Tickmill, a global leader in online trading since 2014. With its ultra-fast trade execution averaging just 0.15 seconds and spreads starting from 0.0 pips, It has earned accolades like “Most Trusted Broker in Europe” and “Best Forex Execution Broker.”

But it's not just about the numbers; It is committed to empowering traders with extensive educational resources and cutting-edge analysis tools. Whether you're a seasoned investor or just starting, Tickmill's user-friendly platform is designed to help you achieve your financial goals with confidence and precision.

Starting with an Introduction to Tickmill

Tickmill is a global online trading company founded in 2014, offering a range of financial instruments including forex, CFDs on stocks, indices, commodities, and cryptocurrencies. Headquartered in London, UK, It has established itself as a trusted name in the online trading industry, serving clients in over 180 countries.

Led by CEO Sudhanshu Agarwal, an industry veteran with extensive experience in financial services, Tickmill operates under multiple regulatory licenses. These include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and licenses in Malaysia, South Africa, Dubai, and Seychelles.

With a team of over 250 professionals, It serves more than 400,000 satisfied clients globally. The company's success is evident in its impressive statistics, including an average monthly trading volume exceeding 129 billion and over 87 million executed trades.

| Key Feature | Details |

|---|---|

| Foundation Year | 2014 |

| Headquarters Country | United Kingdom |

| Regulation | FCA (UK), CySEC (Cyprus), FSA (Seychelles), FSCA (South Africa), LFSA (Malaysia), DFSA (UAE) |

| Products | Forex, CFDs on Stocks, Indices, Commodities, Bonds, Cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Classic, Raw, Islamic, Demo |

| Minimum Deposit | $100 |

| Spreads | From 0.0 pips (Raw account), From 1.6 pips (Classic account) |

| Commissions | $3 per lot per side (Raw account), Zero commission (Classic account) |

| Max Leverage | Up to 1:1000 (varies by regulator and account type) |

| Education | Webinars, trading guides, market analysis, economic calendar |

| Research | Daily market commentary, economic calendar, trading signals |

| Customer Support | 24/5 via live chat, email, and phone in multiple languages |

MT5 and MT4 Trading Platforms

Offers two of the most popular trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Let's take a closer look at each:

1. MetaTrader 4 (MT4)

MT4 is a widely used electronic trading platform that allows retail traders to access online trading of various financial instruments.

Some key features of Tickmill's MT4 offering include:

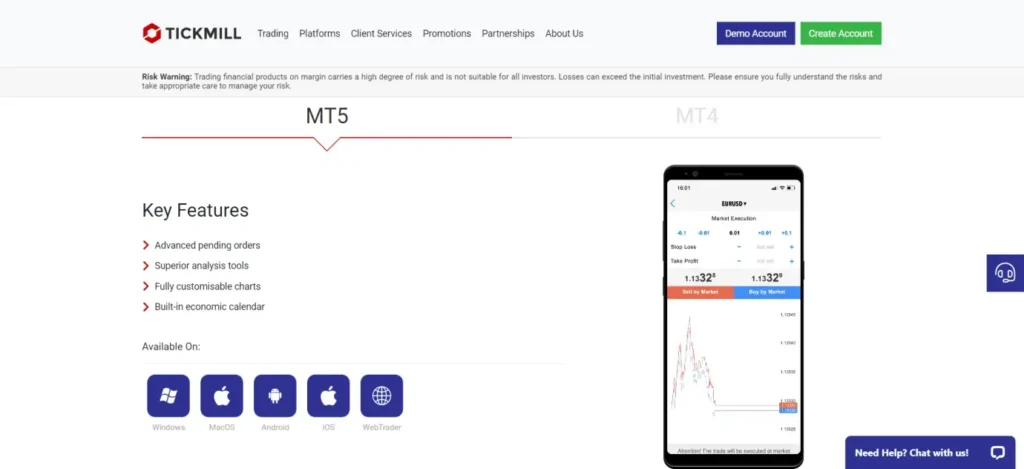

2. MetaTrader 5 (MT5)

MT5 is the newer version of the MetaTrader platform, offering additional features and capabilities. Its features include:

Tickmill Account Types

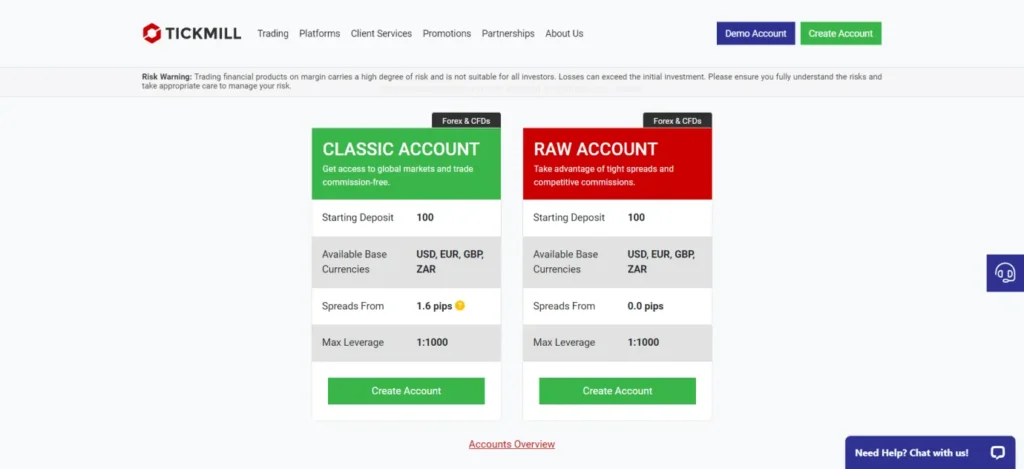

Offers two main account types to cater to different trading preferences and experience levels: Classic and Raw.

- Classic Account:

The Classic Account is designed for traders who prefer commission-free trading, with spreads starting from 1.6 pips. It requires a minimum deposit of $100 and offers leverage up to 1:1000.

- Raw Account:

The Raw Account, on the other hand, is tailored for traders seeking tighter spreads and is comfortable with a commission-based model. It also has a $100 minimum deposit requirement and offers spreads from 0.0 pips, but charges a commission of $3 per lot per side.

| Feature | Classic Account | Raw Account |

|---|---|---|

| Minimum Deposit | $100 | $100 |

| Available Base Currencies | USD, EUR, GBP, ZAR | USD, EUR, GBP, ZAR |

| Spreads From | 1.6 pips | 0.0 pips |

| Maximum Leverage | 1:1000 | 1:1000 |

| Minimum Lot Size | 0.01 | 0.01 |

| Commission | Zero | $3 per lot per side |

| All Strategies Allowed | Yes | Yes |

| Swap-free Islamic Account Option | Yes | Yes |

Seamless Deposits and Easy Withdrawals

Offers a variety of convenient deposit and withdrawal options to cater to traders' preferences. The company provides several methods for funding accounts and retrieving profits, including bank wire transfers, credit/debit cards, and popular e-wallets.

Deposits are generally processed instantly for most electronic methods, while bank wire transfers may take 1-3 business days. Tickmill adheres to a zero-fee policy for deposits of 5,000 USD or equivalent made via bank wire transfer, covering transaction fees up to 100 USD or equivalent.

For withdrawals, Tickmill aims to process requests within one business day, although the actual time may vary depending on the chosen method and the client's bank. The company maintains a policy of returning funds to the same source from which they were deposited, ensuring security and compliance with anti-money laundering regulations.

