Hey there, forex enthusiasts! 👋

Have you ever wondered how to tap into the collective emotions and opinions swirling around the forex market?

Well, buckle up because we're about to dive into the fascinating world of sentimental analysis in forex trading!

By the end of this article, you'll be armed with the knowledge to gauge market sentiment like a pro and make more informed trading decisions.

Whether you're a seasoned trader or just starting out, understanding how to analyze and interpret market sentiment can give you a serious edge. So, let's get started on this exciting journey and uncover the secrets of sentimental analysis in forex trading together!

What is Sentimental Analysis?

Sentiment analysis in forex trading is the process of gauging the overall mood or Sentimental of market participants.

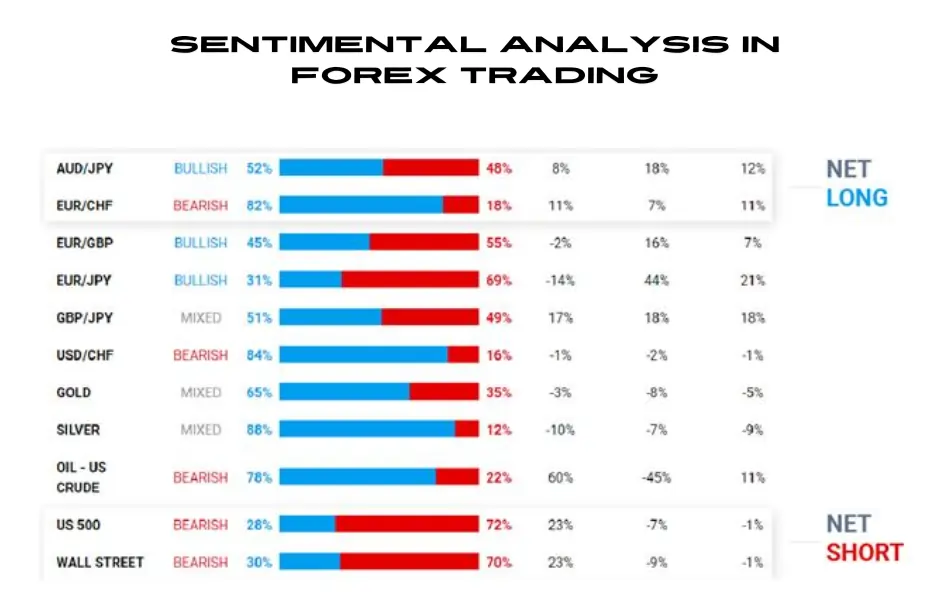

It involves analyzing various indicators and data sources to determine whether traders are predominantly bullish (optimistic) or bearish (pessimistic) about a currency pair. This analysis helps traders understand the crowd psychology and anticipate potential market movements.

Why is Sentiment Analysis Important?

- Market Insight: It provides a deeper understanding of market dynamics by revealing the collective sentiment of traders.

- Trend Identification: It helps identify potential market reversals and trend changes by monitoring shifts in Sentimental.

- Risk Management: By understanding market Sentiment, traders can better manage their risk and avoid being caught on the wrong side of the market.

- Complementary Analysis: Sentimental analysis in forex trading complements technical and fundamental analysis, providing a more comprehensive view of the market.

Key Tools and Indicators for Sentimental Analysis

Several tools and indicators are used in Sentimental analysis in forex trading to gauge market Sentimental:

Commitment of Traders (COT) Report

The COT report, published weekly by the CFTC, provides data on positions held by large speculators and commercial traders in futures markets. It helps identify whether traders are net long or short on currency pairs. This valuable tool offers insights into market sentiment and potential trend directions, aiding traders in making informed decisions.

Open Interest

Open interest measures the total number of open positions in the futures market. Rising open interest alongside price movement typically indicates a strong trend, while declining open interest may signal a potential trend reversal. Traders use this indicator to gauge market participation and confirm the strength of price movements in currency pairs.

Broker Position Summaries

Many forex brokers publish aggregate data showing the percentage of traders who are long or short on specific currency pairs. This information provides insights into retail trader sentiment. By analyzing these summaries, traders can gauge market positioning and potentially identify contrarian trading opportunities when retail sentiment becomes extremely one-sided.

Volatility Index (VIX)

Known as the “fear index,” the VIX measures market volatility and risk sentiment. A rising VIX indicates increasing fear and risk aversion, while a falling VIX suggests improving market confidence. Forex traders use VIX readings to assess overall market sentiment and adjust their trading strategies accordingly, especially during periods of heightened uncertainty.Social

Media and News Sentiment

Analyzing sentiment from social media, news articles, and financial forums provides real-time insights into market sentiment. Natural language processing (NLP) tools can assign sentiment scores to text data, helping traders gauge public opinion on currencies. This information can complement traditional analysis methods and offer a broader perspective on market sentiment.

Pros and Cons of Sentimental Analysis in Forex Trading

| Pros | Cons |

|---|---|

| Provides insights into market psychology and trader behavior | May lag behind price movements, as sentiment often follows price |

| Helps identify potential trend reversals or continuation | Sentiment indicators can remain at extreme levels for extended periods |

| Can be used as a contrarian indicator for trading opportunities | Potential for false signals or premature trade entries |

| Offers additional confirmation for technical and fundamental analysis | |

| Assists in gauging the overall market mood and risk appetite |

Common Questions Related to Sentimental Analysis

What is Sentimental Analysis in Forex Trading?

Sentiment analysis in forex trading involves evaluating the emotions and attitudes of market participants to gauge the overall market mood.

Why is Sentimental Analysis Important in Forex T^rading?

It helps traders understand market dynamics, identify trends, manage risk, and make informed trading decisions.

What are some Common Sentimental Indicators?

Common Sentimental indicators include the Commitment of Traders (COT) report, open interest, broker position summaries, and the Volatility Index (VIX).

How can Social Media be used in Sentimental Analysis?

Social media Sentimental analysis in forex trading involves evaluating posts and comments on platforms like Twitter and Facebook to gauge market Sentimental.

Can Sentimental analysis be used alone for trading decisions?

No, it should be combined with technical and fundamental analysis for a comprehensive trading strategy.

What is the Commitment of Traders (COT) Report?

The COT report, published by the CFTC, provides data on the positions of large speculators and commercial traders in the futures markets.

How does the Volatility Index (VIX) Relate to Sentimental Analysis?

The VIX measures market volatility and risk Sentimental, with a rising VIX indicating increasing fear and risk aversion.

Trade Like a Bot

Sentiment analysis has emerged as a powerful tool in Forex trading, offering traders a nuanced understanding of market dynamics beyond traditional technical and fundamental analysis. By leveraging natural language processing and machine learning, Sentimental analysis in forex trading can decode the emotional tone of market news, social media, and other textual data, providing valuable insights into market Sentimental.

This can help traders anticipate market movements and make more informed decisions. As technology continues to evolve, the integration of Sentimental analysis in Forex trading is likely to become even more sophisticated, offering traders an edge in navigating the complexities of the global currency markets.