XTB stands out as a leading global broker, renowned for its speed, transparency, and innovative offerings. With a presence in over a dozen countries and a robust platform available on the web, desktop, and mobile, It caters to traders seeking access to forex and CFDs with competitive spreads and minimal fees.

The platform is equipped with advanced tools like real-time account monitoring and a trader's calculator, making it easier for users to manage their investments effectively. Recently, It has embraced social trading, allowing investors to engage with top performers and refine their strategies through shared insights.

🏆 Starting with an Introduction to XTB

XTB (X-Trade Brokers) is a leading European provider of trading and investment products, services, and technology solutions, specializing in the OTC financial market with a focus on CFDs. Founded in Poland in 2002, It has grown dynamically and now operates in over 13 countries, including the UK, Poland, Germany, France, and Chile, based on licenses granted by regulators in these jurisdictions.

XTB's headquarters is located at ul. Prosta 67, 00-838, Warsaw, Poland. The company's CEO is Omar Arnaout, who was appointed in January 2017 and has a tenure of over 7 years. Under his leadership, It has continued to expand its global presence and enhance its product offerings.

With a strong focus on technology and innovation, It has positioned itself as a FinTech organization, continuously developing comprehensive solutions for online transactions and investments.

| Key Feature | Details |

|---|---|

| Foundation Year | 2002 |

| Headquarters Country | Poland |

| Regulation | FCA (UK), KNF (Poland), CySEC (Cyprus), BaFin (Germany), CNMV (Spain), more |

| Products | Forex, Stocks, ETFs, Indices, Commodities, Crypto CFDs |

| Platforms | xStation 5 (proprietary), MetaTrader 4 |

| Account Types | Standard |

| Minimum Deposit | $0 (but the first deposit must be at least $250) |

| Spreads | Floating, from 0.8 pips |

| Commissions | None (except equity CFDs and ETFs) |

| Max Leverage | 1:30 (EU), 1:100 (Poland), 1:500 (Mauritius) |

| Education | Extensive – XTB Trading Academy, webinars, videos |

| Research | News feed, economic calendar, market analysis |

| Customer Support | 24/5 via phone, email, live chat |

| Unique Features | Fractional shares, demo account, no dealing desk |

Account Types Best-Suited to Your Needs

XTB understands that every trader is unique, which is why they offer a streamlined account structure to cater to different trading styles and preferences.

They offer the Standard account which is designed to cater to a wide range of traders, from beginners to experienced professionals. With the Standard Account, traders enjoy competitive spreads and pay no commissions on most instruments, making it an attractive choice for cost-conscious traders.

The only exceptions are equity CFDs and ETFs, which do incur commissions. It's important to note that while the Standard Account does not charge commissions on most instruments, the spreads may be slightly wider compared to other account types offered by some brokers.

The Standard Account's lack of a minimum deposit requirement makes it accessible to traders with various account sizes, allowing them to start their trading journey without a significant initial investment.

| Account Type | Minimum Deposit | Spreads | Commissions |

|---|---|---|---|

| Standard | $0 | Floating, from 0.8 pips | None (except equity CFDs and ETFs) |

With no minimum deposit requirement, you can start your trading journey with XTB without breaking the bank. Plus, you can easily switch between account types as your trading needs evolve.

