TeleTrade is the leading CFD broker that's been empowering millions of traders worldwide since 1994. With its wide range of trading tools and favorable terms, Tele has become the go-to platform for making profits in the exciting world of forex, stocks, indices, and more.

Whether you're a seasoned pro or just starting out, TeleTrade has got you covered with its user-friendly interface and expert support. So, buckle up and get ready to explore the limitless possibilities of online trading with TeleTrade.

Starting with an Introduction to TeleTrade

| Key Feature | Details |

|---|---|

| Foundation Year | 1994 |

| Headquarters Country | Cyprus |

| Regulation | CySEC (Cyprus) |

| Products | Forex, CFDs on Stocks, Indices, Commodities, Cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | ECN, NDD, Cent, Demo |

| Minimum Deposit | $10 (Cent account), $100 (NDD account), $500 (ECN account) |

| Spreads | From 0.0 pips (ECN account), From 0.2 pips (NDD and Cent accounts) |

| Commissions | $2 per lot round turn (ECN account), Zero commission (NDD and Cent accounts) |

| Max Leverage | Up to 1:500 |

| Education | Webinars, seminars, trading guides, video tutorials |

| Research | Daily market reviews, technical analysis, economic calendar |

| Customer Support | Live chat, email, phone support in multiple languages |

TeleTrade is a prominent international forex and CFD broker that has been operating in the financial markets since 1994.

The company's headquarters are located in Nicosia, Cyprus, and it operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC). It has a global presence, with over 200 offices in 22 countries, making it one of the largest brokers in Asia and Europe.

As a regulated broker with a long-standing reputation, Tele continues to evolve and adapt to the changing environment of online trading, focusing on providing competitive trading conditions and innovative services to its global client base.

What are the various Account Sizes offered by TeleTrade?

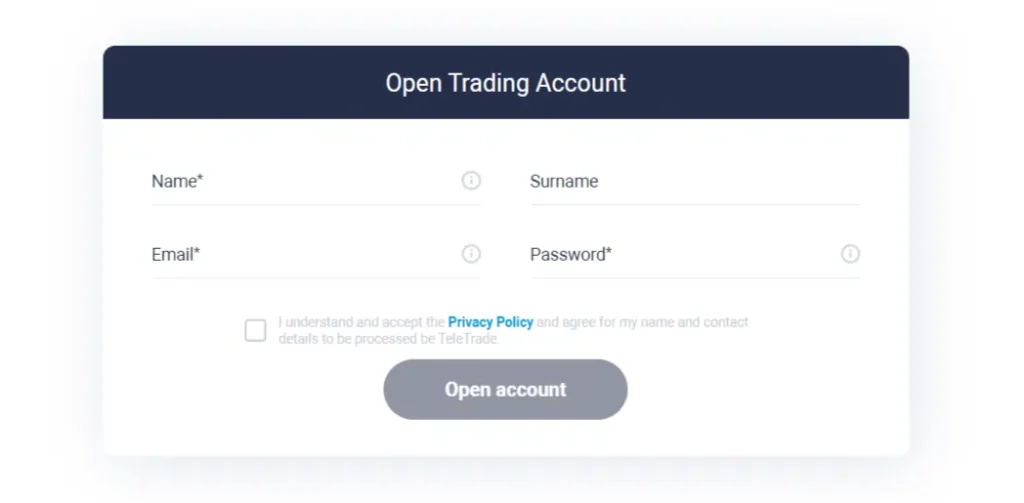

Trade offers a variety of account types to cater to different trader needs and experience levels.

1. Demo Account

The broker provides a risk-free Demo account, allowing traders to practice and familiarize themselves with the platform without using real funds. For those ready to trade with real money, Tele offers several options.

2. ECN Account

The ECN (Electronic Communication Network) account is designed for experienced traders who prefer direct market access and tight spreads, with a minimum deposit of $500.

3. Cent Account

The Cent account is ideal for beginners or those who want to test strategies with minimal risk, featuring a low minimum deposit of just $10.

