation | Danish Financial Supervisory Authority (FSA), UK Financial Conduct Authority (FCA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Australian Securities and Investments Commission (ASIC), and other local regulators |

| Products | Forex, Stocks, CFDs, Futures, Funds, Bonds, ETFs, Managed Portfolios |

| Platforms | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

| Account Types | Classic, Platinum, VIP, Corporate, Joint, Professional |

| Minimum Deposit | $2,000 (Classic), $50,000 (Platinum), $1,000,000 (VIP) |

| Spreads | Varies by account type and product |

| Commissions | Varies by account type and product |

| Max Leverage | Varies by product and regulation |

| Education | Webinars, articles, courses in Saxo Academy |

| Research | Market analysis, newsfeeds, economic calendar, insights from #SaxoStrats |

| Customer Support | 24/5 via phone, email, and live chat in multiple languages |

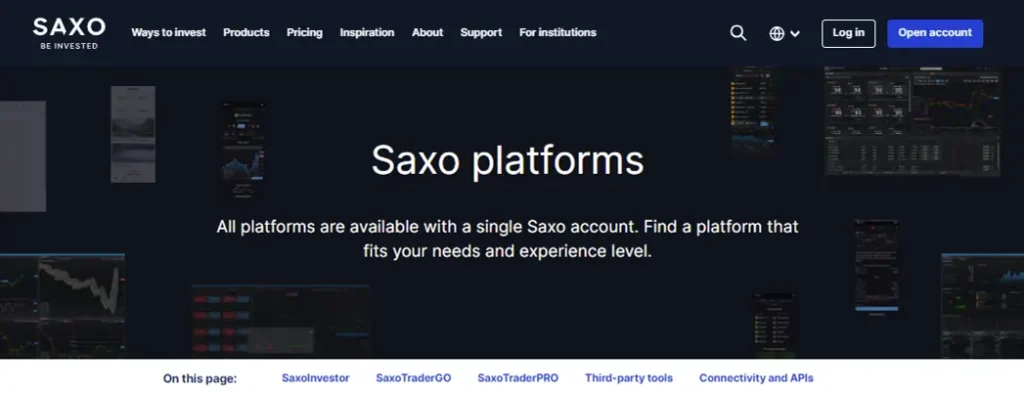

Saxo Bank Trading Platforms

Saxo Bank offers a suite of powerful trading platforms designed to cater to the needs of investors and traders at all levels.

- SaxoInvestor

The SaxoInvestor platform provides a simple and intuitive interface for investors, offering curated stock lists, and access to a range of asset classes including stocks, stock options, mutual funds, ETFs, bonds, and managed portfolios.

- SaxoTraderGO

SaxoTraderGO, the bank's flagship platform, delivers a seamless trading experience across devices with enhanced trade tickets, analysis tools, extensive charting, and access to a wide range of asset classes.

- SaxoTraderPRO

For professional traders seeking advanced features and customization, SaxoTraderPRO offers algorithmic orders, one-click trading, options chains, and a fully customizable workspace across six screens.

| Platform | Key Features | Asset Classes | Interface |

|---|---|---|---|

| SaxoInvestor | Curated stock lists, simple interface | Stocks, ETFs, mutual funds, bonds, managed portfolios | Web and mobile, user-friendly |

| SaxoTraderGO | Advanced tools, analysis, extensive charting | Forex, stocks, ETFs, CFDs, futures, options | Web and mobile, seamless cross-device experience |

| SaxoTraderPRO | Algorithmic orders, customizable workspace | Forex, stocks, ETFs, CFDs, futures, options | Desktop only, multi-screen setup, advanced tools |