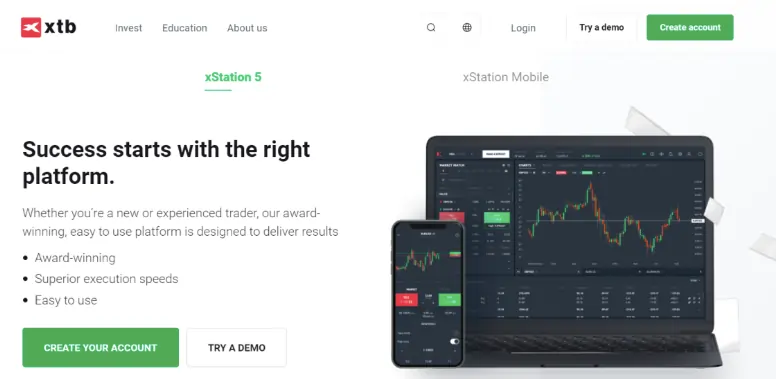

Unlock Your Trading Mettle with xStation 5

It offers a proprietary trading platform, xStation 5. This intuitive and feature-rich platform is designed to cater to traders of all levels, from beginners to seasoned pros. xStation 5 boasts a user-friendly interface, advanced charting tools, and a wide array of customization options, allowing you to tailor your trading experience to your unique preferences.

Some of the key features of xStation 5 include:

Whether you prefer trading on your desktop, web browser, or mobile device, xStation 5 has you covered. The platform is fully compatible with Windows, Mac, iOS, and Android, ensuring that you never miss a trading opportunity, no matter where you are.

Explore a World of Trading Opportunities

One of the standout features of XTB is its extensive range of tradable instruments. With over 5,800 instruments at your fingertips, you can diversify your portfolio and seize opportunities across various asset classes. It offers:

Seamless Deposits and Withdrawals

Funding your XTB account is a breeze, thanks to the various payment methods available. You can choose from bank transfers, credit/debit cards, and popular e-wallets like Skrill, Neteller, and PayPal. Deposits are usually processed instantly, allowing you to start trading right away.

When it comes to withdrawals, It offers a simple and efficient process. You can withdraw funds to your bank account, credit/debit card, or e-wallet, depending on your preference. Withdrawal requests are typically processed within 24 hours, ensuring that you have timely access to your funds.

It's worth noting that They do not charge any fees for deposits or withdrawals. However, keep in mind that your payment provider may impose their own charges, so it's always a good idea to check with them beforehand.

| Method | Deposit | Withdrawal | Processing Time | Fees |

|---|---|---|---|---|

| Bank Transfer | Yes | Yes | Deposits: 1 working day (UK/EU), 2-5 days (other countries) Withdrawals: Same day (UK, if requested before 1 pm GMT), 1 business day (other entities) | No fees from XTB |

| Credit/Debit Card | Yes | No | Instant | No fees from XTB |

| PayPal | Yes (EU residents) | No | Instant | No fees from XTB |

| Skrill | Yes | No | Instant | 2% fee (UK residents), No fee (EU residents), 2% fee (Non-UK/EU residents) |

Commonly Asked Questions Related to XTM

Is XTB regulated?

Yes, XTB is regulated by top-tier financial authorities, including the FCA (UK), BaFin (Germany), CNMV (Spain), KNF (Poland), FSCM (Mauritius), and CySEC (Cyprus).

What is the minimum deposit to open an account with XTB?

No minimum deposit is required to open an account with XTB.

Does XTB charge any account maintenance fees?

No, maintaining an account at XTB is free, provided that at least one trade is made within 12 months.

What is the maximum leverage offered by XTB?

The maximum leverage varies depending on the regulator: 1:30 (FCA, BaFin, CNMV, CySEC), 1:100 (KNF), and 1:3000 (FSCM).

Does XTB offer a demo account?

Yes, It provides a demo account for practice trading.

Does XTB offer 24/7 customer support?

XTB provides 24-hour support during weekdays but not on weekends.

Can you trade directly from charts on XTB's platform?

Yes, XTB's xStation 5 platform allows trading directly from charts.

🏆 Embark on Your Trading Journey with XTB

XTB has established itself as a formidable player in the forex and CFD trading industry. With a strong regulatory framework, competitive pricing, and a user-friendly platform, XTB caters to both novice and experienced traders. The company's commitment to employee satisfaction and engagement is evident in its high Glassdoor ratings and CEO approval. While It offers a wide range of tradable assets and advanced features, traders should be aware of potential fees and account restrictions. The broker's global presence and multi-language support make it accessible to a diverse clientele.