4. NDD Account

Additionally, TeleTrade provides an NDD (No Dealing Desk) account, suitable for traders who want competitive spreads without commissions.

| Account Type | Minimum Deposit | Spreads | Leverage | Execution Type |

|---|---|---|---|---|

| ECN | $500 | From 0.0 pips | Up to 1:500 | Market Execution |

| NDD | $100 | From 0.2 pips | Up to 1:500 | Market Execution |

| Cent | $10 | From 0.2 pips | Up to 1:500 | Market Execution |

| Demo | N/A | From 0.2 pips | Up to 1:500 | Market Execution |

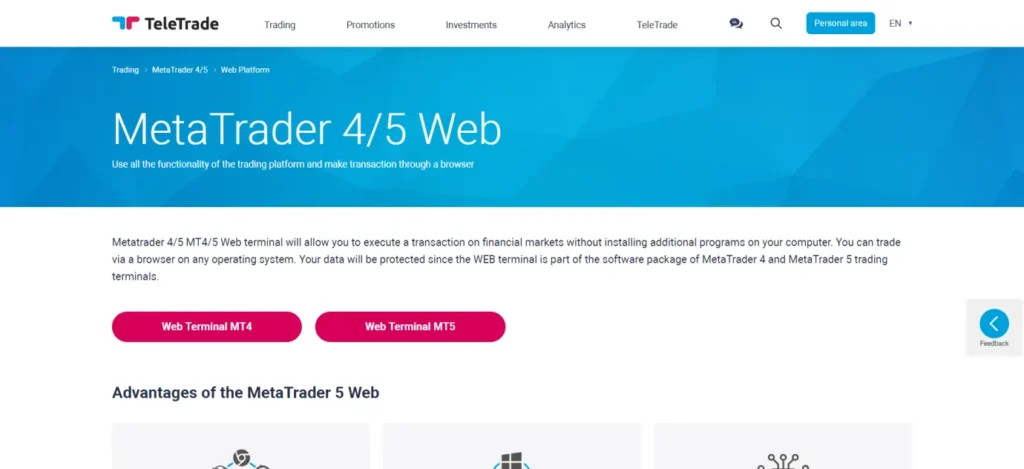

MT4 and MT5 Trading Platforms

TeleTrade offers its clients access to two of the most popular trading platforms in the forex industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Both platforms are available in various formats to suit different trader preferences and needs. Traders can access MT4 and MT5 through desktop applications for Windows, web-based terminals that work directly in browsers without requiring installation, and mobile apps for iOS and Android devices.

This multi-platform approach ensures that TeleTrade clients can manage their trades and monitor the markets from virtually anywhere, at any time. The MT4 platform, known for its user-friendly interface and robust features, is particularly popular among forex traders.

Meanwhile, MT5 offers enhanced capabilities, including access to a wider range of markets and improved analytical tools, making it suitable for traders who wish to diversify beyond forex.

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Markets | Forex, CFDs | Forex, CFDs, Stocks, Futures |

| Availability | Desktop, Web, Mobile | Desktop, Web, Mobile |

| Technical Indicators | 30+ built-in | 38+ built-in |

| Timeframes | 9 | 21 |

| Algorithmic Trading | Yes (MQL4) | Yes (MQL5) |

| One-Click Trading | Yes | Yes |

| Market Depth | Limited | Advanced |

| Economic Calendar | No | Yes |

| Hedging | Yes | Yes |

| Netting | No | Yes |

| Ideal for | Forex-focused traders | Multi-asset traders |

Commission-less Deposits and Withdrawals

TeleTrade offers a variety of deposit and withdrawal options to cater to the diverse needs of its global clientele. The broker supports several payment methods, including credit/debit cards, bank wire transfers, and popular e-wallets such as Skrill and Neteller.

For deposits, TeleTrade does not charge any fees, making it convenient for traders to fund their accounts. However, it's important to note that third-party charges may apply, especially for bank transfers. The minimum deposit amount varies depending on the account type, with the lowest being $10 for a Cent account and $500 for an ECN account.

Withdrawals are processed through the same methods used for deposits, ensuring a smooth and secure transaction process. While TeleTrade itself doesn't impose withdrawal fees, some payment providers may charge their own fees. The processing time for withdrawals can range from a few hours for e-wallets to several business days for bank transfers.