Minimum deposit and withdrawal amounts may apply, with the standard minimum deposit being $100 for most account types.

| Method | Currencies | Min. Deposit | Min. Withdrawal | Deposit Fee | Withdrawal Fee | Processing Time (Deposit) | Processing Time (Withdrawal) |

|---|---|---|---|---|---|---|---|

| Bank Wire | USD, EUR, GBP, ZAR | 100 | 25 | None | None | Within 1-3 Working Days | Within 1 Working Day |

| Credit/Debit Card | EUR, USD, GBP | 100 | 25 | None | None | Instant | Within 1 Working Day |

| Skrill | USD, EUR, GBP | 100 | 25 | None | None | Instant | Within 1 Working Day |

| Neteller | USD, EUR, GBP | 100 | 25 | None | None | Instant | Within 1 Working Day |

| FasaPay | USD, EUR, GBP | 100 | 25 | None | None | Instant | Within 1 Working Day |

| PayPal | USD, EUR, GBP | 100 | 25 | None | None | Instant | Within 1 Working Day |

| Method | Currencies | Min. Deposit | Min. Withdrawal | Deposit Fee | Withdrawal Fee | Processing Time (Deposit) | Processing Time (Withdrawal) |

Asset Classes

Tickmill offers a diverse range of financial instruments across various asset classes:

- Forex

Tickmill provides access to a wide array of currency pairs, including majors, minors, and exotics. Traders can benefit from competitive spreads and high leverage.

- Stocks

Traders can access CFDs on stocks of top corporations from around the world. Some benefits of trading stocks with Tickmill include: No commissions, Dividend payments, and Leverage up to 1:20 for retail clients and 1:100 for professional clients.

- Stock Indices

Tickmill offers CFDs on major global stock indices. Here's a sample of available indices and their trading conditions:

| Instrument | Minimum Spread | Typical Spread | Long Position | Short Position |

|---|---|---|---|---|

| AFRICA40 | 9 | 17.74 | -19.93 | 12.28 |

| DE40 | 0.8 | 0.91 | -2.94 | 0.73 |

| FRANCE40 | 1 | 1 | -5.84 | 1.24 |

| HK50 | 14 | 14 | -3.13 | 1.44 |

| UK100 | 0.9 | 0.9 | -1.59 | 0.77 |

| US30 | 2.2 | 2.52 | -7.7 | 3.15 |

| US500 | 0.39 | 0.39 | -1.08 | 0.45 |

- Commodities

Tickmill offers CFDs on various commodities, including precious metals, energies, and agricultural products.

- Bonds

Traders can speculate on government bond prices through CFDs.

- Cryptocurrencies

Tickmill has expanded its offering to include CFDs on popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Cardano, Ripple, Stellar, Chainlink, and EOS.

Commonly Asked Questions

What is the minimum deposit required to open an account with Tickmill?

The minimum deposit for both Classic and Raw accounts is $100.

What leverage does Tickmill offer?

Tickmill offers leverage up to 1:1000, though this may vary depending on regulatory restrictions in different jurisdictions.

Does Tickmill allow scalping and algorithmic trading?

Yes, Tickmill allows all trading strategies including scalping, hedging, and algorithmic trading.

Are there any fees for deposits and withdrawals?

Tickmill generally does not charge fees for deposits or withdrawals, though third-party payment providers may apply their own fees.

Does Tickmill offer educational resources?

Yes, Tickmill provides various educational materials including webinars, trading guides, market analysis, and an economic calendar.

What customer support options does Tickmill provide?

Tickmill offers customer support via phone, email, and live chat in multiple languages.

Can US citizens use Tickmill?

No, Tickmill does not accept clients from the United States.

Final Say

Tickmill is a reputable and well-regulated broker that offers a comprehensive trading experience for both novice and experienced traders. With competitive pricing, a wide range of tradable assets, and advanced trading tools like Autochartist and the Signal Centre, Tickmill provides a solid platform for traders to reach their full potential. The broker's commitment to fast execution speeds, innovative technology, and exceptional customer support sets it apart in the industry. Whether you're interested in forex, indices, commodities, or even copy trading, Tickmill has the resources and expertise to support your trading journey. As a trusted market leader, Tickmill is worth considering for your trading needs.