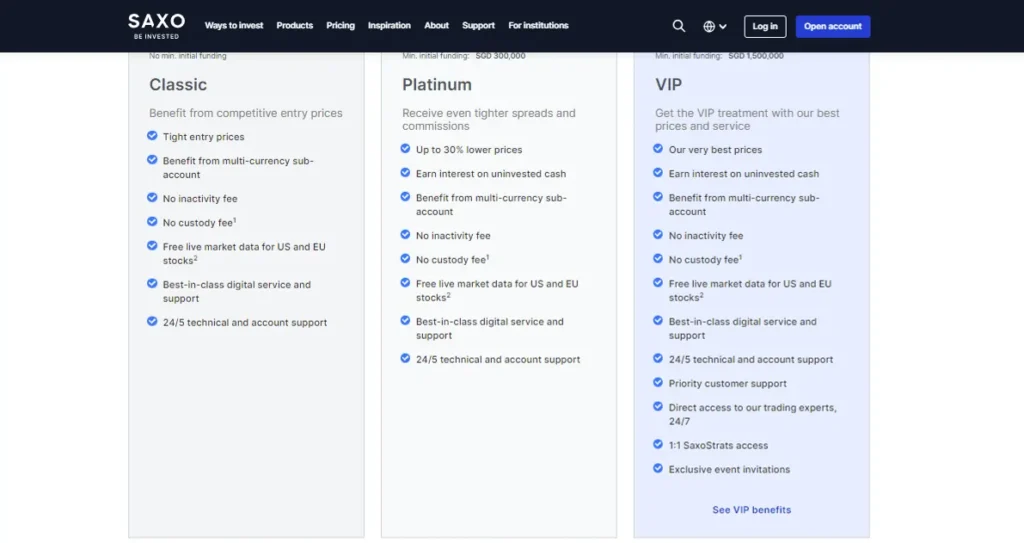

Account Types and Pricing

Saxo Bank offers three main account types to cater to the needs of different investors and traders: Classic, Platinum, and VIP.

- Classic Account:

The Classic account is the entry-level option, requiring the lowest minimum deposit and providing access to a wide range of products and Saxo Bank's powerful trading platforms.

- Platinum Account:

The Platinum account is designed for more active traders, offering tighter spreads, lower commissions, and interest on uninvested cash, but requiring a higher minimum deposit.

- VIP Account:

The VIP account is tailored for high-net-worth individuals, featuring the lowest spreads and commissions, dedicated support, and exclusive access to Saxo Bank's expert strategists, but with the highest minimum deposit requirement.

| Account | Minimum Deposit | Benefits |

|---|---|---|

| Classic | $2,000 | Competitive entry prices |

| Platinum | $50,000 | Tighter spreads, lower commissions, interest on uninvested cash |

| VIP | $1,000,000 | Lowest spreads and commissions, dedicated support, exclusive events |

Deposits and Withdrawals

Saxo Bank supports a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. The bank does not charge any fees for deposits or withdrawals, but it's important to be aware of potential charges from intermediary banks or payment providers.

When withdrawing funds, clients can only transfer money to a bank account held in their own name. Saxo Bank does not facilitate transfers to third-party accounts for security reasons.

Asset Classes and Products

One of Saxo Bank's key advantages is its extensive range of tradable assets and products.

Clients can access over 40,000 financial instruments across various asset classes:

- Stocks and ETFs

- Bonds and Mutual Funds

- Forex and CFDs

- Options and Futures

Frequently Asked Queries

What are the withdrawal options?

Withdrawals can be made to a bank account in the client's name. Third-party payments are not allowed.

Are there any fees for deposits or withdrawals?

Saxo Bank does not charge fees for deposits or withdrawals, but intermediary banks may charge fees.

What customer support options are available?

Saxo Bank offers 24/5 technical and account support, Priority support for higher tier accounts, and Dedicated relationship managers for VIP clients.

Is Saxo Bank regulated?

Yes, Saxo Bank is regulated by multiple authorities including the Danish Financial Supervisory Authority (FSA) and other regulators in the jurisdictions where it operates.

Does Saxo Bank offer educational resources?

Yes, Saxo Bank provides a learning center with articles, webinars, and courses on trading and investing.

What research tools are available?

Saxo Bank offers integrated newsfeeds, economic calendars, market analysis tools, and insights from their #SaxoStrats team of strategists.

👉 Conclusion

Saxo Bank stands as a pioneering force in the realm of online trading and investment, offering a comprehensive suite of financial products and services to both individual and institutional clients. With its robust, intuitive trading platforms and a commitment to transparency and innovation, Saxo Bank empowers over a million clients worldwide to navigate the complexities of global financial markets with confidence. Its strategic partnerships and regulatory compliance across multiple jurisdictions further cement its reputation as a trusted and forward-thinking financial institution.