Deposit Methods

| Method | Processing Time | Minimum Deposit | Fees |

|---|---|---|---|

| Credit/Debit Cards | Instant | $10 | No fees |

| Bank Transfer | 1-3 business days | $100 | Bank charges may apply |

| E-wallets (Skrill, Neteller) | Instant | $10 | No fees |

| Cryptocurrencies | Varies | Equivalent to $10 | No fees |

Withdrawal Methods

| Method | Processing Time | Minimum Withdrawal | Fees |

|---|---|---|---|

| Credit/Debit Cards | 1-3 business days | $10 | No fees |

| Bank Transfer | 3-7 business days | $100 | Bank charges may apply |

| E-wallets (Skrill, Neteller) | 24 hours | $10 | No fees |

| Cryptocurrencies | Varies | Equivalent to $10 | No fees |

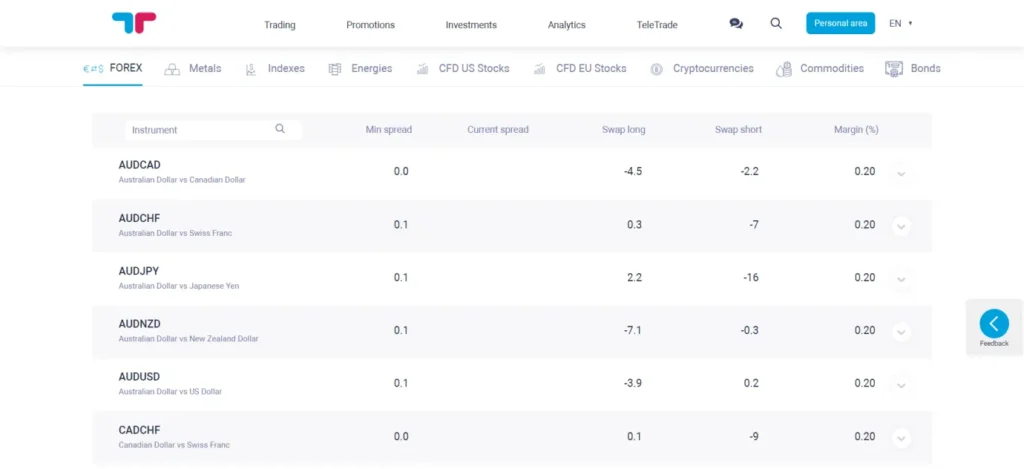

A Diverse Range of Asset Classes

TeleTrade offers a diverse range of asset classes to cater to different trading preferences and strategies. The broker provides access to forex trading with a wide selection of currency pairs, including major, minor, and exotic combinations. Traders can also engage in CFD trading on stocks of major global companies, allowing them to speculate on share price movements without owning the underlying assets.

For those interested in broader market exposure, TeleTrade offers CFDs on major global indices. Commodity traders can access various instruments, including precious metals, energies, and agricultural products. In response to growing market demand, TeleTrade has also incorporated cryptocurrency CFDs into its offering, allowing traders to capitalize on the volatility of digital assets.

| Asset Class | Examples of Available Instruments |

|---|---|

| Forex | EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD |

| Stocks (CFDs) | Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Tesla (TSLA) |

| Indices | S&P 500, NASDAQ 100, FTSE 100, DAX 30, Nikkei 225 |

| Commodities | Gold (XAU/USD), Silver (XAG/USD), Crude Oil (WTI and Brent), Natural Gas |

Repeatedly Asked Questions

Is TeleTrade Regulated?

Yes, TeleTrade is regulated by the Cyprus Securities and Exchange Commission (CySEC).

What is The Minimum Deposit to open an Account?

The minimum deposit varies by account type, starting from $10 for a Cent account.

Does TeleTrade offer Copy Trading?

Yes, TeleTrade offers a copy trading feature called Synchronous Trading.

What leverage does TeleTrade Offer?

TeleTrade offers leverage up to 1:500, depending on the account type and instrument.

Does TeleTrade provide Educational Resources?

Yes, TeleTrade offers various educational materials including webinars, seminars, and trading guides.

Does TeleTrade have a Mobile App?

Yes, TeleTrade offers mobile trading apps for both iOS and Android devices.

Is TeleTrade available Worldwide?

TeleTrade serves clients globally but does not accept traders from certain countries, including the US, Canada, and Iran.

Conclusion

TeleTrade has emerged as a significant player in the online trading and financial services industry. As a regulated broker, it offers a wide range of trading instruments, including forex, CFDs, and cryptocurrencies, catering to both novice and experienced traders.

The company's commitment to education is evident through its comprehensive learning resources and webinars. TeleTrade's user-friendly platforms, including the popular MetaTrader 4 and 5, provide traders with advanced tools for market analysis and execution.